3M 2004 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2004 3M annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.14

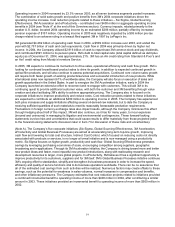

Supreme Court ruling. Various factors could affect the timing and amount of proceeds to be received under the

balance of the Company’s various insurance policies, including (i) additional delays in or avoidance of payment by

insurers; (ii) the extent to which insurers may become insolvent in the future, and (iii) the outcome of the pending

legal proceedings involving the insurers, including the insurers’ pending motion for partial relief from the amount

the Company believes is due under the Minnesota Supreme Court decision.

Respirator Mask/Asbestos Liabilities and Insurance Receivables: The Company estimates its respirator

mask/asbestos liabilities, both the cost to resolve the claim and defense costs, by examining: (i) the Company’s

experience in resolving claims, (ii) apparent trends, (iii) the apparent quality of newly-filed claims (e.g., the

Company believes many of the recently filed claims have been asserted on behalf of asymptomatic claimants), (iv)

changes in the nature and mix of claims (e.g., the proportion of claims asserting usage of the Company’s mask or

respirator products and alleging exposure to each of asbestos, silica or other occupational dusts, and claims

pleading use of asbestos-containing products allegedly manufactured by the Company), (v) the number of current

claims and an assumption for projection of the number of future asbestos and other claims that may be filed

against the Company, (vi) the cost to resolve recently settled claims, and (vii) an estimate of the cost to resolve

and defend against current and future claims. Because of the inherent difficulty in projecting claims that have not

yet been asserted, particularly with respect to the Company’s respiratory products that themselves did not contain

any harmful materials (which makes the various published studies that purport to project future asbestos claims

substantially removed from the Company’s principal experience and which themselves vary widely), the Company

does not believe that there is any single best estimate of this liability, nor that it can reliably estimate the amount or

range of amounts by which the liability may exceed the reserve the Company has established.

Developments may occur that could affect the Company’s estimate of its liabilities and associated expenses.

These developments include, but are not limited to, significant changes in (i) the number of future claims, (ii) the

average cost of resolving claims, (iii) the legal costs of defending these claims and in maintaining trial readiness,

(iv) changes in the mix and nature of claims received, (v) trial and appellate outcomes, (vi) changes in the law and

procedure applicable to these claims, and (vii) the financial viability of other co-defendants and insurers. Congress

is currently considering legislation that would terminate essentially all litigation related to asbestos (but not other

occupational dusts) in exchange for substantial annual payments by the defendant companies and their insurers

and, accordingly, such legislation, if enacted, would bring considerable certainty to the assessment of the

Company’s future asbestos-related liability; the Company supports such legislation in principle, although

enactment of the proposed legislation could cause the Company to record substantial additional liabilities.

As a result of the caseload and the costs of aggressively defending itself, the Company made payments of

$81 million in 2004 and increased its reserves in the fourth quarter of 2004 for the respirator mask/asbestos

liabilities by $40 million to $248 million. No liability had been previously recorded regarding the now-reversed

Mississippi jury verdict and no liability has been recorded regarding the pending action brought by the West

Virginia Attorney General previously described.

As of December 31, 2004, the Company had receivables for insurance recoveries related to the respirator

mask/asbestos litigation of $464 million. The Company increased its receivables in the fourth quarter of 2004 for

insurance recoveries related to respirator mask/asbestos litigation by $20 million and received payments from

insurers and one reinsurer of $4 million in the third quarter of 2004. While the Company has substantial remaining

claims-made and occurrence (pre-1986) insurance coverage, as previously noted, this additional receivable

represents a lower percentage of the additional liability than was the case with receivables recorded prior to 2004,

primarily because of varying degrees of prior settlements at higher levels of the Company’s insurance coverage,

insolvencies of certain insurers, uncertainties concerning the precise manner of assigning particular costs to

specific policies, and the types of claims asserted. Various factors could affect the timing and amount of proceeds

to be received under the Company’s various insurance policies, including (i) delays in or avoidance of payment by

insurers; (ii) the extent to which insurers may become insolvent in the future, and (iii) the outcome of possible legal

proceedings with respect to respirator mask/asbestos liability insurance coverage.

The difference between the accrued liability and insurance receivable represents the time delay between payment

of claims and receipt of insurance reimbursements. Because of the lag time between settlement and payment of a

claim, no meaningful conclusions may be drawn from quarterly changes in the amount of receivables for expected

insurance recoveries and the quarterly changes in the number of claimants at the end of each quarter.