Brother International 2010 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2010 Brother International annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

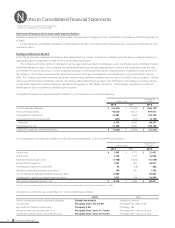

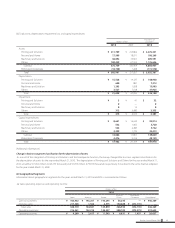

hold or issue derivatives for trading purposes.

Because the counterparties to these derivatives are limited to major international financial institutions with high credit ratings, the Group does

not anticipate any losses arising from credit risk.

Derivative transactions entered into by the Group have been made in accordance with internal policies which regulate the authorization and

credit limit amount.

The contract or notional amounts of derivatives which are shown in the following table do not represent the amounts exchanged by the

parties and do not measure the Group's exposure to credit or market risk.

As noted in Note 14, the Group applied ASBJ Statement No. 10, “Accounting Standard for Financial Instruments” and ASBJ Guidance No. 19,

“Guidance on Accounting Standard for Financial Instruments and Related Disclosures.” The accounting standard and the guidance are applicable

to financial instruments and related disclosures at the end of the fiscal years ending on or after March 31, 2010; therefore, the required information

is disclosed only for 2010.

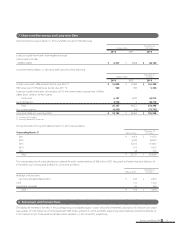

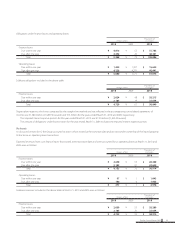

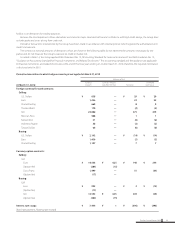

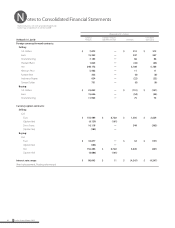

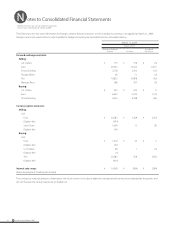

Derivative transactions to which hedge accounting is not applied at March 31, 2010

At March 31, 2010

(Millions of Yen)

Contract

Amount

Contract Amount

due after One Year Fair Value

Unrealized

Gain/(Loss)

Foreign currency forward contracts:

Selling:

U.S. Dollars ¥ 658 ¥ 29 ¥ 29

Euro 1,426 23 23

Pound Sterling 668 8 8

Thailand Baht 170 (4) (4)

Yen 23,080 475 475

Mexican Peso 508 1 1

Korean Won 31 (0) (0)

Indonesia Rupee 58 (2) (2)

Taiwan Dollars 68 (0) (0)

Buying:

U.S. Dollars ¥ 2,142 ¥ (14) ¥ (14)

Euro 1,456 (5) (5)

Pound Sterling 1,107 7 7

Currency option contracts:

Selling:

Call

Euro ¥ 14,553 ¥ 625 ¥ 140 ¥ 244

(Option fee) (384) (15)

Swiss Franc 1,499 51 (34)

(Option fee) (17)

Buying:

Call

Euro ¥ 993 ¥ 3 ¥ (14)

(Option fee) (17)

Yen 14,553 ¥ 625 339 (45)

(Option fee) (384) (15)

Interest rate swaps: ¥ 7,444 ¥ 1 ¥ (395) ¥ (395)

(fixed rate payment, floating rate receipt)

39Brother Annual Report 2010