Brother International 2010 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2010 Brother International annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

Brother Industries, Ltd. and Consolidated Subsidiaries

For the Years ended March 31, 2010 and 2009

Carrying amounts of lease obligations approximate fair value, because neither the risk free rate nor the Group’s credibility has changed signifi-

cantly since the date of lease inception.

Income tax payable

The carrying values of income tax payable approximate fair value because of their short maturities.

Derivatives

The information of the fair value for derivatives is included in Note 15.

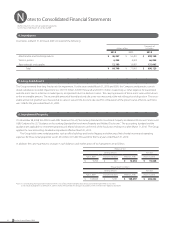

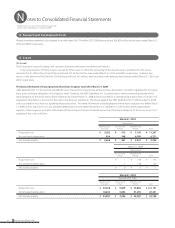

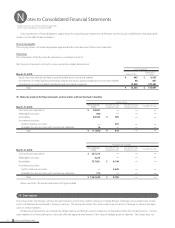

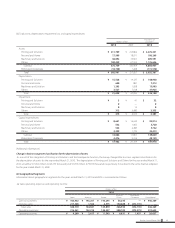

(b) Financial instruments whose fair value cannot be reliably determined

Carrying amount

March 31, 2010 Millions of Yen

Thousands of

U.S. Dollars

Equity securities that do not have a quoted market price in an active market ¥ 645 $ 6,935

Investments in limited liability partnerships that do not have a quoted market price in an active market 80 861

Investments in unconsolidated subsidiaries and associated companies 15,838 170,301

Total ¥ 16,563 $ 178,097

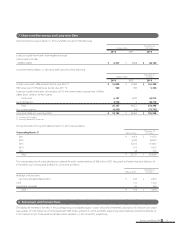

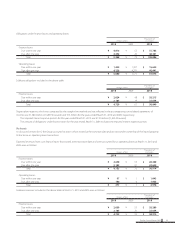

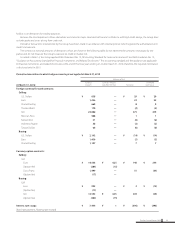

(5) Maturity analysis for financial assets and securities with contractual maturities

Millions of yen

March 31, 2010

Due in one year

or less

Due after one year

through five years

Due after five years

through ten years Due after ten years

Cash and cash equivalents ¥ 49,031 — — —

Marketable securities 300 — — —

Receivables 68,543 ¥ 385 — —

Investment securities

Held-to-maturity securities — 525 — —

Available-for-sale securities with contractual maturities 16———

Total ¥ 117,890 ¥ 910 — —

Thousands of U.S. Dollars

March 31, 2010

Due in one year

or less

Due after one year

through five years

Due after five years

through ten years Due after ten years

Cash and cash equivalents $ 527,215 — — —

Marketable securities 3,226———

Receivables 737,021 $ 4,140 — —

Investment securities

Held-to-maturity securities — 5,645 — —

Available-for-sale securities with contractual maturities 172 — — —

Total $ 1,267,634 $ 9,785 — —

Please see Note 7 for annual maturities of long-term debt.

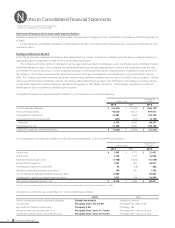

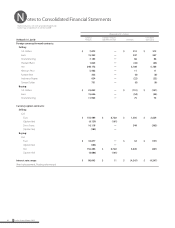

15. Derivatives

The Group enters into foreign currency forward contracts and currency option contracts to hedge foreign exchange risk associated with certain

assets and liabilities denominated in foreign currencies. The Group also enters into interest rate swap contracts to manage its interest rate expo-

sures on certain liabilities.

All derivative transactions are entered into hedge interest and foreign currency exposures incorporated within the Group’s business. Accord-

ingly, market risk in these derivatives is basically offset by opposite movements in the value of hedged assets or liabilities. The Group does not

38 Brother Annual Report 2010