Vonage 2008 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2008 Vonage annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

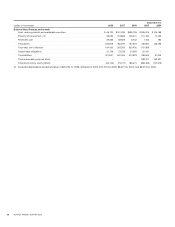

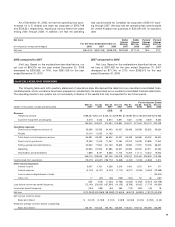

For the

Q

uarter Ende

d

Mar 31,

2007

Jun 30

,

2007

S

ep 30

,

200

7

Dec 31,

2007

M

ar 31,

2008

Jun 30

,

2008

Sep 30,

2008

Dec 31

,

2008

O

perating Data

:

G

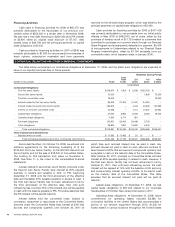

ross subscriber line additions 332,493 236,840 299,978 283,907 281,329 230,832 238,430 201,423

N

e

t

subsc

ri

be

r lin

e add

iti

o

n

s

(

reductions

)

165,646 56,691 77,763 56,016 30,133 2,080 9,460

(

14,744

)

S

ubscriber lines at end of period 2,389,757 2,446,448 2,524,211 2,580,227 2,610,360 2,612,440 2,621,900 2,607,15

6

Average monthly customer churn 2.4% 2.5% 3.0% 3.0% 3.3% 3.0% 3.0% 2.9

%

Average monthly revenue per line

$

28.31

$

28.38

$

28.24

$

28.19

$

28.85

$

29.04

$

28.75

$

28.33

A

verage mont

hl

yte

l

ep

h

ony serv

i

ces

revenue

p

er line $ 27.36 $ 27.63 $ 27.32 $ 27.42 $ 27.87 $ 27.92 $ 27.52 $ 27.28

Avera

g

e monthly direct costs o

f

t

elephon

y

services per line

$

8.03

$

7.21

$

7.30

$

7.11

$

7.26

$

7.22

$

7.20

$

7.2

2

M

ar

k

et

i

ng costs per gros

s

subscriber line additions $ 273.24 $ 286.72 $ 206.30 $ 223.06 $ 216.47 $ 282.89 $ 272.24 $ 309.1

0

E

mployees at end o

f

period 1,729 1,421 1,559 1,543 1,722 1,662 1,573 1,49

1

(

1

)

Excludes de

p

reciation and amortization of

$

4,113,

$

4,191,

$

4,312 and

$

5,818, for the

q

uarters ended March 31, June 30, Se

p

tember 30

and December 31, 2007, respectivel

y

, and

$

4,701,

$

4,728,

$

4,908 and

$

5,917, for the quarters ended March 31, June 30, September 30

an

dD

ecem

b

er 31, 2008, respect

i

ve

l

y

.

(2) $132,951 and $1,349 of sellin

g

,

g

eneral and administrative expense was recorded in the third and fourth quarters of 2007, respectively

,

related to the settlements o

f

our IP liti

g

ation.

(3) In the fourth quarter of 2007, we accelerated the amortization of the deferred financing costs from the original five-year term of our con-

v

ertible notes to a three-year term since the notes could be put to us on December 16, 2008. We recorded

$

2,372 of amortization in the

quarter relating to prior period, which we considered to be immaterial to the current and prior periods.

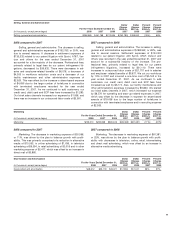

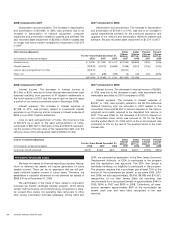

T

e

l

ep

h

ony serv

i

ces revenue.

T

e

l

ep

h

ony serv

i

ces revenu

e

g

enera

ll

y

h

as

i

ncrease

d

on a quarter

l

y

b

as

i

sw

i

t

h

t

h

e except

i

o

n

o

f

the third and

f

ourth quarters o

f

2008. The reduction in teleph-

ony services revenue in the third quarter of 2008 was related to

an

i

ncrease

i

n promot

i

ona

l

act

i

v

i

t

y

an

d

customer cre

di

ts

i

ssue

d

p

rimaril

yf

or customer retention. The decrease in revenue in th

e

f

ourth quarter of 2008 was primarily due to a decline in both th

e

C

anadian dollar and British pound. In addition, an adjustment of

$

788 was recorded to reduce international revenue relating to

p

r

i

or

p

er

i

o

d

s, w

hi

c

h

we cons

id

ere

d

to

b

e

i

mmater

i

a

l

to t

h

e cur

-

r

ent an

d

pr

i

or per

i

o

d

s

.

D

irect costs of telephony services.

D

irect costs of telephon

y

s

erv

i

ces

h

ave rema

i

ne

d

cons

i

stent eac

h

quarter.

R

oyalty. Verizon royalty expense was eliminated sub-

se

q

uent to our settlement with Verizon in

O

ctober 2007

.

D

irect cost of goods sold

.

The fluctuations in direct cost of

g

oo

d

sso

ld

expenses

b

etween t

h

e quarters was

d

ue to t

h

em

ix

in the type of customer equipment sold and the fluctuations i

n

th

esu

b

scr

ib

er

li

ne a

ddi

t

i

ons.

I

na

ddi

t

i

on,

i

n 2008 t

h

ere wer

e

incremental costs

f

rom the reduction in the period over which

deferred customer e

q

ui

p

ment costs are amortized

.

Sellin

g

,

g

eneral and administrative

.

S

ellin

g

,

g

eneral and

administrative expenses generally have decreased on a quarterly

basis with the exce

p

tion of the third

q

uarter of 2007, due to th

e

settlement o

f

several IP liti

g

ation cases. In 2007, sellin

g

,

g

enera

l

and administrative cost declined primarily due to the reductio

n

i

ns

h

are-

b

ase

d

compensat

i

on expense.

F

or 2008, se

lli

n

g

,

g

en

-

eral and administrative cost declined primaril

y

due to the reduc

-

t

ion in legal and consulting costs.

M

arketin

g

.Marketin

g

expense declined in the

f

irst hal

f

o

f

2

007, primarily driven by the plan to balance growth with pro

f

it

-

a

bility and has remained steady throu

g

h the fourth quarter o

f

2008

.

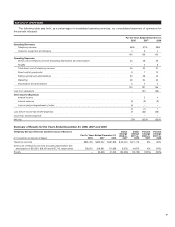

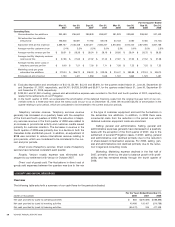

LIQUIDITY AND CAPITAL RESOURCES

O

vervie

w

The followin

g

table sets forth a summary of our cash flows for the periods indicated:

For the Years Ended December 31

,

(

dollars in thousand

s

)

2008 200

7

2006

Net cash provided by (used in) operating activities

$

655

$

(270,926)

$

(188,898

)

Net cash provided by

(

used in

)

investing activitie

s

40,486 131,457

(

210,798

)

Net cash provided by

(

used in

)

financing activities

(

65,470

)

245 477,42

9

36

VO

NA

G

E ANN

U

AL REP

O

RT 2008