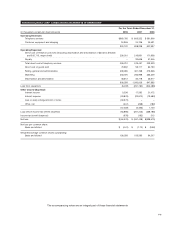

Vonage 2008 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2008 Vonage annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

V

O

NA

G

EH

O

LDIN

GS CO

RP

.

N

O

TE

S

T

OCO

N

SO

LIDATED FINAN

C

IAL

S

TATEMENT

S

—

(C

ontinued

)

(

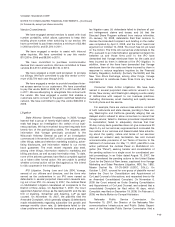

In thousands, except per share amounts

)

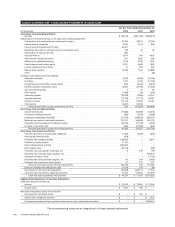

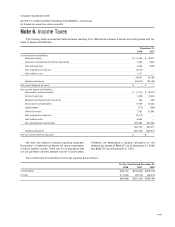

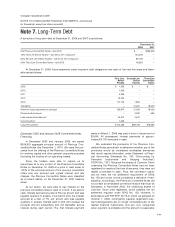

N

o

t

e6.

I

n

co

m

e

T

a

x

es

T

he followin

g

table summarizes deferred taxes resultin

g

from differences between financial accountin

g

basis and ta

x

bas

i

s of asse

t

sa

n

d

li

ab

iliti

es.

D

ecem

b

er

3

1,

2008 200

7

C

urrent assets and liabilities:

D

eferred revenue

$

21

,

405

$

15

,

94

7

A

ccounts rece

i

va

bl

ean

di

nventor

y

a

ll

owances 1,309 1,90

3

A

ccrue

d

expense

s

4,

253 7

,

33

0

D

e

b

tor

i

g

i

na

li

ssue

di

scoun

t

(

2,027

)–

D

e

b

tre

l

ate

d

cost

s

1,

417

–

26

,

357 25

,

180

V

a

l

uat

i

on a

ll

owance

(

26,357

)(

25,180

)

Net current deferred tax asset

$

–

$

–

N

on-current assets an

dli

a

bili

t

i

es:

D

e

p

reciation and amortization

$(

1,141

)$(

5,227

)

A

ccrued ex

p

ense

s

7,408 9,54

6

R

esearch and develo

p

ment tax credit 4

69

4

69

S

tock o

p

tion com

p

ensation

1

7,059 12,23

3

C

a

p

ital lease

s

(

772

)(

356

)

De

f

e

rr

ed

r

e

v

e

n

ue

7,732 12,981

D

ebt ori

g

inal issue discoun

t

(

9,112

)–

Deb

tr

e

l

a

t

ed cos

t

s

6,564 –

N

et operatin

g

loss carryforward 331,983 327,96

5

360,190 357,61

1

Va

l

ua

ti

o

n

a

ll

o

w

a

n

ce

(

360,190

)(

357,611

)

N

e

tn

o

n-

cu

rr

e

nt

de

f

e

rr

ed

t

a

x

asse

t

$

–

$

–

We have net losses for financial reporting purposes.

R

eco

g

nition of deferred tax assets will require

g

eneration

o

ff

uture taxable income. There can be no assurance tha

t

we will generate sufficient taxable income in future years

.

Therefore

,

we established a valuation allowance on net

deferred tax assets of $386,547 as of December 31, 2008

and

$

382

,

791 as of December 31

,

2007

.

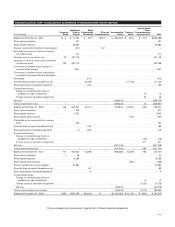

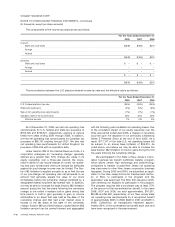

T

he com

p

onents of loss before income tax ex

p

ense are as follows

:

F

or the Years Ended December 31

,

2008 200

7

2006

U

nited

S

tate

s

$

(59,475)

$

(242,030)

$

(302,278)

F

ore

i

g

n

$

(4,423) (25,216) (36,510

)

$

(63,898)

$

(267,246)

$

(338,788)

F-1

5