Vonage 2008 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2008 Vonage annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

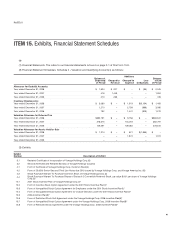

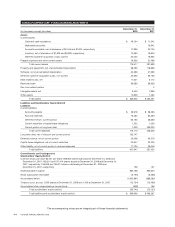

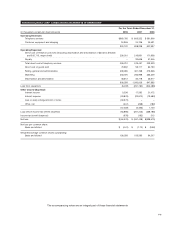

VONAGE HOLDINGS CORP. CONSOLIDATED STATEMENTS OF OPERATIONS

F

or t

h

e

Y

ears

E

n

d

e

dD

ecem

b

er

3

1,

(

In thousands, exce

p

t

p

er share amounts

)

2

008

2

00

72

006

O

perating Revenues

:

Telephony service

s

$

865,765

$

803,522

$

581,806

C

ustomer equipment and shippin

g

34,355 24,706 25,591

900,120 828,228 607,39

7

O

peratin

g

Expenses

:

D

irect cost of telephony services (excluding depreciation and amortization of $20,254, $18,43

4

and $12,715, respectively) 226,210 216,831 171,95

8

R

oyalty – 32,606 51,34

5

Total direct cost o

f

telephony services 226,210 249,437 223,30

3

D

irect cost o

fg

oods sold

7

9,382 59,117 62,730

Sellin

g

,

g

eneral and administrative 298,985 461,768 272,826

Marketin

g

253,370 283,968 365,34

9

D

e

p

reciation and amortization 48,612 35,718 23,67

7

906,559 1,090,008 947,885

Loss from o

p

erations

(

6,439

)(

261,780

)(

340,488

)

O

ther Income

(

Expense

)

:

I

nterest

i

ncom

e

3,236 1

7

,

5

82 21,4

7

2

I

nterest expens

e

(

29,878) (22,810) (19,583

)

L

oss on early extinguishment of notes (30,570) –

–

Other

,

ne

t

(247) (238) (189)

(

57,459) (5,466) 1,70

0

L

oss before income tax benefit (expense) (63,898) (267,246) (338,788

)

Income tax benefit (expense

)

(678) (182) 21

5

N

et

l

os

s

$

(64,576) $ (267,428) $(338,573)

Net loss

p

er common share

:

Bas

i

ca

n

dd

il

u

t

ed

$(

0.41

)$ (

1.72

)$ (

3.59

)

W

e

i

g

h

te

d

-average common s

h

ares outstan

di

ng

:

Bas

i

ca

n

dd

il

u

t

ed

1

56,258 155,593 94,20

7

The accompanyin

g

notes are an inte

g

ral part of these financial statements

F-

5