Brother International 2010 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2010 Brother International annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

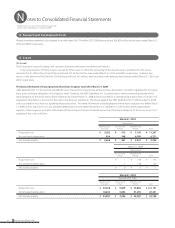

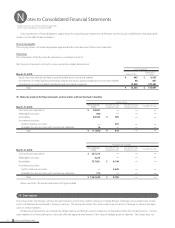

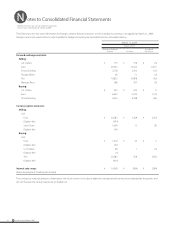

Notes to Consolidated Financial Statements

Brother Industries, Ltd. and Consolidated Subsidiaries

For the Years ended March 31, 2010 and 2009

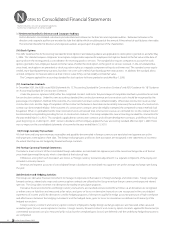

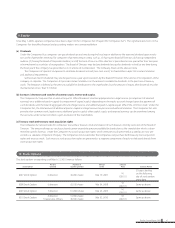

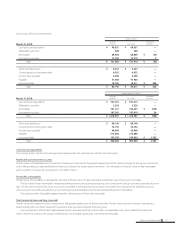

12. Research and Development Costs

Research and development costs charged to income were ¥34,779 million ($373,968 thousand) and ¥36,859 million for the years ended March 31,

2010 and 2009, respectively.

13. Leases

(As lessee)

The Group leases certain buildings and structures, furniture and fixtures, machinery and vehicles.

Total rental expense of finance leases, except for those cases in which the ownership of the leased assets is transferred to the lessee,

amounted to ¥1,548 million ($16,645 thousand) and ¥79 million for the years ended March 31, 2010 and 2009, respectively. Sublease pay-

ments, in the amount of ¥503 million ($5,409 thousand) and ¥63 million, were included in the amounts for the years ended March 31, 2010 and

2009, respectively.

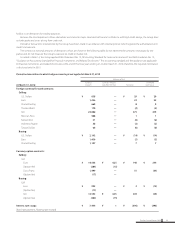

Pro forma information of leased property whose lease inception was before March 31, 2008

ASBJ Statement No. 13, “Accounting Standard for Lease Transactions” requires that all finance lease transactions should be capitalized to recognize

lease assets and lease obligations in the balance sheet. However, the ASBJ Statement No. 13 permits leases without ownership transfer of the

leased property to the lessee whose lease inception was before March 31, 2008 to be accounted for as operating lease transactions if certain “as if

capitalized” information is disclosed in the note to the financial statements. The Group applied the ASBJ Statement No. 13 effective April 1, 2008

and accounted for such leases as operating lease transactions. Pro forma information of leased property whose lease inception was before March

31, 2008 such as acquisition cost, accumulated depreciation, accumulated impairment loss, obligations under finance leases, depreciation

expense, interest expense and other information of finance leases that do not transfer ownership of the leased property to the lessee on an "as if

capitalized" basis was as follows:

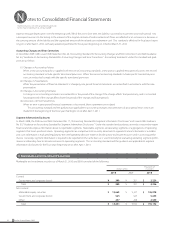

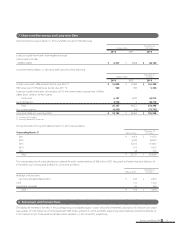

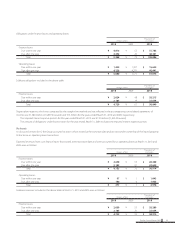

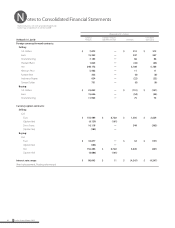

March 31, 2010

Millions of Yen

Buildings and

Structures

Furniture and

Fixtures

Machinery and

Vehicles Total

Acquisition cost ¥ 3,202 ¥ 915 ¥ 7,150 ¥ 11,267

Accumulated depreciation 934 548 4,789 6,271

Net leased property ¥ 2,268 ¥ 367 ¥ 2,361 ¥ 4,996

March 31, 2009

Millions of Yen

Furniture and

Fixtures

Machinery and

Vehicles Total

Acquisition cost ¥ 1 ¥ 144 ¥ 145

Accumulated depreciation 1 138 139

Net leased property ¥ 0 ¥ 6 ¥ 6

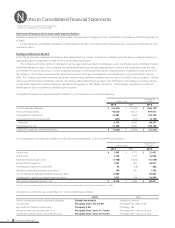

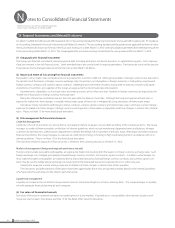

March 31, 2010

Thousands of U.S. Dollars

Buildings and

Structures

Furniture and

Fixtures

Machinery and

Vehicles Total

Acquisition cost $ 34,430 $ 9,839 $ 76,882 $ 121,151

Accumulated depreciation 10,043 5,893 51,495 67,431

Net leased property $ 24,387 $ 3,946 $ 25,387 $ 53,720

34 Brother Annual Report 2010