Avon 2007 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2007 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

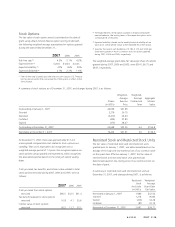

Stock Options

The fair value of each option award is estimated on the date of

grant using a Black-Scholes-Merton option pricing model with

the following weighted-average assumptions for options granted

during the years ended December 31, :

2007 2006 2005

Risk-free rate (1) 4.5% 5.1% 4.2%

Expected term (2) 4 years 4 years 4 years

Expected volatility (3) 27% 26% 25%

Expected dividends (4) 2.1% 2.3% 1.6%

(1) The risk-free rate is based upon the rate on a zero coupon U.S. Treasury

bill, for periods within the contractual life of the option, in effect at the

time of grant.

(2) The expected term of the option is based on historical employee

exercise behavior, the vesting terms of the respective option and a

contractual life of ten years.

(3) Expected volatility is based on the weekly historical volatility of our

stock price, over a period similar to the expected life of the option.

(4) Assumes the current cash dividends of $.185, $.175 and $.165 per

share each quarter on Avon’s common stock for options granted

during 2007, 2006 and 2005, respectively.

The weighted-average grant-date fair values per share of options

granted during 2007, 2006 and 2005, were $8.41, $6.75 and

$9.07, respectively.

A summary of stock options as of December 31, 2007, and changes during 2007, is as follows:

Shares

(in 000’s)

Weighted-

Average

Exercise

Price

Weighted-

Average

Contractual

Term

Aggregate

Intrinsic

Value

Outstanding at January 1, 2007 24,658 $31.85

Granted 2,279 36.75

Exercised (3,410) 24.24

Forfeited (409) 37.80

Expired (470) 38.27

Outstanding at December 31, 2007 22,648 $33.25 6.3 $156.8

Exercisable at December 31, 2007 16,422 $31.91 5.6 $134.3

At December 31, 2007, there was approximately $13.4 of

unrecognized compensation cost related to stock options out-

standing. That cost is expected to be recognized over a

weighted-average period of 1.3 years. We recognize expense on

stock options using a graded vesting method, which recognizes

the associated expense based on the timing of option vesting

dates.

Cash proceeds, tax benefits, and intrinsic value related to total

stock options exercised during 2007, 2006 and 2005, were as

follows:

2007 2006 2005

Cash proceeds from stock options

exercised $85.5 $32.5 $61.4

Tax benefit realized for stock options

exercised 16.8 4.1 20.6

Intrinsic value of stock options

exercised 50.5 11.7 57.1

Restricted Stock and Restricted Stock Units

The fair value of restricted stock and restricted stock units

granted prior to January 1, 2007, was determined based on the

average of the high and low market prices of our common stock

on the grant date. Effective January 1, 2007, the fair value of

restricted stock and restricted stock units granted was

determined based on the closing price of our common stock on

the date of grant.

A summary of restricted stock and restricted stock units at

December 31, 2007, and changes during 2007, is as follows:

Restricted

Stock

And Units

(in 000’s)

Weighted-

Average

Grant-Date

Fair Value

Nonvested at January 1, 2007 1,980 $32.54

Granted 1,214 36.84

Vested (416) 34.28

Forfeited (87) 33.19

Nonvested at December 31, 2007 2,691 $34.71

A V O N 2007 F-19