Avon 2007 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2007 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

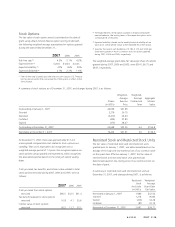

The U.S. pension plans include funded qualified plans and

unfunded non-qualified plans. As of December 31, 2007 and

2006, the U.S. qualified pension plans had benefit obligations of

$683.3 and $735.3, and plan assets of $713.3 and $738.8,

respectively. We believe we have adequate investments and cash

flows to fund the liabilities associated with the unfunded

non-qualified plans.

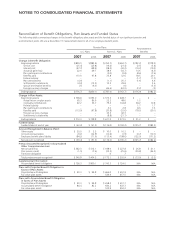

Components of Net Periodic Benefit Cost and Other Amounts Recognized in Other

Comprehensive Income

Pension Benefits

Postretirement BenefitsU.S. Plans Non-U.S. Plans

2007 2006 2005 2007 2006 2005 2007 2006 2005

Net Periodic Benefit Cost:

Service cost $ 25.4 $ 25.8 $ 29.5 $ 19.4 $ 21.4 $ 20.3 $ 3.5 $ 3.4 $ 2.4

Interest cost 47.3 48.4 48.9 38.2 34.2 33.0 10.2 10.5 9.2

Expected return on plan assets (53.6) (54.5) (52.5) (39.7) (31.1) (28.0) (2.3) – –

Amortization of prior service (credit) cost (1.9) (2.2) (2.3) (1.7) .2 1.6 (6.1) (6.0) (6.1)

Amortization of actuarial

losses 36.0 33.1 38.6 13.9 11.5 9.5 1.5 1.9 2.2

Amortization of transition obligation – – – .1 – – – – –

Settlements/curtailments 4.4 11.2 – (.7) 2.6 1.9 – (2.1) –

Special termination benefits .5 6.3 .2 – .6 – – 3.3 –

Other – – – (.7) (.2) (.7) – – –

Net periodic benefit cost $ 58.1 $ 68.1 $ 62.4 $ 28.8 $ 39.2 $ 37.6 $ 6.8 $11.0 $ 7.7

In 2002 and 2001, the plan assets experienced weaker invest-

ment returns, which was mostly due to unfavorable returns on

equity securities. These unfavorable investment returns increased

pension costs in 2007, 2006 and 2005. In addition, net periodic

pension cost may significantly increase in the future if settlement

losses are required to be recorded due to an increase in the

aggregate benefits paid as lump sum distributions. Settlement

losses may result in the future if the number of eligible partic-

ipants deciding to receive lump sum distributions and the amount

of their benefits increases. Curtailment gains or losses may result

in the future if an event occurs that significantly reduces the

number of years of future service of current employees or elimi-

nates the accrual of defined benefits for some or all future serv-

ices of a significant number of employees. Our funding

requirements may be impacted by regulations or interpretations

thereof relating to the transitioning of our pension plan from a

traditional defined benefit plan to a cash balance plan.

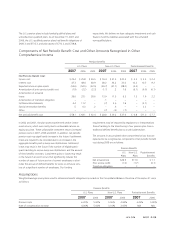

The amounts in accumulated other comprehensive loss that are

expected to be recognized as components of net periodic benefit

cost during 2008 are as follows:

Pension Benefits

Postretirement

Benefits

U.S.

Plans

Non-U.S.

Plans

Net actuarial loss $28.9 $11.0 $ 1.1

Prior service credit (1.0) (1.7) (6.1)

Transition obligation – .1 –

Assumptions

Weighted-average assumptions used to determine benefit obligations recorded on the Consolidated Balance Sheets as of December 31 were

as follows:

Pension Benefits

U.S. Plans Non-U.S. Plans Postretirement Benefits

2007 2006 2007 2006 2007 2006

Discount rate 6.20% 5.90% 5.56% 4.93% 6.26% 5.90%

Rate of compensation increase 4.00% 5.00% 3.10% 3.05% N/A N/A

A V O N 2007 F-23