Avon 2007 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2007 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

RESULTS OF OPERATIONS – CONSOLIDATED

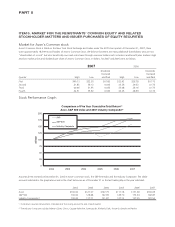

Favorable (Unfavorable)

%/Point Change

2007 2006 2005

2007 vs.

2006

2006 vs.

2005

Total revenue $9,938.7 $8,763.9 $8,149.6 13% 8%

Cost of sales 3,941.2 3,416.5 3,113.2 (15)% (10)%

Selling, general and administrative expenses 5,124.8 4,586.0 3,887.4 (12)% (18)%

Operating profit 872.7 761.4 1,149.0 15% (34)%

Interest expense 112.2 99.6 54.1 (13)% (84)%

Interest income 42.2 55.3 37.3 (24)% 48%

Other expense, net 6.6 13.6 8.0 51% (70)%

Net income $ 530.7 $ 477.6 $ 847.6 11% (44)%

Diluted earnings per share $ 1.21 $ 1.06 $ 1.81 14% (41)%

Advertising expenses (1) $ 368.4 $ 248.9 $ 135.9 (48)% (83)%

Gross margin 60.3% 61.0% 61.8% (.7) (.8)

Selling, general and administrative expenses as a % of

total revenue 51.6% 52.3% 47.7% .7 (4.6)

Operating margin 8.8% 8.7% 14.1% .1 (5.4)

Effective tax rate 33.0% 31.8% 24.0% (1.2) (7.8)

Units sold 7% 2%

Active Representatives 9% 5%

(1) Advertising expenses are included within selling, general and administrative expenses.

Total Revenue

Total revenue increased 13% in 2007 with growth in all segments.

Revenue growth was driven by an increase of 9% in Active Repre-

sentatives, while foreign exchange contributed 5 percentage

points to the revenue growth. An increase in the number of sales

campaigns in Central & Eastern Europe had a minimal impact on

Active Representative growth.

On a category basis, the 2007 increase in revenue was primarily

driven by an increase of 15% in Beauty sales. Within the Beauty

category, fragrance increased 20%, color increased 16%, skin

care increased 6% and personal care increased 21%. Beauty Plus

sales increased 12% and Beyond Beauty sales increased 6%.

Total revenue increased 8% in 2006, as we benefited from the

fourth quarter 2005 acquisition of our licensee in Colombia, as

that market contributed 3 percentage points to revenue growth.

Foreign exchange also contributed 2 percentage points to the

revenue growth. Revenue grew in Latin America, Western Europe,

Middle East & Africa, Central & Eastern Europe, North America

and China. Revenue declined in Asia Pacific.

On a category basis, the 2006 increase in revenue was primarily

driven by an increase of 8% in Beauty sales. Within the Beauty

category, fragrance increased 12%, color increased 3%, skin care

increased 6%, and personal care increased 7%. Beauty Plus sales

increased 10% and Beyond Beauty sales increased 3%.

For additional discussion of the changes in revenue by segment,

see the “Segment Review” section of this Management’s Dis-

cussion and Analysis of Financial Condition and Results of

Operations.

Gross Margin

Gross margin decreased .7 point in 2007, primarily due to an

increase in inventory obsolescence provisions of approximately

$100 in 2007 and an unfavorable mix of products sold, partially

offset by supply chain efficiencies. As discussed in the Overview

section, 2007 and 2006 included incremental inventory obso-

lescence charges of $167.3 and $72.6, respectively, related to our

decision to discontinue the sale of certain products as part of our

PLS program. Additionally, 2006 included incremental inventory

obsolescence charges of $20.5 related to our decisions to dis-

continue the sale of certain heavily discounted products. There will

be no further PLS inventory charges.

Gross margin decreased .8 point during 2006, primarily due to

higher inventory obsolescence provisions, which increased $86.4

in 2006. As discussed in the Overview section, 2006 includes

charges related to our PLS program and our decision to dis-

continue the sale of heavily discounted excess products.