Avon 2007 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2007 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

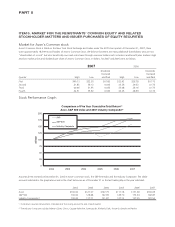

ITEM 6. SELECTED FINANCIAL DATA

We derived the following selected financial data from our audited consolidated financial statements. The following data should be read in

conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our Consolidated Financial

Statements and related Notes.

2007 (1) 2006 (2) 2005 (3) 2004 2003

Income Data

Total revenue $9,938.7 $8,763.9 $8,149.6 $7,747.8 $6,845.1

Operating profit (4) 872.7 761.4 1,149.0 1,229.0 1,042.8

Net income 530.7 477.6 847.6 846.1 664.8

Diluted earnings per share (5) $ 1.21 $ 1.06 $ 1.81 $ 1.77 $ 1.39

Cash dividends per share $ 0.74 $ 0.70 $ 0.66 $ 0.56 $ 0.42

Balance Sheet Data

Total assets $5,716.2 $5,238.2 $4,761.4 $4,148.1 $3,562.3

Debt maturing within one year 929.5 615.6 882.5 51.7 244.1

Long-term debt 1,167.9 1,170.7 766.5 866.3 877.7

Total debt 2,097.4 1,786.3 1,649.0 918.0 1,121.8

Shareholders’ equity 711.6 790.4 794.2 950.2 371.3

(1) In 2007, we recorded restructuring charges and other costs to implement the restructuring initiatives totaling $158.3 related to our multi-year restructuring

plan announced during 2005. We also recorded charges totaling $187.8, including $167.3 of inventory obsolescence expense, related to our product line

simplification program (“PLS”). We also recorded a decrease of $18.3 to shareholders’ equity from the initial adoption of Financial Accounting Standards

Board (“FASB”) Interpretation No. 48, Accounting for Uncertainty in Income Taxes – an interpretation of FASB Statement No. 109, (“FIN 48”).

(2) In 2006, we recorded restructuring charges and other costs to implement the restructuring initiatives totaling $228.8 related to our multi-year restructuring

plan announced during 2005. We also recorded charges totaling $81.4, including $72.6 of inventory obsolescence expense, related to our PLS program. We

also recorded decreases of $232.8 and $254.7 to total assets and shareholders’ equity, respectively, from the initial adoption of Statement of Financial

Accounting Standards (“ SFAS”) No. 158, Employers’ Accounting for Defined Benefit Pension and Other Postretirement Plans - an amendment of FASB

Statements No. 87, 88, 106 and 132R (“SFAS 158”).

(3) In 2005, we recorded restructuring charges and other costs to implement the restructuring initiatives totaling $56.5 related to our multi-year restructuring

plan announced during 2005.

(4) We adopted SFAS No. 123 (revised 2004) Share-Based Payment (“SFAS 123R”), effective January 1, 2006. Operating profit includes charges related to share-

based compensation of $61.6, $62.9, $10.1, $8.8 and $6.6 for the years ended December 31, 2007, 2006, 2005, 2004 and 2003, respectively.

(5) For purposes of calculating diluted earnings per share for the year ended December 31, 2003, after-tax interest expense of $5.7 applicable to convertible

notes, has been added back to net income.