Brother International 2010 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2010 Brother International annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

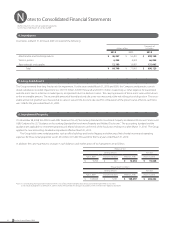

(9) Research and Development Costs

Research and development costs are charged to income as incurred.

(10) Other investments and assets

Intangible assets and goodwill are carried at cost less accumulated amortization, which is calculated by the straight-line method.

(11) Leases

In March 2007, the ASBJ issued ASBJ Statement No. 13, “Accounting Standard for Lease Transactions,” which revised the previous accounting stan-

dard for lease transactions issued in June 1993. The revised accounting standard for lease transactions is effective for fiscal years beginning on or

after April 1, 2008 with early adoption permitted for fiscal years beginning on or after April 1, 2007.

(Lessee)

Under the previous accounting standard, finance leases that deem to transfer ownership of the leased property to the lessee were to be capital-

ized. However, other finance leases were permitted to be accounted for as operating lease transactions if certain “as if capitalized” information is

disclosed in the note to the lessee’s financial statements. The revised accounting standard requires that all finance lease transactions should be

capitalized to recognize lease assets and lease obligations in the balance sheet. In addition, the accounting standard permits leases which existed

at the transition date and do not transfer ownership of the leased property to the lessee to be accounted for as operating lease transactions.

(Lessor)

Under the previous accounting standard, finance leases that deem to transfer ownership of the leased property to the lessee were to be treated as

sales. However, other finance leases were permitted to be accounted for as operating lease transactions if certain "as if sold" information is dis-

closed in the note to the lessor's financial statements. The revised accounting standard requires that all finance leases that deem to transfer own-

ership of the leased property to the lessee should be recognized as lease receivables, and all finance leases that deem not to transfer ownership of

the leased property to the lessee should be recognized as investments in lease.

The Group applied the revised accounting standard effective April 1, 2008. In addition, the Group accounted for leases which existed at the

transition date and do not transfer ownership of the leased property to the lessee as operating lease transactions.

All other leases are accounted for as operating leases.

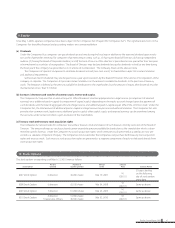

(12) Warranty Reserve

The Group provided a warranty reserve for repair service to cover all repair expenses based on the past warranty experience.

The warranty reserve was included in accrued expenses and amounted to ¥7,215 million ($77,581 thousand) and ¥4,848 million at March 31,

2010 and 2009, respectively.

(13) Income Taxes

The provision for current income taxes is computed based on the pretax income included in the consolidated statements of income. The asset

and liability approach is used to recognize deferred tax assets and liabilities for the expected future tax consequences of temporary differences

between the carrying amounts and the tax bases of assets and liabilities. Deferred taxes are measured by applying currently enacted tax laws to

the temporary differences.

(14) Bonuses to directors and corporate auditors

Bonuses to directors and corporate auditors are accrued at the year end to which such bonuses are attributable.

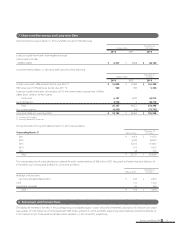

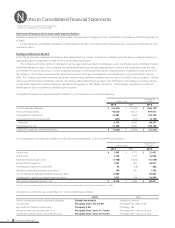

(15) Liability for Retirement Benefits

(i) Employees' Retirement Benefits

The Company has a contributory funded pension plan and a defined contribution pension plan covering substantially all of its employees.

Certain consolidated subsidiaries have non-contributory funded pension plans or unfunded retirement benefit plans. Also, certain foreign

subsidiaries have defined benefit pension plans and defined contribution pension plans.

As of October 1, 2009, the Company and certain consolidated subsidiaries switched part of their retirement benefit systems from a con-

tributory funded pension plan to a defined contribution pension plan. In accordance with this conversion, the Company and certain subsidiar-

ies have applied “Accounting for the Transfer between Retirement Benefit Plans” (ASBJ Guidance No. 1, January 31, 2002). As a result of applying

this accounting standard, the Group recorded a ¥2,985 million ($32,097 thousand) loss on revision of benefit plan under other expenses for the

year ended March 31, 2010.

The Company and certain consolidated subsidiaries account for the liability for retirement benefits based on projected benefit obligations

and plan assets at the balance sheet date. Certain small subsidiaries apply the simplified method to state the liability at the amount which

would be paid if employees retired, less plan assets at the balance sheet date.

23Brother Annual Report 2010