3M 2004 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2004 3M annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

69

The ESOP has been the primary funding source for the Company’s employee savings plans. As permitted by

AICPA Statement of Position 93-6, “Employers’ Accounting for Employee Stock Ownership Plans”, the Company

has elected to continue its practices, which are based on Statement of Position 76-3, “Accounting Practices for

Certain Employee Stock Ownership Plans” and subsequent consensus of the EITF of the FASB. Accordingly, the

debt of the ESOP is recorded as debt, and shares pledged as collateral are reported as unearned compensation

in the Consolidated Balance Sheet and Consolidated Statement of Changes in Stockholders’ Equity and

Comprehensive Income. Unearned compensation is reduced symmetrically as the ESOP makes principal

payments on the debt. Expenses related to the ESOP include total debt service on the notes, less dividends. The

Company contributes treasury shares, accounted for at fair value, to employee savings plans to cover obligations

not funded by the ESOP (reported as an employee benefit expense).

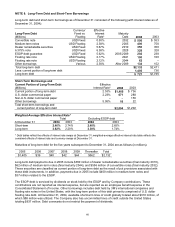

Employee Savings and Stock Ownership Plans

(Millions) 2004 2003 2002

Dividends on shares held by the ESOP $33 $ 31 $ 31

Company contributions to the ESOP 15 17 17

Interest incurred on ESOP notes 12 14 16

Amounts reported as an employee benefit expense:

Expenses related to ESOP debt service 11 13 13

Expenses related to treasury shares 45 43 42

ESOP Debt Shares 2004 2003 2002

Allocated 16,200,282 15,494,346 14,815,180

Committed to be released 705,068 546,798 758,374

Unreleased 6,219,328 7,799,513 9,010,504

Total ESOP debt shares 23,124,678 23,840,657 24,584,058

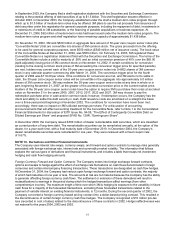

NOTE 14. General Employees’ Stock Purchase Plan (GESPP)

In May 1997, shareholders approved 30 million shares for issuance under the Company’s GESPP. Substantially all

employees are eligible to participate in the plan. Participants are granted options at 85% of market value at the date of

grant. There are no GESPP shares under option at the beginning or end of each year because options are granted on

the first business day and exercised on the last business day of the same month.

General Employees’ Stock

Purchase Plan 2004 2003 2002

Shares

Exercise

Price* Shares

Exercise

Price* Shares

Exercise

Price*

Options granted 1,701,874 $69.65 1,812,055 $57.18 1,865,911 $51.49

Options exercised (1,701,874) 69.65 (1,812,055) 57.18 (1,865,911) 51.49

Shares available for

grant – December 31 13,751,060 15,452,934 17,264,989

*Weighted average

The weighted average fair value per option granted during 2004, 2003 and 2002 was $12.29, $10.09 and $9.09,

respectively. The fair value of GESPP options was based on the 15% purchase price discount.