Brother International 2010 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2010 Brother International annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

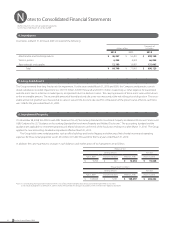

Notes to Consolidated Financial Statements

Brother Industries, Ltd. and Consolidated Subsidiaries

For the Years ended March 31, 2010 and 2009

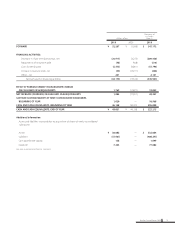

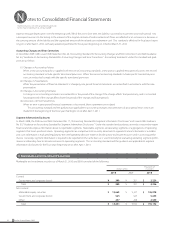

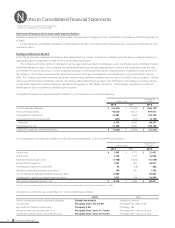

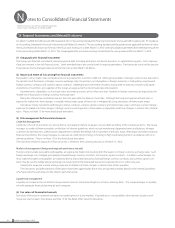

4. Inventories

Inventories at March 31, 2010 and 2009 consisted of the following:

Millions of Yen

Thousands of

U.S. Dollars

2010 2009 2010

Merchandise and Finished products ¥ 46,327 ¥ 56,491 $ 498,140

Work in process 6,224 2,603 66,924

Raw materials and supplies 12,189 12,897 131,065

Total ¥ 64,740 ¥ 71,991 $ 696,129

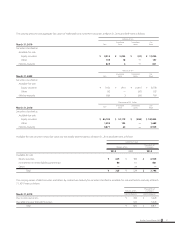

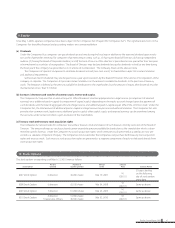

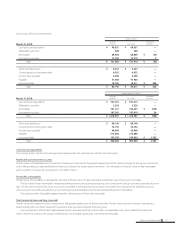

5. Long-lived Assets

The Group reviewed their long-lived assets for impairment. For the years ended March 31, 2010 and 2009, the Company and domestic consoli-

dated subsidiaries recorded impairment loss of ¥315 million ($3,387 thousand) and ¥2,535 million, respectively, as other expense, for leased land

and idle assets due to a decline in market prices, and goodwill due to a decline in value. The carrying amounts of these assets were written down

to the recoverable amount. The recoverable amount of leased land and idle assets was measured at the net selling price at disposition. The recov-

erable amount of goodwill was measured at its value in use and the discount rate used for computation of the present value of future cash flows

was 3.6% for the year ended March 31, 2009.

6. Investment Property

On November 28, 2008, the ASBJ issued ASBJ Statement No. 20, “Accounting Standard for Investment Property and Related Disclosures” and issued

ASBJ Guidance No. 23, “Guidance on Accounting Standard for Investment Property and Related Disclosures.” This accounting standard and the

guidance are applicable to investment property and related disclosures at the end of the fiscal years ending on or after March 31, 2010. The Group

applied the new accounting standard and guidance effective March 31, 2010.

The Group holds some rental properties such as office buildings and land in Nagoya and other areas. Net of rental income and operating

expenses for those rental properties was ¥1,234 million ($13,269 thousand) for the fiscal year ended March 31, 2010.

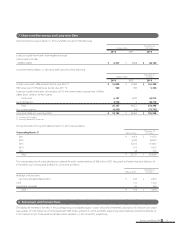

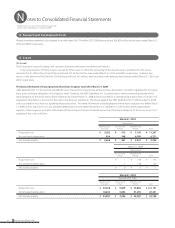

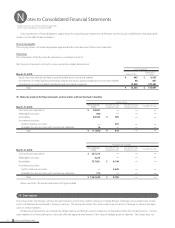

In addition, the carrying amounts, changes in such balances and market prices of such properties are as follows:

Millions of Yen

Carrying amount Fair value

April 1, 2009 Increase/ Decrease March 31, 2010 March 31, 2010

¥ 9,706 ¥ 347 ¥ 10,053 ¥ 19,028

Thousands of U.S. Dollars

Carrying amount Fair value

April 1, 2009 Increase/ Decrease March 31, 2010 March 31, 2010

$ 104,366 $ 3,731 $ 108,097 $ 204,602

Notes: 1) Carrying amount recognized in balance sheet is net of accumulated depreciation and accumulated impairment losses, if any.

2) Fair value of properties as of March 31, 2010 is mainly measured by the Group in accordance with its Real-estate Appraisal Standard.

28 Brother Annual Report 2010