Brother International 2010 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2010 Brother International annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Fund Procurement, Liquidity and Cash Flows

The Brother Group’s financial policies ensure flexible and efficient funding and maintain an appropriate level of

liquidity for current and future operating activities. We have created a cash management system to optimize the

groupwide use of cash held by individual companies. We also maintain open lines of credit with several banking

institutions to complement existing liquidity on hand. Through these measures, we have been working to estab-

lish a system to correct the uneven distribution of funds and minimize the overall borrowing needs of the Group.

Liquidity Management

The Group’s liquidity on hand consists of cash and cash equivalents and the unused portion of open commitment

lines of credit. As of March 31, 2010, cash and cash equivalents totaled ¥49,031 million.

The Group maintains commitment lines of credit with several financial institutions. The entire amount of the

Group’s total ¥30,000 million in open lines of credit was unused, as of March 31, 2010. This total plus cash and cash

equivalents was ¥79,031 million at fiscal year-end. Taking into consideration seasonal funding requirements, debt

payable within one year and business environment risks, the Group believes it has sufficient liquidity on hand to

support operations for one year.

Fund Procurement

As a rule, working capital and other short-term funding is debt payable within one year that is funded with local

currency. The basic policy on long-term funding for manufacturing facilities is that funds should come from

internal reserves, long-term fixed-rate debt and corporate bonds.

As of March 31, 2010, short-term borrowings were ¥6,337 million, primarily denominated in yen.

Unsecured long-term debt totaled ¥5,107 million, with fixed-rate debt procured in yen. Corporate bonds

totaled ¥15,500 million.

As of March 31, 2010, Rating and Investment Information, Inc., assigned the Group’s long-term bonds and

issuer credit “A” ratings and its commercial paper an “a-1” rating. We consider consistent ratings important in

maintaining access to credit and capital markets.

The Brother Group believes that it has sufficient cash for working capital, capital investment and R&D

investment to maintain growth through cash flows from operating activities; liquidity on hand, including open

lines of credit; and a sound corporate financial structure.

Cash Flows

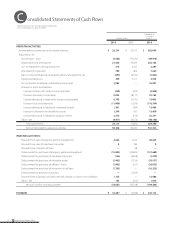

Cash flows from operating activities

Net cash provided by operating activities was ¥50,348 million, ¥29,828 million more than the ¥20,520 million

provided in the previous year. This was primarily due to an increase in income before income taxes and minority

interests, an increase in trade notes and accounts payable and a decrease in inventories.

Cash flows from investing activities

Net cash used in investing activities was ¥18,061 million, ¥8,157 million less than the ¥26,218 million used in the

previous year, reflecting a decrease in disbursement for purchases of property, plant and equipment.

Cash flows from financing activities

Net cash used in financing activities was ¥32,173 million, ¥12,651 million more than the ¥19,522 million used in the

previous year. On the basis of cash flow, the total amount of decrease in short-term borrowings, net, and repay-

ments of long-term debt resulted in ¥26,965 million in disbursements, ¥24,255 million more than in the previous

year. Cash dividends paid used ¥5,375 million, ¥1,426 million less than one year earlier.

As a result of these activities, as well as the exchange rate fluctuations affecting the yen conversion value of cash

and cash equivalents of overseas consolidated subsidiaries, cash and cash equivalents as of March 31, 2010,

amounted to ¥49,031 million, up ¥2,903 million from one year earlier.

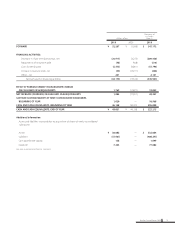

Cash and Cash Equivalents,

End of Year

(¥ billion)

83.2

46.1 49.0

As of March 31

0

20

40

60

80

100

201020092008

Cash Flows from Operating Activities

Cash Flows from Investing Activities

Cash Flows from Financing Activities

-29.3 -26.2

-18.1

-7.0

-19.5

-32.2

-40

-15

10

35

60 58.2

20.5

50.3

Cash Flows

(¥ billion)

Fiscal years ended March 31

201020092008

Interest-bearing Debt

(¥ billion)

30.4

33.6 31.5

As of March 31

0

10

20

30

40

201020092008

11Brother Annual Report 2010