Vonage 2008 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2008 Vonage annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

V

O

NA

G

EH

O

LDIN

GS CO

RP

.

N

O

TE

S

T

OCO

N

SO

LIDATED FINAN

C

IAL

S

TATEMENT

S

—

(C

ontinued

)

(

In thousands, except per share amounts

)

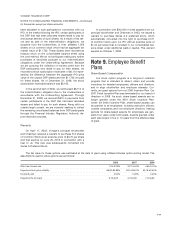

In February 2008, the FA

S

B issued FA

S

BF

S

P 157-2,

which dela

y

ed the effective date of

S

FA

S

No. 157 for all

non

f

inancial assets and non

f

inancial liabilities, except

t

hose that are recognized or disclosed at fair value in the

financial statements on a recurrin

g

basis

(

at leas

t

annually), until fiscal years be

g

innin

g

after November 15

,

2

008, and interim periods within those fiscal years. Thes

e

n

o

nfin

a

n

c

i

a

lit

e

m

s

in

c

l

ude asse

t

sa

n

d

li

ab

iliti

es suc

h

as

r

eportin

g

units measured at

f

air value in a

g

oodwil

l

im

p

airment test and non

f

inancial assets ac

q

uired an

d

li

ab

iliti

es assu

m

ed

in

a bus

in

ess co

m

b

in

a

ti

o

n. Eff

ec

tiv

e

J

anuar

y

1, 2008, we adopted SFAS No. 157 for financia

l

assets and liabilities recognized at

f

air value on a recurring

basis. The

p

artial ado

p

tion of

S

FA

S

No. 157 for financia

l

assets and liabilities did not have a material impact on ou

r

consolidated

f

inancial

p

osition, results o

f

o

p

erations or

cas

hfl

o

w

s

.

I

n February 2007, the FASB issued Statement o

f

Financial Accountin

gS

tandards No. 159

(

“

S

FA

S

No.

1

59”), “The Fair Value Option for Financial Assets and

Financial Liabilities

.

”

Under SFAS No. 159, com

p

anie

s

m

ay elect to measure certain financial instruments an

d

certain other items at

f

air value. The standard require

s

t

hat unrealized gains and losses on items

f

or which the

f

air value option has been elected be reported in earnin

g

s.

SFAS No. 159 was effective for us be

g

innin

g

in the firs

t

quarter o

f

2008. We currently do not have any instrument

s

eligible for election of the fair value option. Therefore, the

adoption of SFAS No. 159 in the first quarter of 2008 did

n

ot impact our consolidated

f

inancial position, results o

f

o

p

erations or cash flows

.

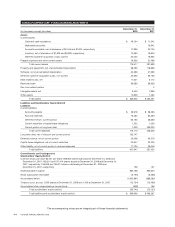

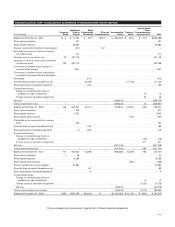

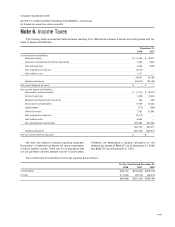

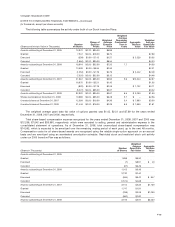

N

ote 2

.

C

ash,

C

ash Equivalents and Marketable

S

ecurities

C

ash, cash equivalents and marketable securities consist of the followin

g:

D

ecem

b

er

3

1

,

2008 2007

C

ash and cash equivalent

s

$

46

,

134 $ 71

,

542

Ma

rk

e

t

ab

l

e secu

riti

es

:

Res

tri

c

t

ed cash

–

5

4

6

U.

S

. corporate bond

s

–28

,

59

9

A

uct

i

on rate secur

i

t

i

es –40

,

35

0

C

ertificate of deposits –

4,991

U.

S

. government notes –5

,4

5

6

T

ota

l

mar

k

eta

bl

e secur

i

t

i

e

s

–7

9,942

T

otal cash, cash equivalents and marketable securities $46,134 $151,484

S

ince all of our marketable securities were converte

d

t

o cas

hi

n 2008, t

h

ere was no unrea

li

ze

dg

a

i

nor

l

oss a

t

D

ecember 31, 2008. We had a

g

ross unrealized

g

ain of

$1

at

D

ecem

b

er 31, 2007.

Th

ere was a gross unrea

li

ze

dl

oss

of $1 and a

g

ross unrealized loss of $13 for the year

ended December 31, 2008 and 2007, respectivel

y

.

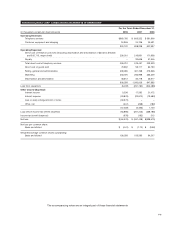

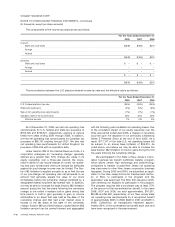

N

o

t

e3.

P

ro

p

ert

y

and E

q

ui

p

ment

D

ecem

b

er

3

1

,

2008 2007

Building (under capital lease)

$

25

,

709 $ 25

,

70

9

N

etwor

k

equ

i

pment an

d

computer

h

ar

d

war

e

104,888 99,0

7

5

Leased e

q

ui

p

ment –

3

7

1

Leasehold im

p

rovements

42

,

12

5

41

,7

45

F

u

rnit

u

r

e

10,887 11,700

V

e

hi

c

l

es

3

1

630

4

Display

s

2

6

2

330

184,187 179,234

Less: accumulated depreciation and amortization

(

85,895

)(

60,568

)

N

et propert

y

an

d

equ

i

pmen

t

$

98

,

292

$

118

,

66

6

F-1

3