Avon 2007 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2007 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

consolidated financial statements. At December 31, 2007 and

2006, other liabilities included minority interests of $38.2 and

$37.0, respectively.

In February 2007, the FASB issued Statement of Financial

Accounting Standards (“SFAS”) No. 159, The Fair Value Option

for Financial Assets and Financial Liabilities – including an

amendment to FASB Statement No. 115, (“SFAS 159”), which

permits entities to choose to measure many financial instruments

and certain other items at fair value that are not currently

required to be measured at fair value. SFAS 159 is effective

January 1, 2008 for Avon. In February 2008, the FASB issued

Staff Position 157-b, Effective Date of FASB Statement No. 157,

which delays the effective date of SFAS No. 157 for nonfinancial

assets and nonfinancial liabilities until January 1, 2009, for Avon.

We believe the adoption of SFAS 159 will have no impact on our

consolidated financial statements.

In September 2006, the FASB issued SFAS No. 157, Fair Value

Measurements (“SFAS 157”), which defines fair value, estab-

lishes a framework for measuring fair value in accordance with

generally accepted accounting principles, and expands dis-

closures about fair value measurements. SFAS 157 is effective

January 1, 2008 for Avon. We believe the adoption of SFAS 157

will not have a material impact on our consolidated financial

statements.

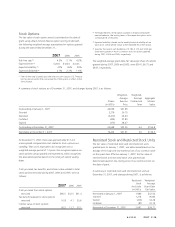

NOTE 3. Inventories

Inventories at December 31 consisted of the following:

2007 2006

Raw materials $ 337.8 $260.6

Finished goods 704.0 639.7

Total $1,041.8 $900.3

NOTE 4. Debt and Other Financing

Debt

Debt at December 31 consisted of the following:

2007 2006

Debt maturing within one year:

Notes payable $ 76.0 $ 81.9

Commercial paper 701.6 335.9

6.55% Notes, due August 2007 – 100.0

Yen credit facility 96.3 92.9

Euro credit facility 32.8 –

Current portion of long-term debt 22.8 4.9

Total $ 929.5 $ 615.6

2007 2006

Long-term debt:

5.125% Notes, due January 2011 $ 499.6 $ 499.5

7.15% Notes, due November 2009 300.0 300.0

4.625% Notes, due May 2013 112.0 110.1

4.20% Notes, due July 2018 249.1 249.0

Other, payable through 2013 with

interest from 1% to 16% 31.0 26.0

Total long-term debt 1,191.7 1,184.6

Adjustments for debt with fair value

hedges (1.0) (9.0)

Less current portion (22.8) (4.9)

Total $1,167.9 $1,170.7

At December 31, 2007 and 2006, notes payable included short-

term borrowings of international subsidiaries at average annual

interest rates of approximately 4.6% and 6.3%, respectively.

Other long-term debt, payable through 2013, includes obliga-

tions under capital leases of $13.6, which primarily relate to

leases of automobiles.

Adjustments for debt with fair value hedges includes adjust-

ments to reflect net unrealized losses of $9.4 and $21.8 on debt

with fair value hedges at December 31, 2007 and 2006,

respectively, and unamortized gains on terminated swap agree-

ments and swap agreements no longer designated as fair value

hedges of $8.4 and $12.8 at December 31, 2007 and 2006,

respectively (see Note 7, Financial Instruments and Risk

Management).

At December 31, 2007 and 2006, we held interest rate swap

contracts that swap approximately 30% of our long-term debt

to variable rates (see Note 7, Financial Instruments and Risk

Management).

In January 2006, we issued in a public offering $500.0 principal

amount of notes payable (“5.125% Notes”) that mature on

January 15, 2011, and bear interest, payable semi-annually, at a

per annum rate equal to 5.125%. The net proceeds from the

offering were used for general corporate purposes, including the

repayment of short-term domestic debt. The carrying value of

the 5.125% Notes represents the $500.0 principal amount, net

of the unamortized discount to face value of $.4 and $.5 at

December 31, 2007 and 2006, respectively.

In June 2003, we issued to the public $250.0 principal amount

of registered senior notes (the “4.20% Notes”) under our

$1,000.0 debt shelf registration statement. The 4.20% Notes

mature on July 15, 2018, and bear interest at a per annum rate

of 4.20%, payable semi-annually. The net proceeds were used to

A V O N 2007 F-11