Vonage 2008 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2008 Vonage annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

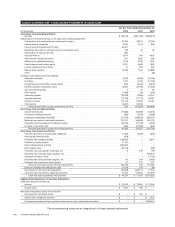

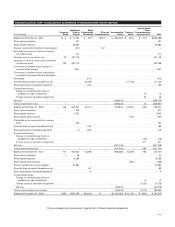

VONAGE HOLDINGS CORP. CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY (DEFICIT)

(

In thousands

)

Common

S

toc

k

Additional

P

a

i

d

-i

n

C

apital

S

tock

S

ubscri

p

tion

R

ece

iv

ab

l

e

D

e

f

e

rr

ed

C

ompensatio

n

Accu

m

u

l

a

t

ed

De

fi

c

it

T

reasur

y

S

toc

k

A

ccumu

l

ate

d

Othe

r

Com

p

rehensiv

e

Income

(

Loss

)

Tota

l

Balance at December 31, 2005 $ 2 $ 14,794 $

(

37

)

$

(

167

)

$

(

382,284

)

$

(

619

)

$

(

174

)

$

(

368,485

)

S

tock o

p

tion exercises 43

1

43

1

S

hare-based expense 26,980

2

6

,

98

0

Reverse unamortized deferred compensation (167) 167 –

B

e

n

ef

i

c

i

a

l

co

nv

e

r

s

i

o

n

of

int

e

r

es

t in kin

do

n

c

onvert

ibl

e notes 214 21

4

I

ssuance o

f

common stock

,

net 31 491

,

113

491,144

I

ssuance o

f

common stock u

p

on conversion

o

f preferred stock 123 387,175

3

87

,

298

C

onversion of preferred stock warrant t

o

c

ommon stock warrant 1,55

7

1

,557

C

onversion of

p

referred stock subscri

p

tion

rece

i

va

bl

e to common stoc

k

su

b

scr

i

pt

i

o

n

Receivable

(

411

)(

411

)

Directed share program transactions, net (5,426) (11,723) (17,149)

g

Stock subscription receivable payments 153 153

y

C

omprehensive loss

:

C

han

g

e in unrealized

g

ain (loss) o

n

available-for-sale investment

s

1

313

Foreign currency translation adjustment

gy

29 29

N

e

tl

oss

(

338,573

)(

338,573

)

Total com

p

rehensive loss – – – –

(

338,573

)

–42

(

338,531

)

Balance at December 31, 2006 156 922,097

(

5,721

)

–

(

720,857

)(

12,342

)(

132

)

183,201

Stock option exercises 1 81

6

817

Share-based ex

p

ense 7,542

7

,5

42

Share-based award activity

y

(

157

)(

157

)

C

onvertible notes converted into commo

n

s

t

oc

k1

52

152

Directed share pro

g

ram transactions, net 169 16

9

Stock subscription receivable payments (7) 286 279

y

C

omprehensive loss

:

C

han

g

e in unrealized

g

ain (loss) o

n

a

v

a

il

ab

l

e

-f

o

r-

sa

l

e

inv

es

tm

e

nt

s

(

13

)(

13

)

Foreign currency translation adjustment

gy

311 311

N

et

l

os

s

(267,428) (267,428

)

Total com

p

rehensive loss – – – –

(

267,428

)

– 298

(

267,130

)

Balance at December 31, 2007 157 930,600

(

5,266

)

–

(

988,285

)(

12,499

)

166

(

75,127

)

S

tock option exercises 1 4

6

4

7

Share-based expense 12,238

12,238

Share-based award activity

y

(

205

)(

205

)

Premium attributed to notes payable 37,884

y

3

7,884

Directed share program transactions, net 62 62

g

Stock subscription receivable payments 9

y

9

Com

p

rehensive loss

:

C

hange in unrealized gain

(

loss

)

o

n

available-

f

or-sale investment

s

(

1) (1)

Foreign currency translation adjustment

gy

(

1,073

)(

1,073

)

Ne

tl

oss

(

64,576

)(

64,576

)

Total comprehensive income

(

loss

)

––– –

(

64,576

)

–

(

1,074

)(

65,650

)

Balance at December 31, 2008 $158 $980,768 $(5,195) $ – $(1,052,861) $(12,704) $ (908) $ (90,742

)

The accompanyin

g

notes are an inte

g

ral part of these financial statements

F

-

7