Brother International 2010 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2010 Brother International annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

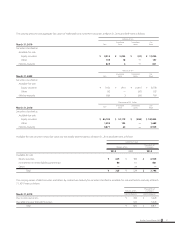

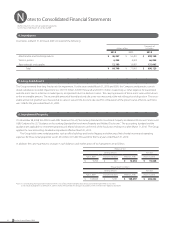

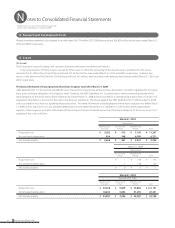

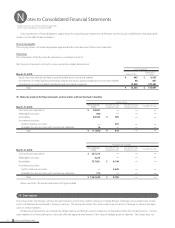

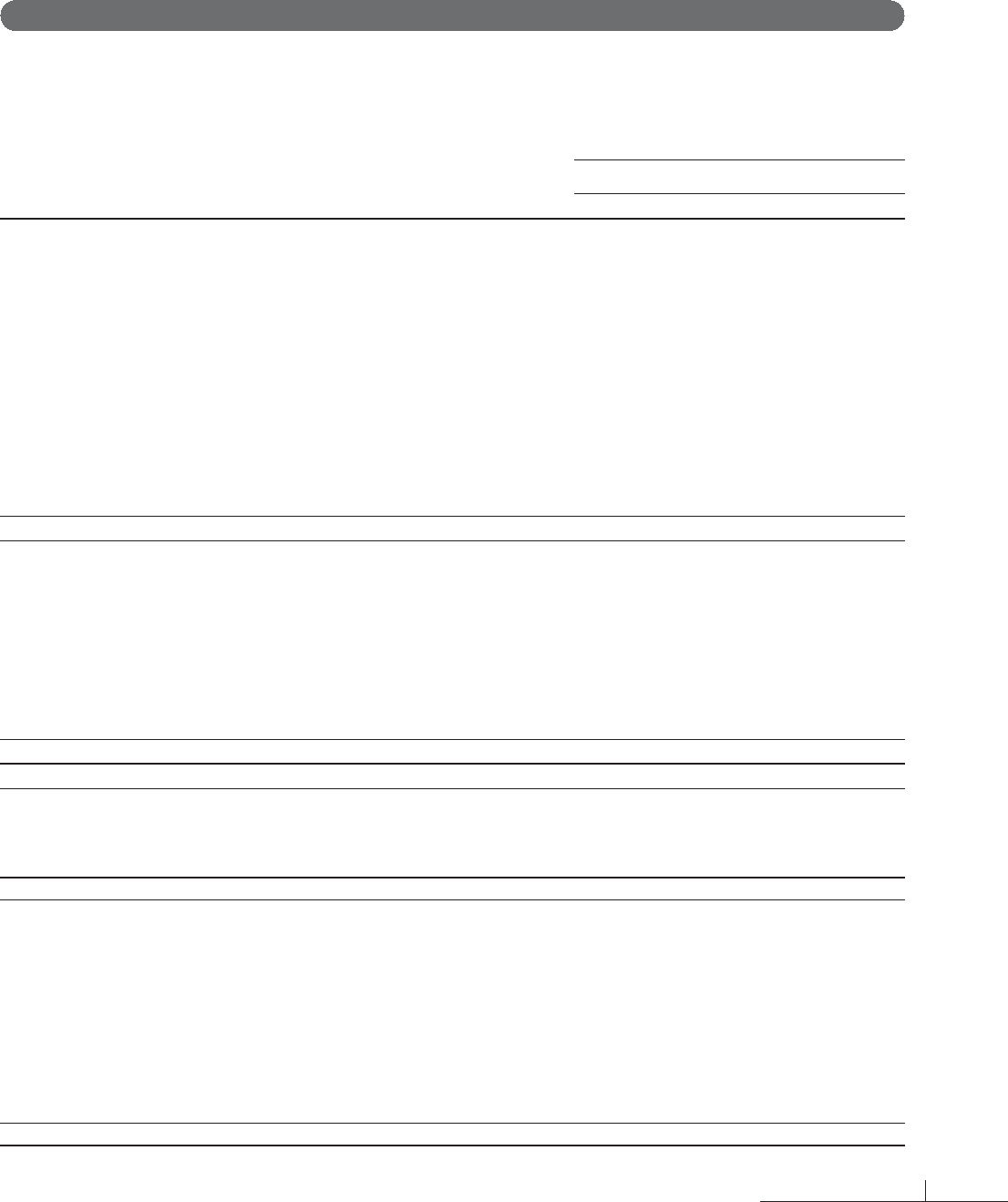

11. Income Taxes

The Company and its domestic subsidiaries are subject to Japanese national and local income taxes which, in the aggregate, resulted in normal

effective statutory tax rate of approximately 41% for the years ended March 31, 2010 and 2009.

The tax effects of significant temporary differences and tax loss carryforwards which resulted in deferred tax assets and liabilities at March 31, 2010

and 2009 were as follows:

Millions of Yen

Thousands of

U.S. Dollars

2010 2009 2010

Deferred Tax Assets:

Inventory ¥ 7,645 ¥ 7,407 $ 82,205

Accrued bonuses 2,397 1,902 25,774

Accrued expenses 2,206 2,385 23,720

Allowance for doubtful accounts 10,461 6,891 112,484

Warranty reserve 1,553 906 16,699

Employees’ retirement benefits 1,276 1,121 13,720

Write-down of investment securities 4,444 3,703 47,785

Depreciation 6,169 4,178 66,334

Tax loss carryforwards 7,375 1,578 79,301

Other 6,312 3,870 67,871

Less valuation allowance (26,074) (12,540) (280,366)

Total deferred tax assets ¥ 23,764 ¥ 21,401 $ 255,527

Deferred Tax Liabilities:

Securities withdrawn from retirement benefit trust ¥ (3,262) ¥ (3,261) $ (35,075)

Prepaid pension cost (5,446) (4,354) (58,559)

Differences between book and tax bases of property, plant and equipment (3,131) (2,955) (33,667)

Undistributed earnings of foreign subsidiaries (2,912) (2,679) (31,312)

Unrealized gain on available-for-sale securities (1,374) (247) (14,774)

Deferred gain on derivatives under hedge accounting (739) (2,120) (7,946)

Other (710) (837) (7,635)

Total deferred tax liabilities ¥ (17,574) ¥ (16,453) $ (188,968)

Net deferred tax assets ¥ 6,190 ¥ 4,948 $ 66,559

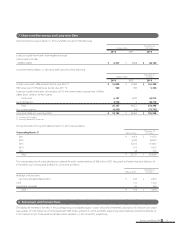

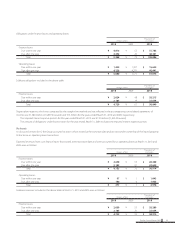

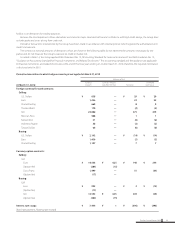

A reconciliation between the normal effective statutory tax rate and the actual effective tax rate reflected in the accompanying consolidated

statements of income for the years ended March 31, 2010 and 2009 were as follows:

2010 2009

Normal effective statutory tax rate 40.50% 40.50%

Expenses not deductible for income tax purposes 1.93 4.45

Revenues not recognized for income tax purposes (0.84) (1.06)

Lower income tax rates applicable to income in certain foreign countries (10.30) (6.48)

Tax credit for R&D expenses (0.91) (2.01)

Taxes on dividends from foreign subsidiaries (0.15) (1.20)

Net change in valuation allowance (3.90) 19.19

Tax effect not recognized on retained earnings of foreign subsidiaries —(16.73)

Other – net (0.87) 1.03

Actual effective tax rate 25.46% 37.69%

33Brother Annual Report 2010