Brother International 2010 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2010 Brother International annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

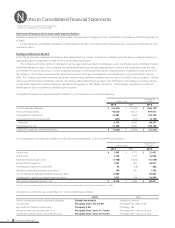

Notes to Consolidated Financial Statements

Brother Industries, Ltd. and Consolidated Subsidiaries

For the Years ended March 31, 2010 and 2009

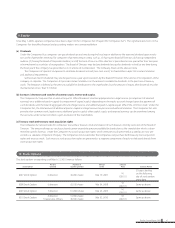

expense through depreciation over the remaining useful life of the asset. Over time, the liability is accreted to its present value each period. Any

subsequent revisions to the timing or the amount of the original estimate of undiscounted cash flows are reflected as an increase or a decrease in

the carrying amount of the liability and the capitalized amount of the related asset retirement cost. This standard is effective for fiscal years begin-

ning on or after April 1, 2010, with early adoption permitted for fiscal years beginning on or before March 31, 2010.

Accounting Changes and Error Corrections

In December 2009, ASBJ issued ASBJ Statement No. 24, “Accounting Standard for Accounting Changes and Error Corrections” and ASBJ Guidance

No. 24, “Guidance on Accounting Standard for Accounting Changes and Error Corrections.” Accounting treatments under this standard and guid-

ance are as follows:

(1) Changes in Accounting Policies

When a new accounting policy is applied with revision of accounting standards, a new policy is applied retrospectively unless the revised

accounting standards include specific transitional provisions. When the revised accounting standards include specific transitional provi-

sions, an entity shall comply with the specific transitional provisions.

(2) Changes in Presentations

When the presentation of financial statements is changed, prior period financial statements are reclassified in accordance with the new

presentation.

(3) Changes in Accounting Estimates

A change in an accounting estimate is accounted for in the period of the change if the change affects that period only, and is accounted

for prospectively if the change affects both the period of the change and future periods.

(4) Corrections of Prior Period Errors

When an error in prior period financial statements is discovered, those statements are restated.

This accounting standard and the guidance are applicable to accounting changes and corrections of prior period errors which are

made from the beginning of the fiscal year that begins on or after April 1, 2011.

Segment Information Disclosures

In March 2008, the ASBJ revised ASBJ Statement No. 17, “Accounting Standard for Segment Information Disclosures” and issued ASBJ Guidance

No. 20, “Guidance on Accounting Standard for Segment Information Disclosures.” Under the standard and guidance, an entity is required to report

financial and descriptive information about its reportable segments. Reportable segments are operating segments or aggregations of operating

segments that meet specified criteria. Operating segments are components of an entity about which separate financial information is available

and such information is evaluated regularly by the chief operating decision maker in deciding how to allocate resources and in assessing perfor-

mance. Generally, segment information is required to be reported on the same basis as is used internally for evaluating operating segment perfor-

mance and deciding how to allocate resources to operating segments. This accounting standard and the guidance are applicable to segment

information disclosures for the fiscal years beginning on or after April 1, 2010.

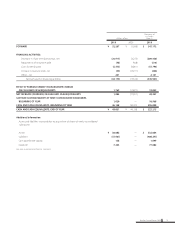

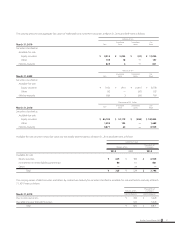

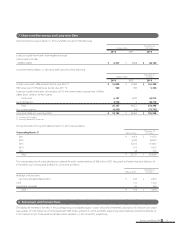

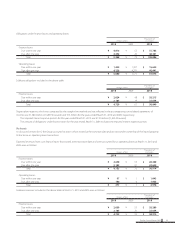

3. Marketable and Investment Securities

Marketable and investment securities as of March 31, 2010 and 2009 consisted of the following:

Millions of Yen

Thousands of

U.S. Dollars

2010 2009 2010

Current:

Government and corporate bonds ¥ 300 ¥ 301 $ 3,226

Total ¥ 300 ¥ 301 $ 3,226

Non-current:

Marketable equity securities ¥ 13,669 ¥ 9,147 $ 146,978

Government and corporate bonds 525 525 5,645

Other 237 238 2,549

Total ¥ 14,431 ¥ 9,910 $ 155,172

26 Brother Annual Report 2010