Brother International 2010 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2010 Brother International annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

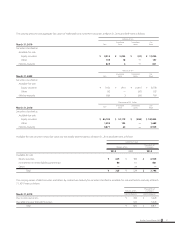

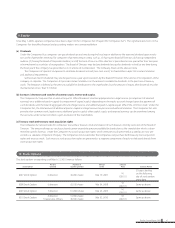

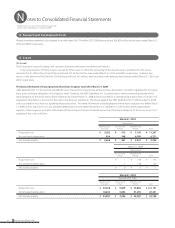

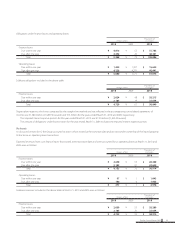

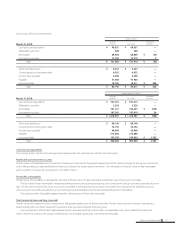

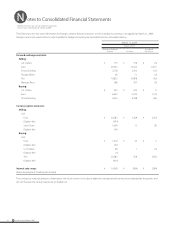

(a) Fair value of financial instruments

Millions of yen

March 31, 2010

Carrying

amount Fair value

Unrealized

gain/loss

Cash and cash equivalents ¥ 49,031 ¥ 49,031 —

Marketable securities 300 300 —

Receivables 68,928 68,869 ¥ (59)

Investment securities 13,705 13,710 5

Total ¥ 131,964 ¥ 131,910 ¥ (54)

Short-term bank loans ¥ 6,337 ¥ 6,337 —

Current portion of long-term debt 6,952 6,952 —

Income taxes payable 4,368 4,368 —

Payables 47,903 47,903 —

Long-term debt 18,185 18,511 ¥ 326

Total ¥ 83,745 ¥ 84,071 ¥ 326

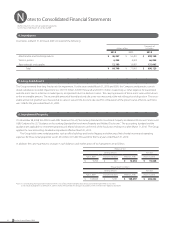

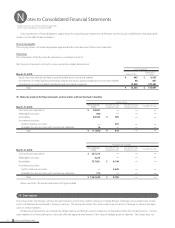

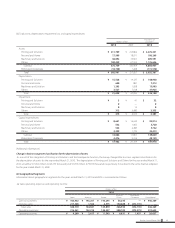

Thousands of U.S. Dollars

March 31, 2010

Carrying

amount Fair value

Unrealized

gain/loss

Cash and cash equivalents $ 527,215 $ 527,215 —

Marketable securities 3,226 3,226 —

Receivables 741,161 740,527 $ (634)

Investment securities 147,365 147,419 54

Total $ 1,418,967 $ 1,418,387 $ (580)

Short-term bank loans $ 68,140 $ 68,140 —

Current portion of long-term debt 74,752 74,752 —

Income taxes payable 46,968 46,968 —

Payables 515,086 515,086 —

Long-term debt 195,538 199,043 $ 3,505

Total $ 900,484 $ 903,989 $ 3,505

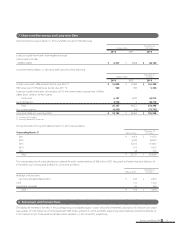

Cash and cash equivalents

The carrying values of cash and cash equivalents approximate fair value because of their short maturities.

Marketable and investment securities

The fair values of marketable and investment securities are measured at the quoted market price of the stock exchange for the equity instruments,

and at the quoted price obtained from the financial institution for certain debt instruments. The information of the fair value for the marketable

and investment securities by classification is included in Note 3.

Receivables and payables

The fair value of receivables is calculated as the total of the fair value of notes receivable and the fair value of accounts receivable.

The fair value of notes receivable is measured at the amount to be received at maturity, discounted at the Group’s assumed corporate discount

rate. On the other hand, the fair value of accounts receivable is the book value of accounts receivable minus allowance for doubtful accounts,

since accounts receivable are settled in a short term period and doubtful accounts are estimated based on collectability.

The carrying values of payables approximate fair value because of their short maturities.

Short-term bank loans and long- term debt

The fair value of Company’s bonds is measured at the quoted market price of the bond market. The fair value of bonds of certain subsidiaries is

determined by the cash flows related to the bond at their assumed corporate borrowing rate.

Carrying amounts of bank loans approximate the fair value because their interest rates are adjustable rates, which reflect the market rate

within short term, and also the Group’s credibility has not changed significantly since the borrowing date.

37Brother Annual Report 2010