Vonage 2008 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2008 Vonage annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financin

g

Activities

C

ash used in financing activities for 2008 of

$

65,470 was

p

rimarily attributable to the repurchase of our previous con-

v

ertible notes of $253,460 in a tender offer in November 2008.

W

e also had a new debt financing for

$

220,300 plus PIK interest

of

$

2,900 offset by original issue discount of

$

7,167, deb

t

r

elated costs of $26,799 and the principal pa

y

ments on capital

l

ease obligations of

$

1,036

.

C

ash provided by financin

g

activities for 2007 of $245 was

p

rimaril

y

attributable to

$

1,265 for net proceeds from exercise of

s

tock options, subscription receivable and from payment

s

r

eceived

f

or the directed share pro

g

ram, which was o

ff

set by th

e

p

rincipal payments on capital lease obligations of

$

1,020.

C

ash provided by financin

g

activities for 2006 of $477,429

was primarily attributable to net proceeds

f

rom our initial public

offerin

g

in May 2006 of $493,040, net of costs, offset by th

e

p

urchase of treasur

y

stock of $11,723 related to customers that

committed to purchase our common stock through our Directed

Share Pro

g

ram and subsequently defaulted on payment, $5,42

6

of net pa

y

ments to Underwriters related to our Directed Shar

e

Program indemnification, offset by

$

1,764 proceeds from ou

r

convertible notes, net of issuance costs, in January 2006

.

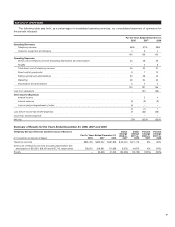

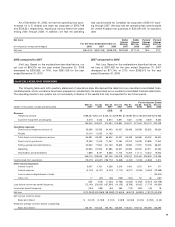

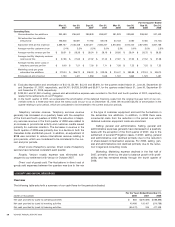

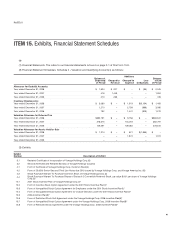

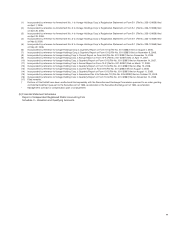

CONTRACTUAL OBLIGATIONS AND OTHER COMMERCIAL COMMITMENTS

The table below summarizes our contractual obli

g

ations at December 31, 2008, and the effect such obli

g

ations are expected to

h

ave on our liquidit

y

and cash

f

low in

f

uture periods.

Payments Due by Period

(

dollars in thousands

)

T

o

t

al

Less

t

han

1

y

ear

2

-3

years

4

-

5

years

After

5

y

ear

s

(

unaudited

)

Contractual Obligations

:

First lien senior facilit

y$

129,974

$

1,303

$

5,538

$

123,133

$

–

S

econd lien senior facilit

y

72,000 – – 1,800 70,20

0

Thi

r

dli

en convert

ibl

e notes 18

,

000 – – – 18

,

00

0

Interest related to first lien senior facilit

y

96,575 21,024 41,457 34,094 –

Interest related to second lien senior facilit

y

165,612 – 4,449 40,228 120,93

5

I

nterest on t

hi

r

dli

en convert

ibl

e notes 42

,

093 – 1

,

112 10

,

057 30

,

924

C

apital lease obligations 37,042 3,960 8,156 8,484 16,442

O

perating lease obligations 4,394 3,774 620 – –

P

urc

h

ase o

bli

gat

i

ons 125,601 92,403 29,498 3,700 –

O

ther obligations

28,600

7

,800 1

5

,600

5

,200

–

Total contractual obligations

$

719,891

$

130,264

$

106,430

$

226,696

$

256,50

1

O

ther

C

ommercial

C

ommitments:

S

tandby letters of credit $ 17,562 $ 17,465 $ 97 $ – $ –

Total contractual obli

g

ations and other commercial commitments $737,453 $147,729 $106,527 $226,696 $256,50

1

S

enior debt facilities.

O

n October 19, 2008, we entered into

definitive agreements for the Financing consisting of (i) the

$

130,300 First Lien Senior Facility, (ii) the $72,000 Second Lien

Senior Facilit

y

and (iii) the sale of $18,000 of Convertible Notes.

The

f

unding

f

or this transaction took place on November 3,

2008.

S

ee Note 11 in the notes to the consolidated financia

l

s

t

a

t

e

m

e

nt

s

.

I

nterest related to second lien senior facilit

y.

A

m

ou

nt

su

n

de

r

t

he Second Lien Senior Facilit

y

bear interest at 20% pa

y

abl

e

quarterly in arrears and payable in kind, or PIK, beginning

December 31, 2008 until the third anniversary of the effective

date and therea

f

ter 20

%

pa

y

able quarterl

y

in arrears in cash. I

f

t

he First Lien Senior Facilit

y

has not been refinanced in full b

y

t

he third anniversary of the effective date, then until suc

h

r

e

f

inancin

g

has occurred 70

%

o

f

the interest due will be payabl

e

i

n cash with the balance pa

y

able in PIK. This table assumes that

th

e

PIK i

nterest w

ill b

epa

id

at matur

i

ty

.

I

nterest related third lien convertible notes

.

Subject to

conversion, repayment or repurchase of the

C

onvertible Notes,

amounts under the

C

onvertible Notes bear interest at 20% that

accrues and compounds quarterl

y

until October 30, 2011 a

t

w

hi

c

h

t

i

me suc

h

accrue

di

nterest ma

yb

epa

id i

n cas

h

.

A

n

y

accrued interest not paid in cash on such date will continue t

o

b

ear interest at 20% that accrues and compounds quarterly and

is pa

y

able in cash on the maturit

y

date of the

C

onvertible Notes.

A

fter October 30, 2011, principal on Convertible Notes will bea

r

interest at 20% payable quarterly in arrears in cash. However, i

f

t

he First Lien

S

enior Facilit

y

has not been refinanced in full b

y

October 31, 2011, then until such refinancing occurs, the cas

h

interest will be capped at 14% with the balance of 6% accruin

g

and compoundin

g

interest quarterly at 20%, to be paid in cas

h

on the maturit

y

date of the Convertible Notes. This tabl

e

assumes t

h

at a

ll

accrue

di

nterest not

p

a

id

w

ill b

e

p

a

id

a

t

m

atur

i

t

y

.

C

apital lease obligations

.

A

t

D

ecem

b

er 31

,

2008

,

we

h

a

d

capital lease obli

g

ations of $37,042 related to our corporat

e

h

eadquarters in Holmdel, New Jerse

y

that expire in 2017.

O

peratin

g

lease obli

g

ations. At December 31, 2008, futur

e

commitments for operating leases included

$

2,389 fo

r

co-location facilities in the

U

nited

S

tates that accommodate

a

portion of our network equipment throu

g

h 2010, $1,335 fo

r

kiosks leased in various locations throu

g

hout the United States

4

0

VO

NA

G

E ANN

U

AL REP

O

RT 2008