Avon 2007 Annual Report Download - page 81

Download and view the complete annual report

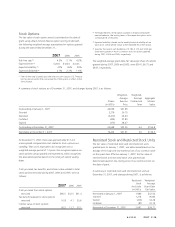

Please find page 81 of the 2007 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.During the fourth quarter 2007, we announced the final ini-

tiatives that are part of our restructuring plan. We expect to

record restructuring charges and other costs to implement

restructuring initiatives of approximately $530 before taxes. We

have recorded total costs to implement, net of adjustments, of

$443.6 ($158.3 in 2007, $228.8 in 2006, and $56.5 in 2005) for

actions associated with our restructuring initiatives. We expect to

record a majority of the remaining costs by the end of 2009.

Restructuring Charges – 2005

In December 2005 and January 2006, exit and disposal activities

that are a part of this multi-year restructuring plan were

approved. Specific actions for this initial phase of our multi-year

restructuring plan included:

• organization realignment and downsizing in each region and

global through a process called “delayering,” taking out layers

to bring senior management closer to operations;

• the exit of unprofitable lines of business or markets, including

the closure of unprofitable operations in Asia, primarily

Indonesia and the exit of a product line in China, and the exit

of the beComing product line in the U.S.; and

• the move of certain services from markets within Europe to

lower cost shared service centers.

The actions described above were completed during 2006,

except for the move of certain services from markets within

Europe to lower cost shared service centers, which is expected to

be completed in phases through 2008.

In connection with initiatives that had been approved to date,

we recorded total costs to implement in 2005 of $56.5, and the

costs consisted of the following:

• charges of $43.2 for employee-related costs, including sev-

erance, pension and other termination benefits, asset impair-

ment charges and cumulative foreign currency translation

charges previously recorded directly to shareholders’ equity;

• charges of $8.4 for inventory write-off; and

• other costs to implement of $4.9 for professional service fees

related to the implementation of these initiatives.

Of the total costs to implement, $48.1 was recorded in selling,

general and administrative expenses in 2005, and $8.4 was

recorded in cost of sales in 2005.

Approximately 58% of these charges resulted in cash

expenditures, with a majority of the cash payments made during

2006.

Restructuring Charges – 2006

During 2006 and January 2007, additional exit and disposal activ-

ities that are a part of our restructuring initiatives were

approved. Specific actions for this phase of our restructuring ini-

tiatives included:

• organization realignment and downsizing in each region and

global through a process called “delayering,” taking out layers

to bring senior management closer to operations;

• the phased outsourcing of certain services, including certain

key human resource and customer service processes;

• the realignment of certain North America distribution

operations;

• the exit of certain unprofitable operations, including the clo-

sure of the Avon Salon & Spa; and

• the reorganization of certain functions, primarily sales-related

organizations.

Many of the actions were completed in 2006, including the

delayering program. A majority of the remaining actions were

completed in 2007. The outsourcing of certain services is

expected to be completed in phases through 2009. The realign-

ment of certain North America distribution operations is

expected to be completed in phases through 2012. The

reorganization of one of our functions is expected to be com-

pleted in phases through 2010.

In connection with initiatives that had been approved to date,

we recorded total costs to implement in 2006 of $228.8, and

the costs consisted of the following:

• charges of $218.3 for employee-related costs, including sev-

erance, pension and other termination benefits;

• favorable adjustments of $16.1, primarily relating to a higher

than expected number of employees successfully pursuing

reassignments to other positions and higher than expected

turnover (employees leaving prior to termination); and

• other costs to implement of $24.9 and $1.7 for professional

service fees related to the implementation of these initiatives

and accelerated depreciation, respectively.

Of the total costs to implement, $229.1 was recorded in selling,

general and administrative expenses in 2006, and a favorable

adjustment of $.3 was recorded in cost of sales in 2006.

Approximately 85% of these charges resulted in cash

expenditures, with a majority of the cash payments made during

2007.

A V O N 2007 F-29