Brother International 2010 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2010 Brother International annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

Brother Industries, Ltd. and Consolidated Subsidiaries

For the Years ended March 31, 2010 and 2009

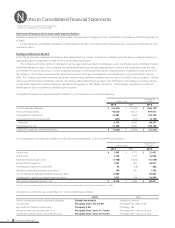

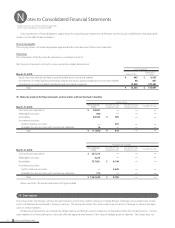

Retirement Allowances for Directors and Corporate Auditors

Retirement allowances for directors and corporate auditors are paid subject to approval of the shareholders in accordance with the Companies Act

of Japan.

Certain domestic consolidated subsidiaries recorded liabilities for their unfunded retirement allowance plan covering all of their directors and

corporate auditors.

Employees’ Retirement Benefits

Under the pension plan, employees terminating their employment are, in most circumstances, entitled to pension payments based on their aver-

age pay during their employment, length of service and certain other factors.

The Company and certain domestic subsidiaries had two types of pension plans for employees: a non-contributory and a contributory funded

defined benefit pension plan. The contributory funded defined benefit pension plan, applied by the Company and established under the Japa-

nese Welfare Pension Insurance Law, covered a substitutional portion of the government and a corporate portion established at the discretion of

the Company. The Company transferred the substitutional portion of the pension obligations and related assets to the government in March

2006. The Company and certain domestic subsidiaries implemented a defined contribution pension plan in fiscal 2005 and on October 1, 2009 by

which a part of the former contributory and non-contributory defined benefit pension plans were terminated. The Company and certain domes-

tic subsidiaries applied accounting treatments specified in the guidance as described in Note 2(15). Certain foreign subsidiaries have defined

benefit pension plans and defined contribution pension plans.

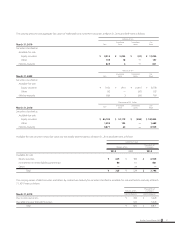

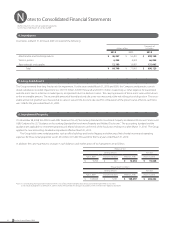

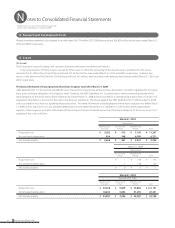

The liability for employees’ retirement benefits at March 31, 2010 and 2009 consisted of the following:

Millions of Yen

Thousands of

U.S. Dollars

2010 2009 2010

Projected benefit obligation ¥ (52,374) ¥ (54,490) $ (563,161)

Fair value of plan assets 44,610 40,552 479,677

Unrecognized actuarial loss 14,395 19,220 154,784

Unrecognized prior service benefit (257) (355) (2,763)

Net asset 6,374 4,927 68,537

Prepaid pension cost 13,406 10,787 144,150

Liability for employees’ retirement benefits ¥ (7,032) ¥ (5,860) $ (75,613)

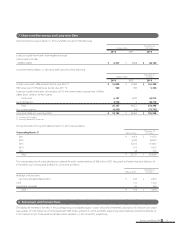

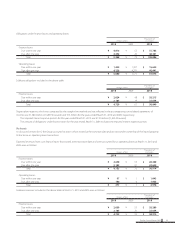

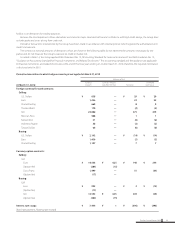

The components of net periodic benefit costs for the years ended March 31, 2010 and 2009 are as follows:

Millions of Yen

Thousands of

U.S. Dollars

2010 2009 2010

Service cost ¥ 1,993 ¥ 2,173 $ 21,431

Interest cost 1,578 1,710 16,968

Expected return on plan assets (1,448) (1,822) (15,570)

Recognized actuarial loss 1,941 897 20,871

Amortization of prior service benefit 43 (78) 462

Additional retirement payments and others * 164 430 1,763

Loss on transfer to defined contribution pension plan 2,985 —32,097

Contribution to defined contribution pension plans 1,022 774 10,989

Net periodic retirement benefits cost ¥ 8,278 ¥ 4,084 $ 89,011

*Includes special termination benefits of ¥327 million paid by a certain consolidated subsidiary for the year ended March 31, 2009.

Assumptions used for the years ended March 31, 2010 and 2009 were as follows:

2010 2009

Periodic recognition of projected benefit obligation Straight-line method Straight-line method

Discount rate Principally from 1.5% to 2.0% Principally from 1.5% to 2.0%

Expected rate of return on plan assets Principally 3.0% Principally 3.0%

Recognition period of actuarial gain / loss Principally from 7 years to 17 years Principally from 7 years to 16 years

Amortization period of prior service benefit / cost Principally from 7 years to 16 years Principally from 7 years to 14 years

30 Brother Annual Report 2010