3M 2004 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2004 3M annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

54

Special termination pension and medical benefits, aggregating $43 million in 2002 and $62 million in 2001, were

offered to eligible employees. Certain pension and medical benefits will generally be paid over their life expectancies.

The Company also recorded $3 million of non-cash stock option expense in 2002 ($8 million in 2001) due to the

reclassification of certain employees age 50 and older to retiree status, resulting in a modification of their original stock

option awards for accounting purposes. The current liabilities and a portion of the non-current liabilities were funded

through cash provided by operations, while funding for certain long-term special termination pension and medical

liabilities are provided through established pension and postretirement trust funds. The majority of the long-term portion

of the liability, primarily special termination pension and medical liabilities, is reflected as a component of 3M’s pension

and medical trust plans as a portion of the Accumulated Benefit Obligation (ABO). It is estimated that 3M’s benefit

plans reflect approximately $24 million of restructuring-related long-term liabilities that had not yet been paid out by the

trusts as of December 31, 2004. This amount is reduced gradually over time as the trust funds make payments.

The restructuring plan included actions in 25 locations in the United States, 27 in Europe, eight in the Asia Pacific area,

13 in Latin America and four in Canada. The Company did not discontinue any major product lines as a result of the

restructuring plan. The restructuring charges did not include any write-down of goodwill or other intangible assets.

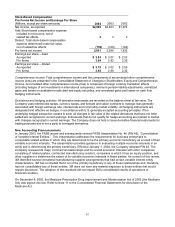

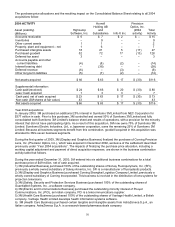

Selected information related to these charges follows:

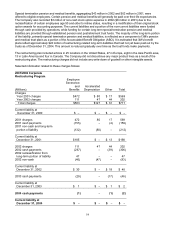

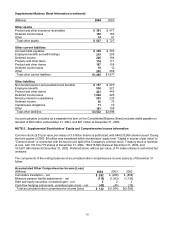

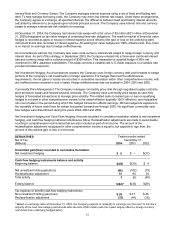

2001/2002 Corporate

Restructuring Program

Employee

Severance

and Accelerated

(Millions) Benefits Depreciation Other Total

Charges

Year 2001 charges $472 $ 80 $ 17 $569

Year 2002 charges 111 47 44 202

Total charges $583 $127 $ 61 $771

Current liability at

December 31, 2000 $ – $ – $ – $ –

2001 charges 472 80 17 569

2001 cash payments (155) – (4) (159)

2001 non-cash and long-term

portion of liability (132) (80) – (212)

Current liability at

December 31, 2001 $185 $ – $ 13 $198

2002 charges 111 47 44 202

2002 cash payments (267) – (39) (306)

2002 reclassification from

long-term portion of liability 47 – – 47

2002 non-cash (46) (47) – (93)

Current liability at

December 31, 2002 $ 30 $ – $ 18 $ 48

2003 cash payments (29) – (17) (46)

Current liability at

December 31, 2003 $ 1 $ – $ 1 $ 2

2004 cash payments (1) – (1) (2)

Current liability at

December 31, 2004 $ –$–$–$–