Vonage 2008 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2008 Vonage annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

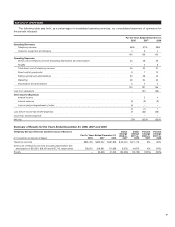

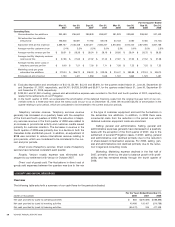

t

hrough 2010,

$

495 for office space leased for our Mississauga,

Ontario office through 2010 and

$

174 for office space leased fo

r

our London, UK office throu

g

h 2010.

P

urchase obligations. At December 31

,

2008

,f

utur

e

commitments for purchase obligations in the above table repre

-

s

ent non-cance

l

a

bl

e contractua

l

o

blig

at

i

ons.

Th

ese

i

nc

l

u

de

$

60,000 in fees throu

g

h 2009 to a vendor that enables a custom

-

er’s call to connect to the

p

ublic switched tele

p

hone network;

$

8,160 in fees for local number portability throu

g

h 2011; $18,700

f

or inbound sales support throu

g

h 2010;

$

14,800 for a credit car

d

company to process our credit card transactions through 2012

;

$

19,507 for the purchase of customer equipment throu

g

h 2010

and $4,433 for providin

g

broadband internet access services to

our customers through 2011.

O

ther obli

g

ations.

A

t

D

ecem

b

er 31, 2008, we were o

blig

ate

d

t

o pay AT&T $28,600 throu

g

h 2012 for the settlement a

g

reement,

which required Vonage to pay AT&T

$

650 each month.

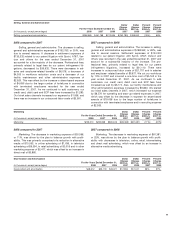

SUMMARY OF CRITICAL ACCOUNTING POLICIES AND ESTIMATES

Our si

g

nificant accountin

g

policies are summarized in Note

1

t

o our

f

inancial statements. The

f

ollowing describes our critical

account

i

n

g

po

li

c

i

es an

d

est

i

mates:

U

se of Estimate

s

O

ur consolidated financial statements are

p

re

p

ared in con

-

f

ormity with accountin

g

principles

g

enerally accepted in th

e

United

S

tates, which require management to make estimates and

assum

p

tions that affect the amounts re

p

orted and disclosed i

n

t

he consolidated

f

inancial statements and the accompanyin

g

n

otes. Actual results could differ materially from these estimates

.

O

nanon

g

oin

g

basis, we evaluate our estimates, includin

g

t

he

f

ollowin

g

:

>

t

hose related to the average period o

f

service to a customer

(

the “customer relationshi

pp

eriod”

)

used to amortiz

e

deferred revenue and deferred customer ac

q

uisition cost

s

associated with customer activation;

>

t

he use

f

ul lives o

f

property and equipment and intangibl

e

assets

;

an

d

>

assumptions used for the purpose of determining share

-

b

ased compensation usin

g

the Black-

S

choles option mode

l

(

“Model”), and on various oth

e

r assumptions that we believe

d

t

o be reasonable. The key inputs for this Model are stoc

k

p

rice at valuation date, strike price for the option, the dividend

y

ield, risk-

f

ree interest rate, li

f

eo

f

option in

y

ears and volatilit

y

.

W

e

b

ase our est

i

mates on

hi

stor

i

ca

l

ex

p

er

i

ence, ava

il

a

bl

e

m

arket information, appropriate valuation methodolo

g

ies and o

n

v

arious other assumptions that we believe to be reasonable, the

r

esults of which form the basis for making judgments about th

e

carryin

g

values of assets and liabilities.

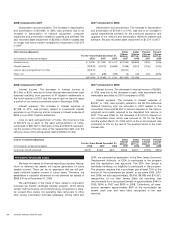

Revenue Reco

g

nition

O

peratin

g

revenues consist of telephony services revenue

s

and customer equipment (which enables our telephon

y

services

)

an

d

s

hi

pp

i

ng revenues.

Th

epo

i

nt

i

nt

i

me at w

hi

c

h

revenues are

r

eco

g

nized is determined in accordance with

S

taff Accountin

g

Bulletin No. 104, Revenue Recognition, and Emerging Issues Tas

k

Force

C

onsensus No. 01-9

,

A

ccounting for

C

onsideration

G

iven

by

a Vendor to a

C

ustomer

(

Includin

g

a Reseller of the Vendor’

s

P

roducts

)

.

S

ubstantially all of our operating revenues are telephony serv

-

i

ces revenues, which are derived primarily from monthly sub

-

scription fees that customers are char

g

ed under our service plans.

We also derive telephon

y

services revenues

f

rom per minute

f

ee

s

for international calls and for any calling minutes in excess of a

c

ustomer’s monthly plan limits. Monthly subscription fees are

a

utomatically char

g

ed to customers’ credit cards, debit cards or

E

C

P in advance and are recognized over the following month

w

hen services are provided. Revenues

g

enerated from interna-

tional calls and

f

rom customers exceedin

g

allocated call minutes

under limited minute plans are recognized as services are pro-

v

id

e

d

,t

h

at

i

s, as m

i

nutes are use

d

,an

d

are

bill

e

d

to a customer

’s

c

redit cards, debit cards or ECP in arrears. As a result of ou

r

multiple billing cycles each month, we estimate the amount o

f

r

e

v

e

n

ues ea

rn

ed

fr

o

m int

e

rn

a

ti

o

n

a

l

ca

ll

sa

n

d

fr

o

m

cus

t

o

m

e

r

s

e

xceedin

g

allocated call minutes under limited minute plans but

not billed

f

rom the end o

f

each billing cycle to the end o

f

eac

h

report

i

n

g

per

i

o

d

.

Th

ese est

i

mates are

b

ase

d

pr

i

mar

il

y upon

hi

stor-

ica

l min

u

t

es a

n

d

h

a

v

e bee

n

co

n

s

i

s

t

e

nt with

ou

r

ac

t

ua

lr

esu

lt

s

.

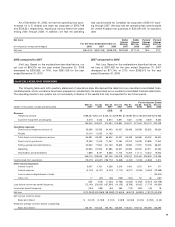

We also generate revenues by charging a fee for activating

service.

C

ustomer activation fees, alon

g

with the related customer

a

cquisition amounts

f

or customer equipment in the direct channe

l

a

nd for rebates and retailer commissions in the retail channel u

p

to but not exceedin

g

the activation fee, are deferred and amor

-

tized over the estimated average customer relationship period.

T

he amortization of deferred customer e

q

ui

p

ment is recorded to

d

irect cost of

g

oods sold. The amortization of deferred rebates i

s

recorded as a reduction to telephon

y

services revenues. The

a

mortization of deferred retailer commissions is recorded as

mar

k

et

i

n

g

expense.

F

or 2006 an

d

2007, t

h

e est

i

mate

d

customer

relationship period was 60 months. For 2008, due to the increas

e

i

nc

h

urn, t

h

e customer re

l

at

i

ons

hip p

er

i

o

d

was re

d

uce

d

to 4

8

months. In 2009, the customer relationshi

pp

eriod will be further

reduced to 44 months based upon

f

urther anal

y

sis o

f

historical

trends

.

W

ea

l

so prov

id

ere

b

ates to customers w

h

o purc

h

ase t

h

e

ir

c

ustomer equipment

f

rom retailers and satis

fy

minimum servic

e

p

eriod re

q

uirements. These rebates in excess of activation fee

s

a

re recorded as a reduction o

f

revenues over the service period

based upon the estimated number o

f

customers that will ulti-

mate

l

y earn an

d

c

l

a

i

mt

h

ere

b

ates

.

Customer equipment and shipping revenues include sales t

o

o

ur retailers, who subsequently resell this customer equipment t

o

c

ustomers. Revenues were reduced for pa

y

ments to retailers an

d

rebates to customers, who purchased their customer equipmen

t

through these retailers, to the extent of customer equipment an

d

s

hi

pp

i

n

g

revenues

.

I

nventor

y

Inventor

y

consists o

f

the cost o

f

customer equipment and i

s

s

tated at the lower o

f

cost or market, with cost determined using

the average cost method. We provide an inventory allowance for

c

ustomer equ

i

pment t

h

at

h

as

b

een returne

dby

customers

b

ut

ma

y

not be able to be re-issued to new customers or returned to

the manufacturer for credit.

I

n

co

m

e

T

a

x

es

We recognize de

f

erred tax assets and liabilities

f

or th

e

e

xpected tax consequences of temporary differences between th

e

tax bases o

f

assets and liabilities and their reported amounts

using tax rates in e

ff

ect

f

or the year the di

ff

erences are expecte

d

t

o

r

e

v

e

r

se

.

We ha

v

e

r

eco

r

ded a

v

alua

t

io

n

allo

w

a

n

ce o

nt

he

a

ssumption that we will not

g

enerate taxable income.

41