Vonage 2008 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2008 Vonage annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

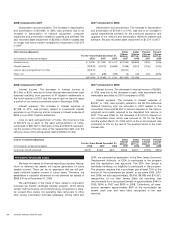

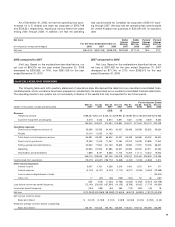

2008 com

p

ared to 2007

D

epreciation and amortization

.

T

he increase in depreciatio

n

and amortization of

$

12,894, or 36%, was primarily due to an

increase in depreciation of network equipment, computer

equipment and amortization related to patents and so

f

tware. We

also recorded asset im

p

airment of

$

3,666 in 2008 for assets that

n

o lon

g

er had future benefit compared to impairment of $1,37

4

in 2007.

2007 com

p

ared to 2006

D

epreciation and amortization

.

T

he increase in depreciatio

n

and amortization of

$

12

,

041

,

or 51%

,

was due to an increase in

capital expenditures primaril

y

for the continued expansion and

u

pgrade o

f

our network and amortization related to patents and

s

oftware. We also recorded asset im

p

airment of

$

1,374 in 2007

.

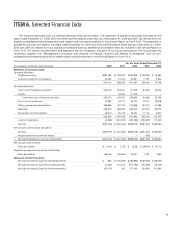

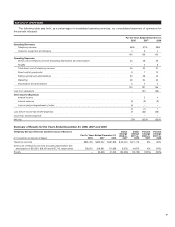

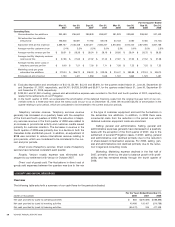

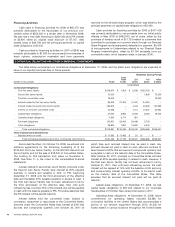

O

ther Income

(

Expense

)

F

or the Years Ended December 31

,

D

o

ll

a

r

Chang

e

2008

v

s.

2007

D

o

ll

ar

Change

200

7v

s

.

2006

P

ercent

C

hang

e

2008

v

s.

2007

P

ercent

Change

200

7v

s

.

2006

(

in thousands, except percentages

)

2008 200

7

2006

I

nterest income

$

3,236

$

17,582

$

21,472

$

(14,346)

$

(3,890) (82%) (18%)

I

nterest expense

(

29,878

)(

22,810

)(

19,583

)(

7,068

)(

3,227

)(

31%

)(

16%

)

Loss on early extinguishment of notes

(

30,570

)

––

(

30,570

)

–*

*

O

ther, net

(

247

)(

238

)(

189

)(

9

)(

49

)(

4%

)(

26%

)

$

(57,459)

$

(5,466)

$

1,700

$

(51,993)

$

(7,166

)

2008

compare

d

to

200

7

I

nt

e

r

es

t

i

n

co

m

e

.

T

h

e dec

r

ease

in int

e

r

es

tin

co

m

eo

f

$

14,346, or 82%, was due to lower interest rates and lower cas

h

b

alances resulting

f

rom payment o

f

IP litigation settlements in

t

he fourth quarter of 2007, and the use of cash on hand to repay

a portion o

f

our exitin

g

convertible notes in November 2008

.

I

nterest ex

p

ense

.

T

he increase in interest ex

p

ense of

$

7,068, or 31%, was primaril

y

related to incremental interest

expense on our Financing and an increase in interest expense o

f

$

662 on our AT&T litigation settlement.

L

oss on early extinguishment o

f

notes

.

W

e incurred a los

s

of $30,570 as a result of the early extinguishment of notes

,

comprised of $20,452 in third part

y

costs and $9,672 represent-

ing the excess o

f

the

f

air value o

f

the replacement debt over th

e

carrying value of the extinguished debt and

$

446 of other

.

200

7 compare

d

to

2006

I

nt

e

r

es

t

i

n

co

m

e.

T

he decrease in interest income of $3,890,

or 18

%

, was due to the decrease in cash, cash equivalents an

d

m

arketable securities

f

or 2007 com

p

ared to 2006.

I

nterest expense

.

T

he increase in interest expense o

f

$

3,227, or 16%, was primarily related to the

$

2,703 additiona

l

deferred financin

g

cost we recorded in 2007 related to th

e

convertible notes and $2,254 in interest expense on the Verizon

judgment and royalty required to be deposited into escrow in

2

007. This was offset by the decrease of $1,913 in interest on

our convertible notes, which was accrued at 7

%f

or the three

m

onths ended March 31

,

2006 which is the in kind interest rat

e

com

p

ared to 5% for the rest of the

q

uarters which is the cas

h

i

nt

e

r

es

tr

a

t

e

.

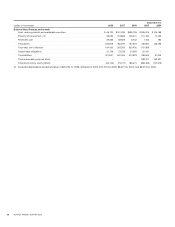

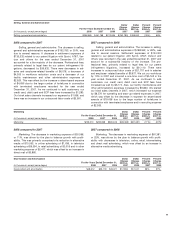

I

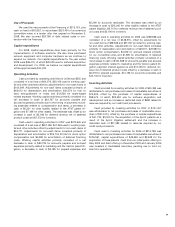

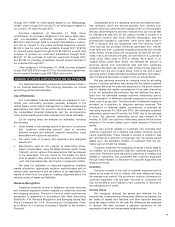

ncome Tax Benefit

(

Ex

p

ense

)

F

or t

h

e

Y

ears

E

n

d

e

dD

ecem

b

er

3

1

,

Dollar

C

han

ge

2008 vs.

2007

Dolla

r

C

han

g

e

2

007 vs.

2006

Pe

r

ce

nt

C

han

ge

2008 vs

.

2007

Pe

r

ce

nt

C

han

g

e

2

007 vs.

2006

(in thousands, except percentages

)

2008 200

7

2006

I

ncome tax benefit (expense) $(678) $(182) $215 $(496) $(397) (273%) (185%

)

PROVISION FOR INCOME TAXES

W

e have net losses

f

or

f

inancial reportin

g

purposes. Reco

g

-

n

ition o

f

de

f

erred tax assets will require generation o

ff

utur

e

t

axa

bl

e

i

ncome.

Th

ere can

b

e no assurance t

h

at we w

ill g

en-

erate su

ff

icient taxable income in

f

uture

y

ears. There

f

ore, we

established a valuation allowance on net de

f

erred tax assets o

f

$

386,547 as of December 31, 2008

.

W

e participated in the State of New Jersey’s corporatio

n

b

usiness tax benefit certificate transfer pro

g

ram, which allows

certa

i

n

high

tec

h

no

l

o

g

yan

dbi

otec

h

no

l

o

g

y compan

i

es to trans-

f

er unused New Jersey net operating loss carryovers to othe

r

N

ew

J

ersey corporat

i

on

b

us

i

ness taxpayers.

D

ur

i

ng 2003 an

d

2004, we su

b

m

i

tte

d

an app

li

cat

i

on to t

h

e

N

ew

J

ersey

E

conom

i

c

Development Authority, or EDA, to participate in the pro

g

ra

m

and the a

pp

lication was a

pp

roved. The EDA then issued a

certificate certifyin

g

our eli

g

ibility to participate in the pro

g

ram

.

The pro

g

ram requires that a purchaser pay at least 75

%

o

f

th

e

amount o

f

the surrendered tax bene

f

it. In tax years 2006, 200

7

and 2008, we sold approximately, $6,493, $8,488 and $10,051,

r

espectively, of our New Jersey State net operatin

g

los

s

carryforwards for a recognized benefit of approximately

$

496 in

2006, $649 in 2007 and $605 in 2008. Collectively, all trans-

actions represent approximatel

y

85

%

o

f

the surrendered ta

x

b

ene

f

it each year and have been recognized in the yea

r

recei

v

ed

.

3

4

VO

NA

G

E ANN

U

AL REP

O

RT 2008