3M 2004 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2004 3M annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.49

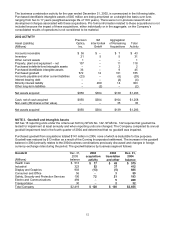

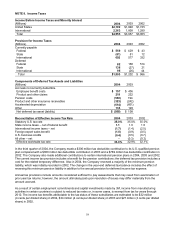

In December 2004, the FASB issued FASB Staff Position (FSP) No. 109-2, “Accounting and Disclosure Guidance

for the Foreign Earnings Repatriation Provision within the American Jobs Creation Act of 2004”, which provides

guidance under SFAS No. 109, “Accounting for Income Taxes,” with respect to recording the potential impact of

the repatriation provisions of the American Jobs Creation Act of 2004 (the Jobs Act) on enterprises’ income tax

expense and deferred tax liability. The Jobs Act was enacted on October 22, 2004. The Jobs Act creates a

temporary incentive for U.S. corporations to repatriate accumulated income earned abroad by providing an 85%

dividends received deduction for certain dividends from controlled foreign corporations. FSP No. 109-2 states that

an enterprise is allowed time beyond the financial reporting period of enactment to evaluate the effect of the Jobs

Act on its plan for reinvestment or repatriation of foreign earnings for purposes of applying SFAS No. 109. The

deduction is subject to a number of limitations and uncertainty remains as to how to interpret certain provisions in

the Act. As such, the Company is not yet in a position to decide whether, and to what extent, the Company might

repatriate foreign earnings that have not yet been remitted to the U.S. and, as provided for in FSP No. 109-2, the

Company has not adjusted its tax expense or deferred tax liability to reflect the repatriation provisions of the Jobs

Act. Based on the Company’s analysis to date, however, it is possible that the Company will repatriate an amount

totaling between $800 million and $950 million, with the respective tax liability ranging from $40 million to

$50 million. The Company expects to be in a position to finalize its assessment after issuance of further regulatory

guidance and passage of statutory technical corrections.

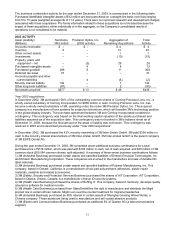

NOTE 2. Acquisitions and Divestitures

Year 2004 acquisitions:

In February 2004, 3M (Industrial Business) purchased 100 percent of the outstanding common shares of

HighJump Software, Inc., a U.S. company that provides supply chain execution software and solutions. The total

purchase price of approximately $66 million included $23 million of cash paid (net of cash acquired) plus 541,581

shares of 3M common stock. The 3M common stock had a market value of $43 million at the acquisition

measurement date and was previously held as 3M treasury stock.

In March 2004, 3M (Safety, Security and Protection Services Business) purchased 91 percent of the outstanding

shares of Hornell Holding AB, a Swedish company, for approximately $95 million, including assumption of debt.

This $95 million includes $57 million of cash paid (net of cash acquired) and the acquisition of $38 million of debt,

most of which has been repaid. Subsequently, 3M acquired all of the remaining outstanding shares for

approximately $6 million in cash. Hornell Holding AB is a global supplier of personal protective equipment for

welding applications.

In August 2004, 3M (Health Care Business) purchased 100 percent of the outstanding shares of Info-X Inc., a

U.S. company, for $17 million in cash (net of cash acquired). The acquired company provides coding compliance

software and data for health care organizations.

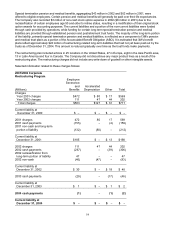

Purchased identifiable intangible assets for these acquisitions are being amortized on a straight-line basis over lives

ranging from two to 20 years (weighted-average life of 11 years). Research and development charges from these

acquisitions totaled $1 million. Pro forma information related to these acquisitions is not included because the impact

of these acquisitions, either individually or in the aggregate, on the Company’s consolidated results of operations is not

considered to be material.

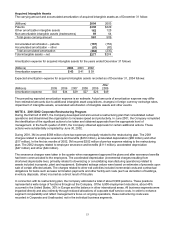

In September 2004, 3M and Corning Incorporated reached a settlement related to issues associated with 3M’s

2002 acquisition of Corning Precision Lens, Inc. (now called Precision Optics, Inc.). In September 2004, 3M

received $30 million from Corning related to this settlement.