Avon 2007 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2007 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

Foreign exchange forward and option contracts – The fair values

of forward and option contracts were determined based on

quoted market prices from banks.

Interest rate swap and treasury lock agreements – The fair values

of interest rate swap and treasury lock agreements were esti-

mated based on quotes from market makers of these instru-

ments and represent the estimated amounts that we would

expect to receive or pay to terminate the agreements.

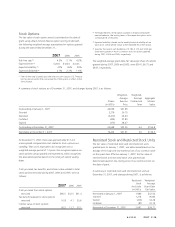

The asset (liability) amounts recorded in the balance sheet

(carrying amount) and the estimated fair values of financial

instruments at December 31 consisted of the following:

2007 2006

Carrying

Amount Fair Value

Carrying

Amount Fair Value

Cash and cash

equivalents $ 963.4 $ 963.4 $ 1,198.9 $ 1,198.9

Fixed–income

securities 18.8 18.8 18.0 18.0

Grantor trust cash

and cash

equivalents 10.7 10.7 25.2 25.2

Debt maturing within

one year 929.5 929.5 (615.6) (615.6)

Long-term debt, net

of related discount

or premium 1,167.7 1,178.4 (1,170.4) (1,165.4)

Foreign exchange

forward and

option contracts 2.8 2.8 7.9 7.9

Interest rate swap

and treasury lock

agreements (29.0) (29.0) (13.4) (13.4)

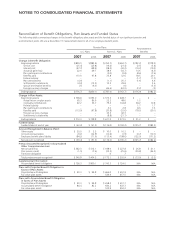

NOTE 8. Share-Based Compensation

Plans and Other Long-Term Incentive

Plan

The Avon Products, Inc. 2005 Stock Incentive Plan (the “2005

Plan”), which is shareholder approved, provides for several types

of share-based incentive compensation awards including stock

options, stock appreciation rights, restricted stock, restricted

stock units and performance unit awards. Under the 2005 Plan,

the maximum number of shares that may be awarded is

31,000,000 shares, of which no more than 8,000,000 shares

may be used for restricted stock awards and restricted stock unit

awards. Shares issued under share-based awards will be primarily

funded with issuance of new shares.

We have issued stock options, restricted stock, restricted stock

units and stock appreciation rights under the 2005 Plan. Stock

option awards are granted with an exercise price equal to the

market price of Avon’s stock at the date of grant; those option

awards generally vest in thirds over the three-year period follow-

ing each option grant date and have ten-year contractual terms.

Restricted stock or restricted stock units generally vest after three

years.

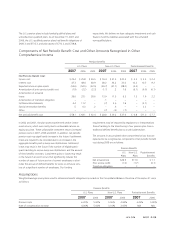

We recognized compensation cost of $61.6, $62.9 and $10.1

for stock options, restricted stock, restricted stock units, and

stock appreciation rights, all of which was recorded in selling,

general and administrative expenses, during the three years

ended December 31, 2007, 2006 and 2005, respectively. The

total income tax benefit recognized for share-based arrange-

ments was $20.7, $21.5 and $3.5 during the three years ended

December 31, 2007, 2006 and 2005, respectively.

As discussed in Note 1, Description of the Business and Sig-

nificant Accounting Policies, effective January 1, 2006, we

adopted the fair value recognition provisions of SFAS 123R using

the modified prospective application method. The following

table summarizes the proforma effects on net income and earn-

ings per share as if we had applied the fair value recognition

provisions of SFAS 123 to share-based compensation for the year

ended December 31, 2005.

2005

Net income, as reported $847.6

Add: compensation expense recognized for restricted

stock and restricted stock units, net of taxes 6.6

Less: share-based compensation expense determined

under FAS No. 123, net of taxes (37.7)

Pro forma net income $816.5

Earnings per share:

Basic – as reported $ 1.82

Basic – pro forma $ 1.75

Diluted – as reported $ 1.81

Diluted – pro forma $ 1.74