3M 2004 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2004 3M annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.19

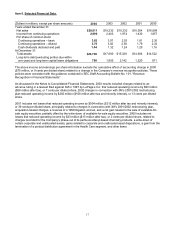

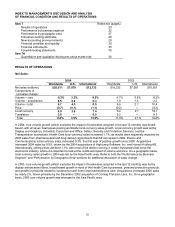

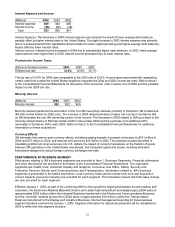

Operating income in 2004 increased by 23.3% versus 2003, as all seven business segments posted increases.

The combination of solid sales growth and positive benefits from 3M’s 2004 corporate initiatives drove the

operating income increase. Cost reduction projects related to these initiatives – Six Sigma, Global Sourcing

Effectiveness, 3M Acceleration and eProductivity – contributed over $400 million in aggregate operating income

benefits in 2004 (see “Note A” at the end of this Overview section). Currency impacts, related primarily to the

weaker U.S. dollar, boosted 2004 operating income by an estimated $286 million, partially offset by increased

pension expense of $157 million. Operating income in 2003 was negatively impacted by a $93 million pre-tax

charge related to an adverse ruling in a lawsuit filed against 3M in 1997 by LePage’s Inc.

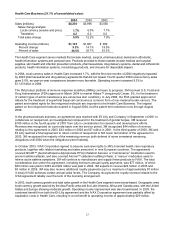

3M generated $4.282 billion of operating cash flows in 2004, a $509 million increase over 2003, and ended the

year with $2.757 billion of cash and cash equivalents. Cash flow in 2004 was primarily driven by higher net

income. In 2004, the Company utilized $2.916 billion of cash to repurchase 3M common stock and pay dividends,

and contributed $591 million to its pension plans. 3M’s debt to total capital ratio (total capital defined as debt plus

equity) as of December 31, 2004, was approximately 21%. 3M has an AA credit rating from Standard & Poor’s and

an Aa1 credit rating from Moody’s Investors Service.

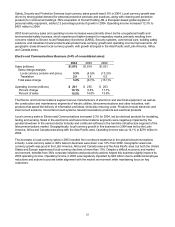

In 2005, 3M expects to continue its momentum to drive sales, operational efficiency and cash flow growth. 3M is

looking for continued broad-based product sales to drive its growth, in addition to expected continued growth in

optical film products, and will also continue to assess potential acquisitions. Continued core volume sales growth

will require both faster growth of existing products/services and successful introduction of new products. While

international sales now represent 61% of worldwide sales, the Company will also focus on execution of sales and

growth opportunities in the United States. In part to energize the 3M Acceleration initiative, early in 2004 the

Company launched an extensive effort to reconnect and re-engage with customers. This will aid 3M in its

continuing quest to provide additional customer value, with both the customer and 3M benefiting through value

creation and also facilitating 3M’s ability to achieve appropriate pricing. The Company also is focused on its

corporate initiatives to improve productivity and reduce costs. Cost reduction projects related to these initiatives

are expected to contribute an additional $400 million to operating income in 2005. The Company has experienced

both price increases and supply limitations affecting several oil-derived raw materials, but to date the Company is

receiving sufficient quantities of such materials to meet its reasonably foreseeable production requirements.

Fluctuations in foreign currency exchange rates also impact results, although the Company minimizes this effect

through hedging about half of this impact. 3M will also continue, as it has for many years, to incur expenses

(insured and uninsured) in managing its litigation and environmental contingencies. These forward-looking

statements involve risks and uncertainties that could cause results to differ materially from those projected (refer

to the forward-looking statements discussion later in Item 7 for discussion of these risks and uncertainties).

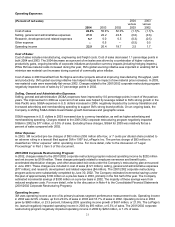

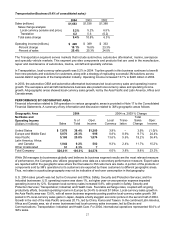

(Note A). The Company’s five corporate initiatives (Six Sigma, Global Sourcing Effectiveness, 3M Acceleration,

eProductivity and Global Business Processes) are aimed at accelerating long-term top-line growth, improving

cash flow and lowering its total cost structure. Indirect Cost Control, which focused on reducing costs not directly

associated with products or services, is no longer a formal initiative and is now managed using a productivity

metric. Six Sigma focuses on higher growth, productivity and cash flow. Global Sourcing Effectiveness generates

savings by leveraging purchasing economies of scale, encouraging competition among suppliers, geographic

broadening and e-applications. Through its 3M Acceleration initiative, the Company is driving toward more and better

new product ideas and faster, more impactful new product introductions, along with reallocating research and

development resources to larger, more global projects. In eProductivity, 3M believes it has a significant opportunity to

improve productivity for its customers, suppliers and for 3M itself. 3M’s Global Business Processes initiative continues

3M’s ongoing effort to standardize, simplify and strengthen its business processes in order to increase the speed,

efficiency and quality of service functions vital to its business operations worldwide. There can be no assurance that

all of the estimated cost savings from such activities will be realized. Numerous factors may create offsets to these

savings, such as the potential for weakness in sales volumes, normal increases in compensation and benefits,

and other inflationary pressures. The Company estimates that cost reduction projects related to initiatives provided

a combined incremental benefit to operating income of more than $400 million in 2004, after contributing a similar

amount in 2003. These initiatives provided an incremental benefit to operating income of more than $500 million in

2002.