3M 2004 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2004 3M annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

30

FINANCIAL CONDITION AND LIQUIDITY

The Company generates significant ongoing cash flow as evidenced by the reduction in net debt during 2004 as

follows:

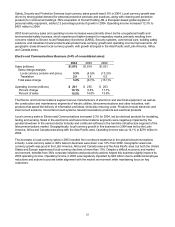

At December 31

(Millions) 2004 2003 2002

Total Debt $2,821 $2,937 $3,377

Less: Cash & Cash Equiv. 2,757 1,836 618

Net Debt $ 64 $1,101 $2,759

3M believes its ongoing cash flows provide ample cash to fund expected investments and capital expenditures.

The Company has an AA credit rating from Standard & Poor’s and an Aa1 credit rating from Moody’s Investors

Service. The Company has sufficient access to capital markets to meet currently anticipated growth and

acquisition investment funding needs. The Company does not utilize derivative instruments linked to the

Company’s stock.

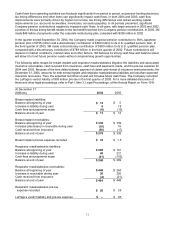

The Company’s financial condition and liquidity at December 31, 2004, remained strong. Various assets and liabilities,

including cash and short-term debt, can fluctuate significantly from month-to-month depending on short-term liquidity

needs. Working capital (defined as current assets minus current liabilities) totaled $2.649 billion at December 31, 2004,

compared with $2.638 billion at December 31, 2003. This slight increase was primarily related to an increase in cash

($921 million) offset by an increase in debt classified as short-term borrowings and current portion of long-term debt

($892 million). The cash balance benefited from higher net income and working capital improvements in accounts

receivable, inventory and accounts payable.

The Company uses various working capital measures that place emphasis and focus on certain working capital assets

and liabilities (i.e. accounts receivable, inventory, accounts payable). These measures may not be computed the same

as similarly titled measures used by other companies. The accounts receivable turnover index (defined as quarterly

net sales – fourth quarter at year-end – multiplied by four, divided by ending net accounts receivable) totaled 7.29 at

December 31, 2004, an improvement from 6.95 at December 31, 2003. Receivables increased $78 million compared

with December 31, 2003, with currency translation of $120 million (due to the weaker U.S. dollar) driving this increase.

The inventory turnover index (defined as quarterly factory cost – fourth quarter at year-end – multiplied by four, divided

by ending inventory) was 5.29 at December 31, 2004, an improvement from 5.12 at December 31, 2003. Inventories

increased $81 million compared with December 31, 2003, with currency translation of $80 million accounting for almost

all of this increase. Another working capital measure used by the Company also reflects the impact of accounts

payable. This combined index (defined as quarterly net sales – fourth quarter at year-end – multiplied by four, divided

by ending net accounts receivable plus inventory less accounts payable) was 5.78 at December 31, 2004, an

improvement from 5.48 at December 31, 2003. Accounts payable increased $81 million compared to December 31,

2003.

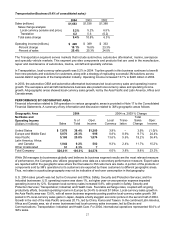

Cash Flows from Operating Activities:

Years ended December 31

(Millions) 2004 2003 2002

Net income $ 2,990 $ 2,403 $1,974

Depreciation and amortization 999 964 954

Company pension contributions (591) (749) (1,086)

Company pension expense 325 168 141

Income taxes (deferred and accrued income taxes) 396 539 568

Accounts receivable 56 38 145

Inventories 7 281 279

Accounts payable 35 62 138

Other – net 65 67 (121)

Net cash provided by operating activities $ 4,282 $ 3,773 $2,992