3M 2004 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2004 3M annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

51

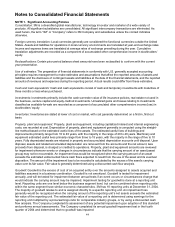

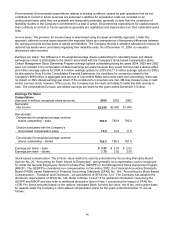

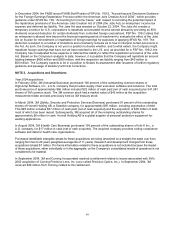

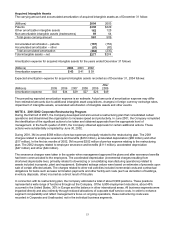

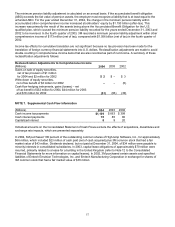

The business combination activity for the year ended December 31, 2003, is summarized in the following table.

Purchased identifiable intangible assets of $12 million are being amortized on a straight-line basis over lives ranging

from 5 to 15 years (weighted-average life of 11.3 years). There were no in-process research and development charges

associated with these acquisitions. Pro forma information related to these acquisitions is not included because the

impact of these acquisitions, either individually or in the aggregate, on the Company’s consolidated results of

operations is not considered to be material.

2003 ACTIVITY

Asset (Liability)

(Millions)

Sumitomo

3M Limited

Precision Optics, Inc.

(2003 activity)

Aggregation of

Remaining Acquisitions

Total

Activity

Accounts receivable $ – $ – $ 4 $ 4

Inventory 9 – 14 23

Other current assets – – 1 1

Investments – – (15) (15)

Property, plant, and

equipment – net – (3) 29 26

Purchased intangible assets – 4 8 12

Purchased goodwill 289 8 11 308

Deferred tax asset 37 – – 37

Accounts payable and other

current liabilities – 4 (6) (2)

Minority interest liability 139 – 1 140

Other long-term liabilities (97) – 2 (95)

Net assets acquired $377 $ 13 $ 49 $439

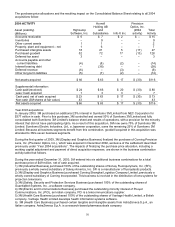

Year 2002 acquisitions:

In December 2002, 3M purchased 100% of the outstanding common shares of Corning Precision Lens, Inc., a

wholly owned subsidiary of Corning Incorporated, for $850 million in cash. Corning Precision Lens, Inc. has

become a wholly owned subsidiary of 3M, operating under the name 3M Precision Optics, Inc. The acquired

company is a manufacturer of lens systems for projection televisions, which will broaden 3M’s technology position

in the global display industry. The purchase agreement between 3M and Corning Incorporated contained a

contingency. This contingency was based on the final working capital valuation of the assets purchased and

liabilities assumed as of the acquisition date. This contingency was not booked in 3M’s balance sheet as of

December 31, 2002, because the final amount of the asset or liability was not known. This contingency was

resolved in 2003 and is described previously under “Year 2003 acquisitions”.

In December 2002, 3M purchased the 43% minority ownership of 3M Inter-Unitek GmbH. 3M paid $304 million in

cash to the minority interest shareholders of 3M Inter-Unitek GmbH. 3M Inter-Unitek GmbH is the parent company

of 3M ESPE Dental AG.

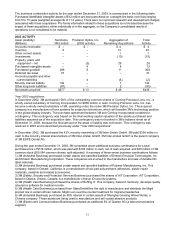

During the year ended December 31, 2002, 3M completed seven additional business combinations for a total

purchase price of $139 million, which was paid with $104 million in cash, net of cash acquired, and $35 million of 3M

common stock (555,584 common shares, split-adjusted). A summary of these seven business combinations follows:

1) 3M (Industrial Business) purchased certain assets and specified liabilities of Emtech Emulsion Technologies, Inc.

and Emtech Manufacturing Corporation. These companies are involved in the manufacture and sale of durable film

label materials.

2) 3M (Industrial Business) purchased certain assets and specified liabilities of Polymer Manufacturing, Inc. This

company, based in Oxnard, California, is a manufacturer of two-part polyurethane adhesives, plastic repair

materials, sealants and related accessories.

3) 3M (Safety, Security and Protection Services Business) purchased the shares of AiT Corporation. AiT Corporation,

based in Ottawa, Ontario, Canada, is a manufacturer of travel ID security systems.

4) 3M (Health Care Business) purchased the shares of Ruffing IT. This company, based in Germany, develops quality

assurance software for medical records.

5) 3M (Health Care Business) purchased from GlaxoSmithKline the right to manufacture and distribute the Migril

product line in certain African nations. Migril is an over-the-counter treatment for migraine headaches.

6) 3M (Industrial Business) purchased an 80% interest in certain assets of Shanghai Grinding Wheel Works, a

Chinese company. These assets are being used to manufacture and sell coated abrasive products.

7) 3M (Electro and Communications Business) purchased an additional 6% of Quante AG (a telecommunications

supplier).