Avon 2007 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2007 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

income taxes on the December 31, 2006 Consolidated Balance

Sheet. In order to consistently report certain distribution and

sourcing costs across all segments, we reclassified net amounts

of $18.1 and $20.5 from cost of sales to selling, general and

administrative expenses on the Consolidated Statements of

Income for the years ended December 31, 2006 and 2005,

respectively. We also reclassified $6.4 and $9.4 from changes in

inventory to obsolescence expense on the Consolidated State-

ments of Cash Flows for the years ended December 31, 2006

and 2005, respectively.

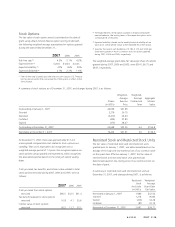

Earnings per Share

We compute basic earnings per share (“EPS”) by dividing net

income by the weighted-average number of shares outstanding

during the year. Diluted EPS is calculated to give effect to all

potentially dilutive common shares that were outstanding during

the year.

For each of the three years ended December 31, the compo-

nents of basic and diluted EPS were as follows:

(Shares in millions) 2007 2006 2005

Numerator:

Net income $ 530.7 $ 477.6 $ 847.6

Denominator:

Basic EPS weighted-average

shares outstanding 433.47 447.40 466.28

Diluted effect of assumed

conversion of share-based

awards 3.42 1.76 3.19

Diluted EPS adjusted weighted-

average shares outstanding 436.89 449.16 469.47

Earnings Per Share:

Basic $ 1.22 $ 1.07 $ 1.82

Diluted $ 1.21 $ 1.06 $ 1.81

At December 31, 2007 and 2006, we did not include stock

options to purchase 7.4 million shares and 12.9 million shares of

Avon common stock, respectively, in the calculations of diluted

EPS because the exercise prices of those options were greater

than the average market price and their inclusion would be anti-

dilutive.

NOTE 2. New Accounting Standards

Standards Implemented

Effective January 1, 2007, we adopted Financial Accounting

Standards Board (“FASB”) Interpretation No. 48, Accounting for

Uncertainty in Income Taxes – an interpretation of FASB State-

ment No. 109, (“FIN 48”). See Note 6, Income Taxes, for addi-

tional information.

Effective January 1, 2006, we adopted SFAS No. 123 (revised

2004), Share-Based Payment (“SFAS 123R”). See Note 1,

Description of Business and Summary of Significant Accounting

Policies, and Note 8, Share-Based Compensation Plans and Other

Long-Term Incentive Plan, for additional information.

Effective December 31, 2006, we adopted SFAS No. 158,

Employers’ Accounting for Defined Benefit Pension and Other

Postretirement Plans – an amendment of FASB Statements

No. 87, 88, 106 and 132R (“SFAS 158”). See Note 10, Employee

Benefit Plans, for additional information.

Effective December 31, 2006, we adopted Staff Accounting

Bulletin No. 108, Considering the Effects of Prior Year Misstate-

ments when Quantifying Misstatements in Current Year Financial

Statements (“SAB 108”), which provides interpretive guidance

on the consideration of the effects of prior year misstatements in

quantifying current year misstatements for the purpose of a

materiality assessment. SAB 108 allows for a one-time transi-

tional cumulative effect adjustment to beginning retained earn-

ings as of January 1, 2007, for errors that were not previously

deemed material, but are material under the guidance in SAB

108. The adoption of SAB 108 had no impact on our Con-

solidated Financial Statements.

Effective January 1, 2006, we adopted SFAS No. 151, Inventory

Costs (“SFAS 151”), which requires certain inventory-related

costs to be expensed as incurred. The adoption of SFAS 151 had

no impact on our Consolidated Financial Statements.

Standards to be Implemented

In December 2007, the FASB issued SFAS No. 141 (revised

2007), Business Combinations, (“SFAS 141R”), which changes

how business combinations are accounted for and will impact

financial statements both on the acquisition date and in sub-

sequent periods. SFAS 141R is effective January 1, 2009 for

Avon and will be applied prospectively. The impact of adopting

SFAS 141R will depend on the nature and terms of future

acquisitions.

In December 2007, the FASB issued SFAS No. 160, Non-

controlling Interests in Consolidated Financial Statements,

(“SFAS”) which changes the accounting and reporting stan-

dards, for the noncontrolling interests in a subsidiary in con-

solidated financial statements. SFAS 160 recharacterizes minority

interests as noncontrolling interests and requires noncontrolling

interests to be classified as a component of shareholders equity.

SFAS 160 is effective January 1, 2009 for Avon, and requires

retroactive adoption of the presentation and disclosure require-

ments for existing minority interests. We do not believe the

adoption of SFAS 160 will have a material impact on our