Vonage 2008 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2008 Vonage annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

V

O

NA

G

EH

O

LDIN

GS CO

RP

.

N

O

TE

S

T

OCO

N

SO

LIDATED FINAN

C

IAL

S

TATEMENT

S

—

(C

ontinued

)

(

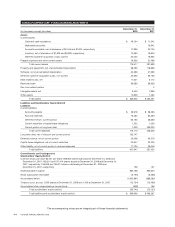

In thousands, except per share amounts

)

T

he following shares were excluded from the calculation of diluted earnings per common share because of their anti-

d

il

u

tiv

ee

ff

ec

t

s

:

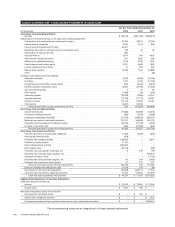

For the Years Ended December 31,

2008 2007 200

6

C

ommon stock warrants 514 3

,

085 3

,

08

5

C

onvertible notes

(

1

)

—17

,

824 17

,

83

5

C

onvertible notes

(

2

)

62

,

069 — —

R

es

tri

c

t

ed s

t

oc

k

u

nit

s

3,

100 3

,

104 1

,

912

Emplo

y

ee stock option

s

2

9

,

227 18

,

257 17

,

00

4

9

4

,

910 42

,

270 39

,

836

(1) In December 2005 and January 2006, we issued $249,919 a

gg

re

g

ate principal amount of our Previous Convertibl

e

N

otes due December 1, 2010. The first interest payment on the Previous Convertible Notes of

$

3,645 was paid in-

kind. In November 2008, we completed a financin

g

transaction consistin

g

of (i) a $130,300 first lien senior facility, (ii) a

$72,000 second lien senior facility and (iii) the sale of $18,000 of convertible notes. The proceeds from the financin

g

p

lus cash on hand were used to re

p

urchase the Previous Convertible Notes. The share amounts in 2007 and 2006 are

related to the Previous

C

onvertible Notes.

(2) The share amount in 2008 is related to our convertible notes issued in November 2008.

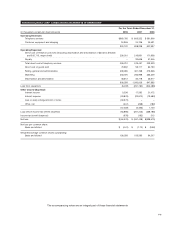

Share-Based Com

p

ensation

We account for share-based com

p

ensation in accord

-

ance with Statement of Financial Accountin

g

Standards

N

o. 123

(

R

)

,Share-Based Payment (

“

S

FAS 123

(

R

)

”

)

. Under

t

he fair value reco

g

nition provisions of this statement

,

share-based compensation cost is measured at the

g

rant

date based on the

f

air value o

f

the award and is recog

-

nized as expense over the applicable vestin

g

period of th

e

stock award usin

g

the accelerated method

.

Recent Accountin

g

Pronouncement

s

In June 2008, the Financial Accountin

gS

tandards

B

oard (“FASB”) ratified Emer

g

in

g

Issues Task Forc

e

(“EITF”) Issue No. 07-5, “Determining Whether an Instru-

ment

(

or an Embedded Feature

)

Is Indexed to an Entity’s

O

wn Stock” (“EITF 07-5”). EITF 07-5 provides that an

entity should use a two step approach to evaluate

whether an equity-linked financial instrument

(

or

embedded feature) is indexed to its own stock, includin

g

evaluating the instrument’s contingent exercise and

settlement

p

rovisions. It also clarifies on the im

p

act of

f

orei

g

n currency denominated strike prices and market-

based emplo

y

ee stock option valuation instruments on

t

he evaluation. EITF 07-5 is effective for fiscal year

s

be

g

innin

g

a

f

ter December 15, 2008. The adoption o

f

EITF

0

7-5 will not have an impact on our consolidated

f

inancia

l

p

osition and results of o

p

erations.

In May 2008, the FA

S

B issued

S

tatement of Financial

Accountin

g

Standards No. 162 (“SFAS No. 162”), “The

H

ierarchy of Generally Accepted Accounting Principles.”

S

FA

S

No. 162 identifies the sources of accountin

g

princi-

ples and the

f

ramework

f

or selectin

g

the principles used in

t

he

p

re

p

aration o

ff

inancial statements that are

p

resente

d

in conformity with

g

enerally accepted accountin

g

princi-

ples. SFAS No. 162 becomes effective 60 days followin

g

t

he Securities and Exchange Commission’s approval of

t

he Public

C

ompany Accountin

gO

versi

g

ht Board

amendments to AU Section 411

,

“The Meanin

g

o

f

Present

Fairly in

C

onformity With

G

enerally Accepted Accounting

Princi

p

les.

”

W

e do not ex

p

ect that the ado

p

tion of SFA

S

No. 162 will have a material impact on our consolidate

d

f

in

a

n

c

i

a

l

s

t

a

t

e

m

e

nt

s.

I

n April 2008, the FA

S

B issued F

S

P No. 142-3

(

“F

S

P

1

42-3”), “Determination of the Useful Life of Intangible

A

ssets.” F

S

P 142-3 amends the factors an entity shoul

d

cons

id

er

i

n

d

eve

l

op

i

n

g

renewa

l

or extens

i

on assumpt

i

on

s

u

sed in determining the use

f

ul li

f

eo

f

recognized intangibl

e

assets under FA

S

B

S

tatement No. 142

,

“

G

oodwill an

d

O

ther Intan

g

ible Assets.” This new

g

uidance applies

p

rospectively to intangible assets that are acquire

d

i

ndividually or with a group of other assets in busines

s

combinations and asset acquisitions. F

S

P 142-3 is effec

-

t

ive

f

or

f

inancial statements issued

f

or

f

iscal

y

ears an

d

i

nterim periods beginning after December 15, 2008. Earl

y

adoption is prohibited.

S

ince this

g

uidance will be applie

d

p

rospectivel

y

, on adoption, there will be no impact to our

current consolidated financial statements

.

I

n March 2008

,

the FASB

,

affirmed the consensus of

FA

S

B

S

taff Position

(

F

S

P

)

Accounting Principles Boar

d

O

pinion No. 14-1

(

APB 14-1

),

Accountin

g

for

C

onvertibl

e

Debt Instruments That May Be Settled in Cash upon Con-

version

(

Including Partial

C

ash

S

ettlement

)

,w

hi

c

h

a

ppli

es

to all co

nv

e

rt

ible deb

t

i

n

s

tr

u

m

e

nt

s

t

ha

t

ha

v

ea

n

e

t

se

tt

le

-

m

ent

f

eature

;

which means that such convertible deb

t

i

nstruments,

b

yt

h

e

i

r terms, may

b

e sett

l

e

d

e

i

t

h

er w

h

o

ll

yo

r

p

artiall

y

in cash upon conversion. F

S

P APB 14-1 requires

i

ssuers o

f

convertible debt instruments that ma

y

be settled

w

h

o

ll

y or part

i

a

ll

y

i

n cas

h

upon convers

i

on to separate

l

y

account for the liabilit

y

and equit

y

components in a man-

n

er re

f

lective o

f

the issuer’s nonconvertible debt borrowin

g

rate. Previous guidance provided for accounting for this

ty

pe of convertible debt instrument entirel

y

as debt. F

SP

A

PB 14-1 is e

ff

ective

f

or

f

inancial statements issued

f

or

f

iscal years beginning after December 15, 2008 and interim

p

eriods within those fiscal

y

ears. The adoption of F

S

PAP

B

1

4-1 will not have an impact on our

f

inancial statements

.

F

-

12

V

O

NA

G

E ANN

U

AL REP

O

RT 200

8