3M 2004 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2004 3M annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.48

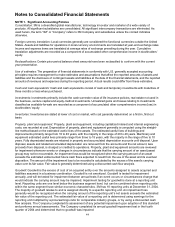

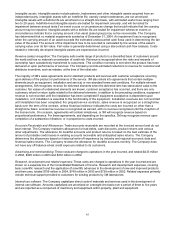

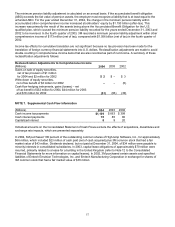

In September 2004, the FASB’s Emerging Issues Task Force finalized EITF Issue No. 04-08, “The Effect of

Contingently Convertible Debt on Diluted Earnings per Share” that would require the dilutive effect of shares from

contingently convertible debt to be included in the diluted earnings per share calculation regardless of whether the

contingency has been met. The Company has $639 million in aggregate face amount of 30-year zero coupon

senior notes that are convertible into approximately 6 million shares of common stock if certain conditions are met.

These conditions have never been met. The FASB is also in the process of amending SFAS No. 128, anticipated

to be issued in 2005, which is expected to further address this and several other issues. Unless the Company

takes steps to modify certain terms of this debt security, EITF Issue No. 04-08 and proposed SFAS No. 128R

(when effective), would result in an increase of approximately 6 million shares to diluted shares outstanding to give

effect to the contingent issuance of shares. Also, using the if-converted method, net income for the diluted

earnings per share calculations would be adjusted for interest expense associated with this debt instrument. EITF

Issue No. 04-08 would have been effective beginning with the Company’s 2004 fourth quarter. However, due to

the FASB’s delay in issuing SFAS No. 128R and the Company’s intent and ability to settle this debt security in

cash versus the issuance of stock, the impact of the additional diluted shares will not be included in the diluted

earnings per share calculation until SFAS No. 128R is effective. Prior periods’ diluted shares outstanding and

diluted earnings per share amounts will be restated to present comparable information when SFAS No. 128R is

effective. The estimated annual reduction in 3M’s diluted earnings per share would have been approximately $.02

per share for total year 2004. Because the impact of this standard is ongoing, 3M’s diluted shares outstanding and

diluted earnings per share amounts would be impacted until retirement or modification of certain terms of this debt

security.

In November 2004, the FASB issued SFAS No. 151, “Inventory Costs – An Amendment of ARB No. 43,

Chapter 4”. SFAS No. 151 amends the guidance in Accounting Research Bulletin (ARB) No. 43, Chapter 4,

“Inventory Pricing,” to clarify the accounting for abnormal amounts of idle facility expense, freight, handling costs,

and wasted material (spoilage). Among other provisions, the new rule requires that items such as idle facility

expense, excessive spoilage, double freight, and rehandling costs be recognized as current-period charges

regardless of whether they meet the criterion of “so abnormal” as stated in ARB No. 43. Additionally, SFAS

No. 151 requires that the allocation of fixed production overheads to the costs of conversion be based on the

normal capacity of the production facilities. SFAS No. 151 is effective for fiscal years beginning after June 15,

2005, and is required to be adopted by the Company effective January 1, 2006. The Company does not expect

SFAS No. 151 to have a material impact on 3M’s consolidated results of operations or financial condition.

In December 2004, the FASB issued SFAS No. 153, “Exchanges of Nonmonetary Assets – An Amendment of

APB Opinion No. 29”. SFAS No. 153 eliminates the exception from fair value measurement for nonmonetary

exchanges of similar productive assets in paragraph 21(b) of APB Opinion No. 29, “Accounting for Nonmonetary

Transactions,” and replaces it with an exception for exchanges that do not have commercial substance. SFAS

No 153 specifies that a nonmonetary exchange has commercial substance if the future cash flows of the entity are

expected to change significantly as a result of the exchange. SFAS No. 153 is effective for the fiscal periods

beginning after June 15, 2005, and is required to be adopted by the Company effective January 1, 2006. The

Company does not expect SFAS No. 153 to have a material impact on 3M’s consolidated results of operations or

financial condition.

In December 2004, the FASB issued SFAS No. 123 (revised 2004), “Share-Based Payment”. SFAS No. 123R

supersedes APB Opinion No. 25, which requires recognition of an expense when goods or services are provided.

SFAS No. 123R requires the determination of the fair value of the share-based compensation at the grant date

and the recognition of the related expense over the period in which the share-based compensation vests. SFAS

No. 123R permits a prospective or two modified versions of retrospective application under which financial

statements for prior periods are adjusted on a basis consistent with the pro forma disclosures required for those

periods by the original SFAS No. 123. The Company is required to adopt the provisions of SFAS No. 123R

effective July 1, 2005, at which time the Company will begin recognizing an expense for unvested share-based

compensation that has been issued or will be issued after that date. Under the retroactive options, prior periods

may be restated either as of the beginning of the year of adoption, January 1, 2005 for the Company, or for all

periods presented. The Company has not yet finalized its decision concerning the transition option it will utilize to

adopt SFAS No. 123R. The Company’s Management Stock Ownership Program (MSOP) is a three-year plan that

requires shareholder approval at the May 2005 Annual Shareholder Meeting. The Company is considering various

changes that will be detailed in the Company’s Definitive Proxy Statement, but will not be finalized until approval

has been granted by the Company’s shareholders. The Company does expect the impact of the adoption of SFAS

No. 123R to be material, but due to potential changes in the MSOP, future share-based compensation amounts

may differ from the pro forma amounts disclosed earlier in Note 1 to the Consolidated Financial Statements.