3M 2004 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2004 3M annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

58

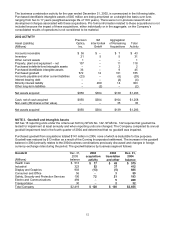

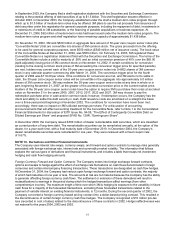

NOTE 8. Income Taxes

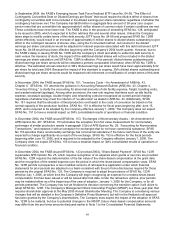

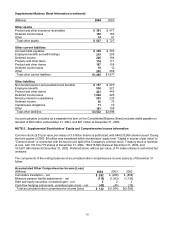

Income Before Income Taxes and Minority Interest

(Millions)

2004 2003 2002

United States $2,192 $1,848 $1,725

International

2,363 1,809 1,280

Total

$4,555 $3,657 $3,005

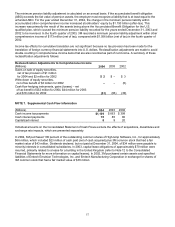

Provision for Income Taxes

(Millions)

2004 2003 2002

Currently payable

Federal $ 559 $ 429 $ 43

State (61) 81 12

International 692 577 332

Deferred

Federal 82 168 514

State 136 (27) 21

International 95 (26) 44

Total $1,503 $1,202 $ 966

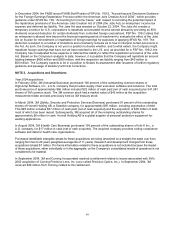

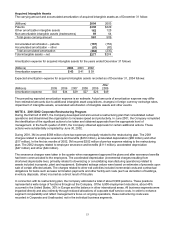

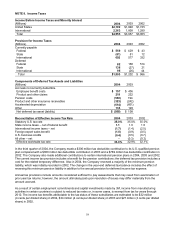

Components of Deferred Tax Assets and Liabilities

(Millions)

2004 2003

Accruals not currently deductible

Employee benefit costs $ 157 $ 406

Product and other claims 219 222

Pension costs (530) 194

Product and other insurance receivables (323) (242)

Accelerated depreciation (614) (601)

Other

133 129

Net deferred tax asset (liability) $ (958) $ 108

Reconciliation of Effective Income Tax Rate 2004 2003 2002

Statutory U.S. tax rate 35.0% 35.0% 35.0%

State income taxes – net of federal benefit 1.1 1.0 1.0

International income taxes – net (1.7) (1.4) (2.5)

Foreign export sales benefit (1.0) (0.9) (0.5)

U.S. business credits (0.4) (0.5) (0.7)

All other – net – (0.3) (0.2)

Effective worldwide tax rate 33.0% 32.9% 32.1%

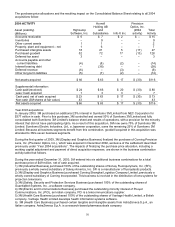

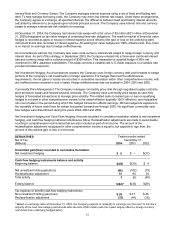

In the third quarter of 2004, the Company made a $300 million tax deductible contribution to its U.S. qualified pension

plan compared with a $600 million tax deductible contribution in 2003 and a $789 million tax deductible contribution in

2002. The Company also made additional contributions to certain international pension plans in 2004, 2003 and 2002.

The current income tax provision includes a benefit for the pension contributions; the deferred tax provision includes a

cost for the related temporary difference. Also in 2004, the Company reversed a majority of the minimum pension

liability, which was initially recorded in 2002. The change in the year-end deferred tax balance includes the effect of

reversing this minimum pension liability in addition to the annual provision for deferred income tax expense.

Annual tax provisions include amounts considered sufficient to pay assessments that may result from examination of

prior year tax returns; however, the amount ultimately paid upon resolution of issues may differ materially from the

amount accrued.

As a result of certain employment commitments and capital investments made by 3M, income from manufacturing

activities in certain countries is subject to reduced tax rates or, in some cases, is exempt from tax for years through

2012. The income tax benefits attributable to the tax status of these subsidiaries are estimated to be $32 million

(4 cents per diluted share) in 2004, $34 million (4 cents per diluted share) in 2003 and $27 million (3 cents per diluted

share) in 2002.