Avon 2007 Annual Report Download - page 59

Download and view the complete annual report

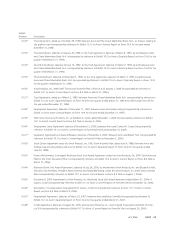

Please find page 59 of the 2007 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(In millions, except per share and share data)

NOTE 1. Description of the Business

and Summary of Significant Accounting

Policies

Business

When used in these notes, the terms “Avon,” “Company,”

“we” or “us” mean Avon Products, Inc.

We are a global manufacturer and marketer of beauty and

related products. Our business is conducted worldwide primarily

in one channel, direct selling. We manage our operations based

on geographic operations and our reportable segments are

North America; Latin America; Western Europe, Middle East &

Africa; Central & Eastern Europe; Asia Pacific; and China. We

also centrally manage global Brand Marketing and Supply Chain

organizations.

Sales are made to the ultimate customers principally by

independent Avon Representatives. Product categories include

Beauty, which consists of cosmetics, fragrances, skin care and

toiletries; Beauty Plus, which consists of fashion jewelry,

watches, apparel and accessories; and Beyond Beauty, which

consists of home products and gift and decorative products.

Sales from Health and Wellness and mark. are included among

these three categories based on product type.

Principles of Consolidation

The consolidated financial statements include the accounts of

Avon and our majority and wholly-owned subsidiaries. Inter-

company balances and transactions are eliminated.

Use of Estimates

The preparation of financial statements in conformity with gen-

erally accepted accounting principles in the United States of

America requires us to make estimates and assumptions that

affect the reported amounts of assets and liabilities, the dis-

closure of contingent assets and liabilities at the date of the

financial statements and the reported amounts of revenues and

expenses during the reporting period. Actual results could differ

materially from those estimates and assumptions. On an ongoing

basis, we review our estimates, including those related to

restructuring reserves, allowances for doubtful accounts receiv-

able, allowances for sales returns, provisions for inventory obso-

lescence, income taxes and tax valuation reserves, share-based

compensation, loss contingencies, and the determination of

discount rate and other actuarial assumptions for pension, post-

retirement and postemployment benefit expenses.

Foreign Currency

Financial statements of foreign subsidiaries operating in other

than highly inflationary economies are translated at year-end

exchange rates for assets and liabilities and average exchange

rates during the year for income and expense accounts. The

resulting translation adjustments are recorded within accumu-

lated other comprehensive loss. Financial statements of sub-

sidiaries operating in highly inflationary economies are translated

using a combination of current and historical exchange rates and

any translation adjustments are included in current earnings.

Gains or losses resulting from foreign currency transactions are

recorded in other expense, net.

Revenue Recognition

Net sales primarily include sales generated as a result of Repre-

sentative orders less any discounts, taxes and other deductions.

We recognize revenue upon delivery, when both title and the

risks and rewards of ownership pass to the independent Repre-

sentatives, who are our customers. Our internal financial systems

accumulate revenues as orders are shipped to the Representa-

tive. Since we report revenue upon delivery, revenues recorded

in the financial system must be reduced for an estimate of the

financial impact of those orders shipped but not delivered at the

end of each reporting period. We use estimates in determining

the adjustments to revenue and operating profit for orders that

have been shipped but not delivered as of the end of the period.

These estimates are based on daily sales levels, delivery lead

times, gross margin and variable expenses. We also estimate an

allowance for sales returns based on historical experience with

product returns. In addition, we estimate an allowance for

doubtful accounts receivable based on an analysis of historical

data and current circumstances.

Other Revenue

Other revenue primarily includes shipping and handling fees bil-

led to Representatives.

Cash and Cash Equivalents

Cash equivalents are stated at cost plus accrued interest, which

approximates fair value. Cash equivalents are high-quality, short-

term money market instruments with an original maturity of

three months or less and consist of time deposits with a number

of U.S. and non-U.S. commercial banks and money market fund

investments.

Inventories

Inventories are stated at the lower of cost or market. Cost is

determined using the first-in, first-out (“FIFO”) method. We clas-

sify inventory into various categories based upon their stage in

A V O N 2007 F-7