Avon 2007 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2007 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

ITEM 5. MARKET FOR THE REGISTRANTS’ COMMON EQUITY AND RELATED

STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Market for Avon’s Common stock

Avon’s Common Stock is listed on the New York Stock Exchange and trades under the AVP ticker symbol. At December 31, 2007, there

were approximately 18,399 record holders of Avon’s Common Stock. We believe that there are many additional shareholders who are not

“shareholders of record” but who beneficially own and vote shares through nominee holders such as brokers and benefit plan trustees. High

and low market prices and dividends per share of Avon’s Common Stock, in dollars, for 2007 and 2006 were as follows:

2007 2006

Quarter High Low

Dividends

Declared

and Paid High Low

Dividends

Declared

and Paid

First $40.13 $32.55 $0.185 $32.43 $26.78 $0.175

Second 41.85 36.13 0.185 33.26 29.53 0.175

Third 40.66 31.95 0.185 33.08 26.16 0.175

Fourth 42.51 35.92 0.185 34.25 28.99 0.175

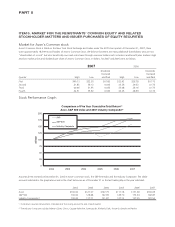

Stock Performance Graph

Comparison of Five Year Cumulative Total Return(1)

Avon, S&P 500 Index and 2007 Industry Composite(2)

0

25

50

75

100

125

150

175

200

2002 2003 2004 2005 2006 2007

$ Value

AVP

S&P 500

Industry Composite

Assumes $100 invested on December 31, 2002 in Avon’s common stock, the S&P 500 Index and the Industry Composite. The dollar

amounts indicated in the graph above and in the chart below are as of December 31 or the last trading day in the year indicated.

2002 2003 2004 2005 2006 2007

Avon $100.00 $127.07 $147.79 $111.18 $131.69 $160.69

S&P 500 100.00 128.68 142.69 149.70 173.34 182.87

Industry Composite (2) 100.00 117.11 131.87 137.13 157.35 181.53

(1) Total return assumes reinvestment of dividends at the closing price at the end of each quarter.

(2) The Industry Composite includes Alberto-Culver, Clorox, Colgate–Palmolive, Estée Lauder, Kimberly Clark, Procter & Gamble and Revlon.