3M 2004 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2004 3M annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

46

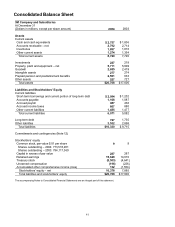

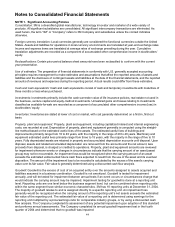

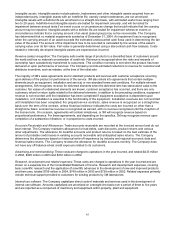

Environmental: Environmental expenditures relating to existing conditions caused by past operations that do not

contribute to current or future revenues are expensed. Liabilities for remediation costs are recorded on an

undiscounted basis when they are probable and reasonably estimable, generally no later than the completion of

feasibility studies or the Company’s commitment to a plan of action. Environmental expenditures for capital projects

that contribute to current or future operations generally are capitalized and depreciated over their estimated useful

lives.

Income taxes: The provision for income taxes is determined using the asset and liability approach. Under this

approach, deferred income taxes represent the expected future tax consequences of temporary differences between

the carrying amounts and tax basis of assets and liabilities. The Company records a valuation allowance to reduce its

deferred tax assets when uncertainty regarding their reliability exists. As of December 31, 2004, no valuation

allowances were recorded.

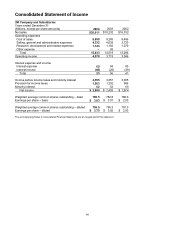

Earnings per share: The difference in the weighted average shares outstanding for calculating basic and diluted

earnings per share is attributable to the dilution associated with the Company’s stock-based compensation plans.

Certain Management Stock Ownership Program average options outstanding during the years 2004, 2003 and 2002

were not included in the computation of diluted earnings per share because they would not have had a dilutive effect

(6.6 million average options for 2004, 6.4 million average options for 2003 and 11.0 million average options for 2002).

As discussed in Note 9 to the Consolidated Financial Statements, the conditions for conversion related to the

Company’s $639 million in aggregate face amount of Convertible Notes have never been met; accordingly, there was

no impact on 3M’s diluted earnings per share. If the conditions for conversion are met, 3M may choose to pay in cash

and/or common stock; however, if this occurs, the Company has the intent and ability to settle this debt security in

cash. The computations for basic and diluted earnings per share for the years ended December 31 follow:

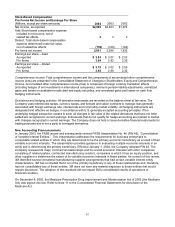

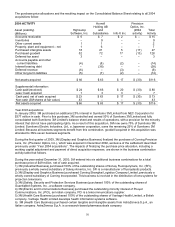

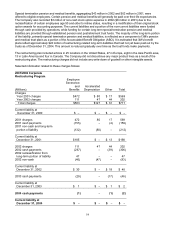

Earnings Per Share

Computations

(Amounts in millions, except per share amounts) 2004 2003 2002

Numerator:

Net income $2,990 $2,403 $1,974

Denominator:

Denominator for weighted average common

shares outstanding – basic 780.5 782.8 780.0

Dilution associated with the Company’s

stock-based compensation plans 16.0 12.5 11.0

Denominator for weighted average common

shares outstanding – diluted 796.5 795.3 791.0

Earnings per share – basic $ 3.83 $ 3.07 $ 2.53

Earnings per share – diluted 3.75 3.02 2.50

Stock-based compensation: The intrinsic value method is used as prescribed by Accounting Principles Board

Opinion No. 25, “Accounting for Stock Issued to Employees”, and generally no compensation cost is recognized

for either the General Employees’ Stock Purchase Plan (GESPP) or the Management Stock Ownership Program

(MSOP). The GESPP is considered non-compensatory. In December 2002, the Financial Accounting Standards

Board (FASB) issued Statement of Financial Accounting Standards (SFAS) No. 148, “Accounting for Stock-Based

Compensation – Transition and Disclosure – an amendment of SFAS No. 123.” The Company has adopted the

disclosure requirements of SFAS No. 148. Refer to Notes 14 and 15 for additional information concerning the

GESPP and MSOP and also refer to additional discussion later in Note 1 concerning the impact of SFAS No.

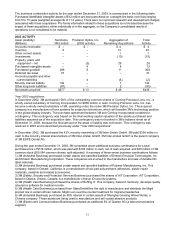

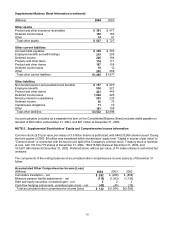

123R. Pro forma amounts based on the options’ estimated Black-Scholes fair value, net of tax, at the grant dates

for awards under the Company’s stock-based compensation plans for the years ended December 31 are as

follows: