Vonage 2008 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2008 Vonage annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

V

O

NA

G

EH

O

LDIN

GS CO

RP

.

N

O

TE

S

T

OCO

N

SO

LIDATED FINAN

C

IAL

S

TATEMENT

S

—

(C

ontinued

)

(

In thousands, except per share amounts

)

N

o

t

e

7

.

L

ong-Term Debt

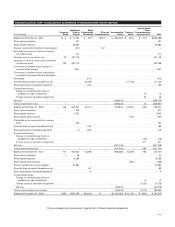

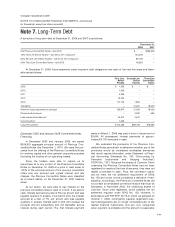

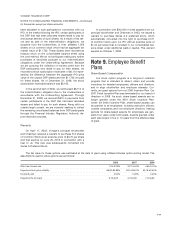

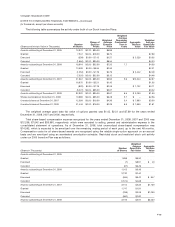

A schedule o

f

lon

g

-term debt at December 31, 2008 and 2007 is as

f

ollows:

D

ecem

b

er

3

1,

2

008 200

7

5

%

Previous

C

onvertible Notes—due 201

0

$

–

$

253,320

1

6% First Lien

S

enior Facility—due 2013, net of discount 104,459

–

20%

S

econd Lien

S

enior Facility—due 2015, net of discount 69,708

–

20

%

Third Lien

C

onvertible Notes—due 201

5

18,580

–

At December 31, 2008, future payments under long-term debt obligations over each of the next five years and there-

a

ft

e

r

a

r

eas

f

o

ll

o

w

s

:

Fi

r

s

t

Lien

S

enior

Facilit

y

S

econd Lie

n

S

enior

Facilit

y

Thi

r

d Lien

C

onvertible

No

t

es

2009

$

1,303 $ – $

–

2010

1

,

303

–

–

2011

4

,

23

5–

–

2012

13

,

030

–

–

2013

110

,

103 1

,

800

–

T

h

e

r

eaf

t

e

r–7

0

,

200 18

,

000

M

inimum

f

uture payments o

f

principal 129,974 72,000 18,000

Pl

us acc

r

e

t

ed

int

e

r

es

t –

2

,

320

5

80

L

ess u

n

a

m

o

rtiz

ed d

i

scou

nt

24

,

212 4

,

612

C

urrent

p

ortio

n

1

,

303

–

–

Lon

g

-term portio

n

$

104,459 $69,708 $18,580

December 2005 and January 2006

C

onvertible Note

s

Fi

nanc

i

n

g

I

n

D

ecem

b

er 2005 an

dJ

anuary 2006, we

i

ssue

d

$

249,919 a

gg

re

g

ate principal amount of Previous Con

-

vertible Notes due December 1, 2010. We used the pro

-

ceeds from the offering of the Previous

C

onvertible Note

s

for workin

g

capital and other

g

eneral corporate purpose

s

(includin

g

the fundin

g

of our operatin

g

losses).

S

ince the holders were able to re

q

uire us to

r

epurchase all or an

y

portion of the Previous Convertibl

e

N

otes on December 16, 2008 at a

p

rice in cash e

q

ual t

o

100% of the

p

rinci

p

al amount of the

p

revious convertibl

e

notes plus an

y

accrued and unpaid interest and lat

e

charges, the Previous Convertible Notes were classifie

d

as a current

li

a

bili

ty on t

h

e

D

ecem

b

er 31, 2007

b

a

l

anc

e

s

h

ee

t

.

A

t our opt

i

on, we were a

bl

e to pay

i

nterest on t

he

previous convertible notes in cash or in kind. I

f

we paid in

cash, interest accrued at a rate o

f

5

%p

er annum and was

payable quarterly in arrears. If we paid in kind, the interest

accrued at a rate o

f

7

%

per annum and was pa

y

able

quarterly in arrears. Interest paid in kind will increase th

e

principal amount outstandin

g

and will thereafter accrue

interest durin

g

each period. The

f

irst interest payment

m

ade on March 1, 2006 was

p

aid in kind in the amount o

f

$

3,645. All subsequent interest payments of approx

-

i

mately $3,100 were paid in cash.

W

e evaluated the provisions of the Previous Con-

v

ertible Notes periodically to determine whether any of th

e

p

rov

i

s

i

ons wou

ld b

e cons

id

ere

d

em

b

e

dd

e

dd

er

i

vat

i

ves

t

hat would require bifurcation under

S

tatement of Finan

-

cial Accountin

g

Standards No. 133, (“Accountin

g

for

Derivative Instruments and Hedging Activities”)

(

“SFAS No. 133”

)

. Because the shares of Common Stock

u

nderlying the Previous

C

onvertible Notes had not been

re

g

istered for resale at the time of issuance, they were no

t

rea

dily

convert

ibl

e to cas

h

.

Th

us, t

h

e convers

i

on opt

i

on

did not meet the net settlement requirement of SFA

S

No. 133 and would not be considered a derivative i

ff

ree-

s

tanding. Accordingly, the Previous

C

onvertible Notes did

no

t

co

nt

a

in

a

n

e

m

bedded co

nv

e

r

s

i

o

nf

ea

t

u

r

e

th

a

tm

us

t

be

b

ifurcated. In November 2006, the underlyin

g

shares o

f

Common Stock were re

g

istered, which satisfied the net

s

ettlement required under SFAS No. 133. However, i

n

accordance with FSP EITF 00-19-2, which we ado

p

ted o

n

O

ctober 1, 2006, contingently payable registration pay-

m

ent arran

g

ements are no lon

g

er considered part of the

related

f

inancial instruments and are only reco

g

nize

d

when pa

y

ment is probable and the amount is reasonabl

y

F

-

17