Avon 2007 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2007 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

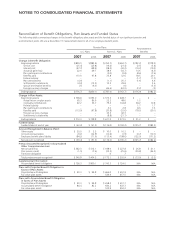

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

repay a portion of convertible notes, which matured in July

2003. The carrying value of the 4.20% Notes represents the

$250.0 principal amount, net of the unamortized discount to

face value of $.9 and $1.0 at December 31, 2007 and 2006,

respectively.

In April 2003, the call holder of $100.0, 6.25% Notes due May

2018 (the “Notes”), embedded with put and call option fea-

tures, exercised the call option associated with these Notes, and

thus became the sole note holder of the Notes. Pursuant to an

agreement with the sole note holder, we modified these Notes

into $125.0 aggregate principal amount of 4.625% notes due

May 15, 2013. The modified principal amount represented the

original value of the putable/callable notes, plus the market

value of the related call option and approximately $4.0 principal

amount of additional notes issued for cash. In May 2003, $125.0

principal amount of registered senior notes were issued in

exchange for the modified notes held by the sole note holder.

No cash proceeds were received by us. The registered senior

notes mature on May 15, 2013, and bear interest at a per

annum rate of 4.625%, payable semi-annually (the “4.625%

Notes”). The 4.625% Notes were issued under our $1,000.0

debt shelf registration statement. The transaction was accounted

for as an exchange of debt instruments and, accordingly, the

premium related to the original notes is being amortized over

the life of the new 4.625% Notes. At December 31, 2007 and

2006, the carrying value of the 4.625% Notes represents the

$125.0 principal amount, net of the unamortized discount to

face value and the premium related to the call option associated

with the original notes totaling $13.0 and $14.9, respectively.

The indentures under which the above notes were issued contain

certain covenants, including limits on the incurrence of liens and

restrictions on the incurrence of sale/leaseback transactions and

transactions involving a merger, consolidation or sale of sub-

stantially all of our assets. At December 31, 2007, we were in

compliance with all covenants in our indentures.

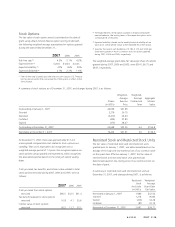

Annual maturities of long-term debt (including unamortized

discounts and premiums and excluding the adjustments for debt

with fair value hedges) outstanding at December 31, 2007, are

as follows:

2008 2009 2010 2011 2012

After

2012 Total

Maturities $22.8 $303.8 $2.0 $501.3 $1.1 $375.0 $1,206.0

Other Financing

We have a five-year, $1,000.0 revolving credit and competitive

advance facility (the “credit facility”), which expires in January

2011. The credit facility may be used for general corporate

purposes. The interest rate on borrowings under the credit

facility is based on LIBOR or on the higher of prime or 1/2% plus

the federal funds rate. The credit facility has an annual fee of

$.675, payable quarterly, based on our current credit ratings.

The credit facility contains various covenants, including a finan-

cial covenant which requires Avon’s interest coverage ratio

(determined in relation to our consolidated pretax income and

interest expense) to equal or exceed 4:1. At December 31, 2007,

there were no amounts outstanding under the credit facility.

We maintain a $1,000.0 commercial paper program. Under the

program, we may issue from time to time unsecured promissory

notes in the commercial paper market in private placements

exempt from registration under federal and state securities laws,

for a cumulative face amount not to exceed $1,000.0 out-

standing at any one time and with maturities not exceeding 270

days from the date of issue. The commercial paper short-term

notes issued under the program are not redeemable prior to

maturity and are not subject to voluntary prepayment. The

commercial paper program is supported by our credit facility.

Outstanding commercial paper effectively reduces the amount

available for borrowing under the credit facility. At

December 31, 2007, we had commercial paper outstanding of

$701.6 at an average annual interest rate of 5.05%.

In April 2007, we entered into a one-year, Euro 50 million ($72.9

at the exchange rate on December 31, 2007) uncommitted

credit facility (“Euro credit facility”) with the Bank of Tokyo-

Mitsubishi UFJ, Ltd. Borrowings under the Euro credit facility

bear interest at the Euro LIBOR rate plus an applicable margin.

The Euro credit facility is available for general corporate pur-

poses. The Euro credit facility is designated as a hedge of our

investments in our Euro-denominated functional currency sub-

sidiaries. At December 31, 2007, there was $32.8 (Euro 22.5

million) outstanding under the Euro credit facility.

In August 2006, we entered into a one-year, Japanese yen 11.0

billion ($96.3 at the exchange rate on December 31, 2007)

uncommitted credit facility (“yen credit facility”) with the Bank

of Tokyo-Mitsubishi UFJ, Ltd. Borrowings under the yen credit

facility bear interest at the yen LIBOR rate plus an applicable

margin. The yen credit facility is available for general corporate

purposes, including working capital and the repayment of out-

standing indebtedness. The yen credit facility was used to repay

the Japanese yen 9.0 billion note which came due in September

2006, as well as for other general corporate purposes. The yen