Brother International 2013 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2013 Brother International annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

35

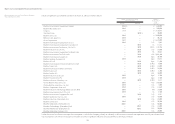

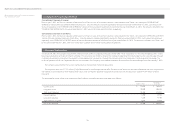

Notes to Consolidated Financial Statements

Brother Industries, Ltd. and Consolidated Subsidiaries

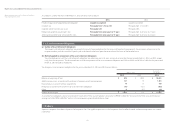

Year ended March 31, 2013 3. Changes in Presentation Method

(Consolidated statement of income)

Prior to April 1, 2012, the “Gain on valuation of derivatives” and “Gain on sales of investment securities” were included in the “Other - net” among the “OTHER INCOME

(EXPENSES)” section of the consolidated statement of income. Since the amounts increased significantly during this fiscal year ended March 31, 2013, such amounts are

disclosed separately in the “OTHER INCOME (EXPENSES)” section of the consolidated statement of income for the year ended March 31, 2013. The amounts included in the

“OTHER INCOME (EXPENSES)” for the year ended March 31, 2012, were ¥137 million and ¥24 million, respectively.

(Consolidated statement of cash flows)

Prior to April 1, 2012, the “Gain on valuation of derivatives” and “Gain on sales of investment securities” were included in the “Other - net” among the “OPERATING ACTIVITIES”

section of the consolidated statement of cash flows. Since the amounts increased significantly during this fiscal year ended March 31, 2013, such amounts are disclosed

separately in the “OPERATING ACTIVITIES” section of the consolidated statement of cash flows for the year ended March 31, 2013. The amounts included in the “Other - net”

for the year ended March 31, 2012, were ¥137 million (cash outflow) and ¥7 million (cash outflow), respectively.

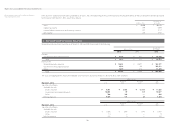

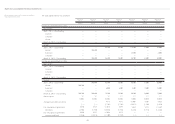

4. Business Combination

On January 30, 2013, the Company acquired the additional shares of Nissei Corporation through a tender offer. Nissei Corporation is in the industrial part business mainly

focusing on production and sales of reducers and gears. This acquisition was made to advance the strategy of expanding the industrial part business outside Japan through

its global network and to strengthen the research and development of new business through the Company and Nissei Corporation’s technology and knowledge. The

results of operations for Nissei Corporation Business are included in the Company’s consolidated statement of income from the deemed acquisition date, January 1, 2013.

The Company accounted for this business combination by the purchase method of accounting.

The acquisition cost was ¥17,712 million ($188,426 thousand) in cash through a tender offer. The total cost of acquisition has been allocated to the assets acquired and

the liabilities assumed based on their respective fair values. Gain on negative goodwill recognized in connection with the acquisition totaled ¥7,194 million ($76,532

thousand).

The estimated fair values of the assets acquired and the liabilities assumed at the acquisition date are as follows:

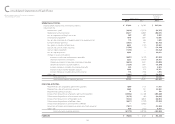

Millions of Yen

Thousands of

U.S. Dollars

Current assets ¥ 15,686 $ 166,872

Long-term assets 28,800 306,383

Total assets acquired 44,486 473,255

Current liabilities 1,760 18,724

Long-term liabilities 1,326 14,106

Total liabilities assumed 3,086 32,830

Net assets acquired ¥ 41,400 $ 440,425