3M 2004 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2004 3M annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

31

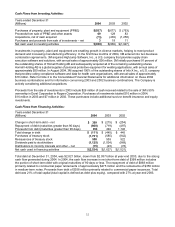

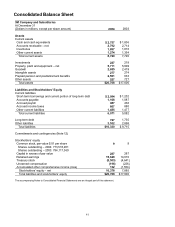

Cash flows from operating activities can fluctuate significantly from period to period, as pension funding decisions,

tax timing differences and other items can significantly impact cash flows. In both 2004 and 2003, cash flow

improvements were primarily driven by higher net income, tax timing differences and certain working capital

improvements (i.e. accounts receivables, inventories, accounts payable). In all periods presented, significant

Company pension contributions negatively impacted cash flows. In all years, with larger amounts in 2003 and 2002,

a portion of the tax timing benefit relates to the tax benefit received from Company pension contributions. In 2003, 3M

made $46 million of payments under the corporate restructuring plan, compared with $306 million in 2002.

In the quarter ended September 30, 2004, the Company made a special pension contribution to 3M’s Japanese

pension plan of $155 million and a discretionary contribution of $300 million to its U.S. qualified pension plan. In

the third quarter of 2003, 3M made a discretionary contribution of $600 million to its U.S. qualified pension plan,

compared with a discretionary contribution of $789 million in the third quarter of 2002. Future contributions will

depend on market conditions, interest rates and other factors. 3M believes its strong cash flow and balance sheet

will allow it to fund future pension needs without compromising growth opportunities.

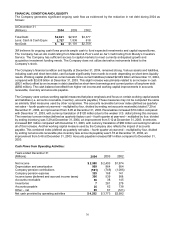

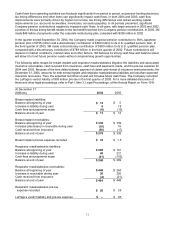

The following table recaps for breast implant and respirator masks/asbestos litigation the liabilities and associated

insurance receivables, cash received from insurance, cash fees and payments made, and the pre-tax expense for

2004 and 2003. Because of the time delay between payment of claims and receipt of insurance reimbursements, the

December 31, 2004, amounts for both breast implant and respirator mask/asbestos liabilities are less than expected

insurance recoveries. Thus, the expected net inflow of cash will increase future cash flows. The Company recorded

the LePage’s verdict liability of $93 million pre-tax in the first quarter of 2003. For a more detailed discussion of

these and other legal proceedings, refer to Part I, Item 3, Legal Proceedings, of this Annual Report on Form 10-K.

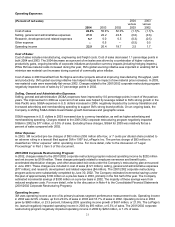

At December 31

(Millions) 2004 2003

Breast implant liabilities:

Balance at beginning of year $ 13 $ 5

Increase in liability during year 6 18

Cash fees and payments made (8) (10)

Balance at end of year $ 11 $ 13

Breast implant receivables:

Balance at beginning of year $ 338 $ 339

Increase (decrease) in receivable during year (10) 16

Cash received from insurance (50) (17)

Balance at end of year $ 278 $ 338

Breast implant pre-tax expense recorded $ 16 $ 1.5

Respirator mask/asbestos liabilities:

Balance at beginning of year $ 289 $ 161

Increase in liability during year 40 231

Cash fees and payments made (81) (103)

Balance at end of year $ 248 $ 289

Respirator mask/asbestos receivables:

Balance at beginning of year $ 448 $ 264

Increase in receivable during year 20 205

Cash received from insurance (4) (21)

Balance at end of year $ 464 $ 448

Respirator mask/asbestos pre-tax

expense recorded $ 20 $ 26

LePage’s verdict liability and pre-tax expense $ – $ 93