Vonage 2008 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2008 Vonage annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

ITEM 5

.

M

arket for Re

g

istrant’s

C

ommon Equity, Related

S

tockholde

r

M

atters and Issuer Purchases of Equity

S

ecuritie

s

Price Range of

C

ommon

S

toc

k

O

ur common stock has been listed on the New York

S

tock Exchan

g

e under the ticker symbol “V

G

” since May 24, 2006. Prior to

t

hat time, there was no public market

f

or our common stock. The

f

ollowing table sets

f

orth the high and low sales prices

f

or our com

-

m

on stock as reported on the NY

S

E for the quarterly periods indicated.

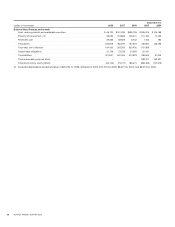

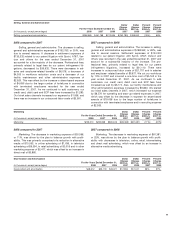

Price Range of Common Stock

g

High L

o

w

2008

F

ourt

h

quarte

r

$

1.32

$

0.5

7

Thi

r

d

quarte

r

$

1.96

$

0.9

0

Second quarter

$

2.05

$

1.6

6

Fi

rst quarte

r

$

2.43

$

1.69

2007

Fourth

q

uarte

r

$

2.70

$

0.9

6

T

hird

q

uarte

r

$

3.19

$

0.89

S

econd

q

uarter

$

4.43

$

2.83

First

q

uarte

r

$

7.01

$

2.98

H

o

l

de

r

s

A

t January 31, 2009, we had approximately 198 stockholders

o

fr

eco

r

d

. Thi

s

n

u

m

be

r

does

n

o

tin

c

l

ude be

n

e

fi

c

i

a

l

o

wn

e

r

s

wh

ose

s

h

a

r

es a

r

e

h

e

l

d

in

s

tr

ee

tn

a

m

e.

Divi

de

n

ds

W

e have never paid cash dividends on our common stock

,

and we do not anticipate paying any cash dividends on ou

r

co

mm

o

n

s

t

oc

kf

o

r

a

tl

eas

tth

e

n

e

xt 12 m

o

nth

s

.W

e

int

e

n

d

t

o

r

e

t

a

i

n

all o

f

our earnin

g

s, i

f

any,

f

or

g

eneral corporate purposes, and, i

f

a

pp

ro

p

riate, to finance the ex

p

ansion of our business

.

Use of Proceeds from Initial Public

O

ffering

O

n May 23, 2006, the

S

ecurities and Exchange

C

ommission

declared effective our Re

g

istration

S

tatement on Form

S

-1

(

Fil

e

No. 333-131659) relating to our IPO. After deducting underwritin

g

d

iscounts and commissions and other o

ff

ering expenses, our ne

t

p

roceeds from the offering equaled approximately $491,144

,

w

hich includes $1,896 of costs incurred in 2005. We hav

e

i

nvested the net proceeds o

f

the o

ff

ering in short-term, interest

b

earing securities pending their use to fund our expansion, includ-

i

n

g

fundin

g

marketin

g

expenses and operatin

g

losses. Except fo

r

p

ayments in connection with IP litigation settlements and debt

repayment, t

h

ere

h

as

b

een no mater

i

a

l

c

h

ange

i

n our p

l

anne

d

use

o

f proceeds from our IP

O

as described in our final prospectu

s

filed with the Securities and Exchange Commission pursuant t

o

Rule 424

(

b

)

. We did not use any of the net proceeds from the IP

O

until after the year ended December 31, 2006. Throu

g

h the yea

r

e

nded December 31, 2008, we used

$

418,881 of the net proceed

s

from the IPO to fund operating activities of

$

270,926 including

$212,225 for IP liti

g

ation settlements, $40,327 to pay noteholder

s

o

f our previousl

y

issued convertible notes,

$

26,799 for deb

t

related costs related to the Financing and

$

80,829 for capital

e

xpenditures, software development and patent purchases.

2

3