U-Haul 2005 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2005 U-Haul annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

73 I AMERCO ANNUAL REPORT

Amerco and Consolidated Entities

Notes to Consolidated Financial Statements, continued

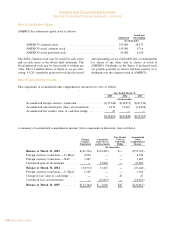

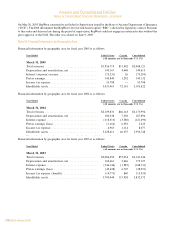

Leasecommitmentsforleaseshavingtermsofmorethanoneyearasoffiscalyear-endwereasfollows:

AMERCO AND CONSOLIDATED ENTITIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS Ì (Continued)

Note 16: Contingent Liabilities and Commitments

The Company leases a portion of its rental equipment and certain of its facilities under operating leases

with terms that expire at various dates substantially through 2034. At March 31, 2005, AMERCO has

guaranteed $143.9 million of residual values for these assets at the end of the respective lease terms. Certain

leases contain renewal and fair market value purchase options as well as other restrictions. At the expiration of

the lease, the Company has options to renew the lease, purchase the asset for fair market value, or sell the

asset to a third party on behalf of the lessor. AMERCO has been leasing equipment since 1987 and has

experienced no material losses relating to these types of residual value guarantees.

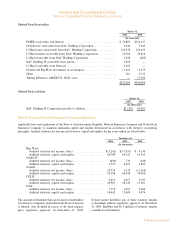

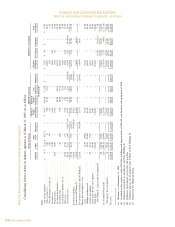

Lease expense during each fiscal years-end was as follows:

March 31,

2005 2004 2003

(In thousands)

Lease expense ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $151,354 $160,727 $166,100

Lease commitments for leases having terms of more than one year as of fiscal year-end were as follows:

Property

Plant and Rental

Equipment Equipment Total

(In thousands)

Year-ended:

2006 ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $ 11,854 $ 90,262 $102,116

2007 ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 11,067 72,287 83,354

2008 ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 10,935 40,071 51,006

2009 ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 10,621 26,649 37,270

2010 ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 10,215 16,408 26,623

Thereafter ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 45,544 11,287 56,831

Total ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $100,236 $256,964 $357,200

Note 17: Contingencies

Kocher

On March 2, 2005 Oxford settled a case pending in Wetzel County, West Virginia bearing the case

caption Charles Kocher v. Oxford Life Insurance Co., Civil Action No. 00-C-51-K (the ""Action''). In

consideration of the payment of $12.8 million, Charles A Kocher (""Kocher'') executed a General Release of

all claims against Oxford, Republic Western, and Evanston Insurance Company, together with certain

affiliates, subsidiaries, officers, directors, employees and other related parties of each of them, including but

not limited to all claims that were or could have been asserted in the Action. Pursuant to the General Release,

Kocher agreed to the dismissal with prejudice of the Action, with each party bearing its own costs and

attorneys' fees. Oxford received $2.2 million in reimbursement from its E&O carrier related to the settlement

of the Action.

Shoen

On September 24, 2002, Paul F. Shoen filed a derivative action in the Second Judicial District Court of

the State of Nevada, Washoe County, captioned Paul F. Shoen vs. SAC Holding Corporation et al.,

CV02-05602, seeking damages and equitable relief on behalf of AMERCO from SAC Holdings and certain

current and former members of the AMERCO Board of Directors, including Edward J. Shoen, Mark V.

F-31

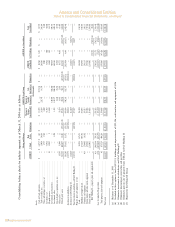

Note 17: Contingencies

Kocher

OnMarch2,2005OxfordsettledacasependinginWetzel

County,WestVirginiabearingthecasecaptionCharles

Kocher v. Oxford Life Insurance Co., Civil Action

No. 00-C-51-K (the “Action”). In consideration of the

paymentof$12.8million,CharlesAKocher(“Kocher”)

executedaGeneralReleaseofallclaimsagainstOxford,

Republic Western, and Evanston Insurance Company,

together with certain affiliates, subsidiaries, officers,

directors,employeesandotherrelatedpartiesofeachof

them,includingbutnotlimitedtoallclaimsthatwereor

couldhavebeenassertedintheAction.Pursuanttothe

General Release, Kocher agreed to the dismissal with

prejudiceoftheAction,witheachpartybearingitsown

costs and attorneys’ fees. Oxford received $2.2 million

in reimbursement from its E&O carrier related to the

settlementoftheAction.

Shoen

OnSeptember24,2002,PaulF.Shoenfiledaderivative

actionintheSecondJudicialDistrictCourtoftheState

ofNevada,WashoeCounty,captionedPaulF.Shoenvs.

SAC Holding Corporation et al., CV02-05602, seeking

damagesandequitablereliefonbehalfofAMERCOfrom

SAC Holdingsandcertaincurrentandformermembers

oftheAMERCOBoardofDirectors,includingEdwardJ.

Shoen,MarkV.ShoenandJamesP.Shoenasdefendants.

AMERCO is named a nominal defendant for purposes

of the derivative action. The complaint alleges breach

of fiduciary duty, self-dealing, usurpation of corporate

opportunities, wrongful interference with prospective

economic advantage and unjust enrichment and seeks

the unwinding of sales of self-storage properties by

subsidiariesofAMERCOtoSACHoldingsinprioryears.

Thecomplaintseeksadeclarationthatsuchtransfersare

void as well as unspecified damages. On October 28,

2002, AMERCO, the Shoen directors, the non-Shoen

directorsandSACHoldingsfiledMotionstoDismissthe

complaint.Inaddition,onOctober28,2002,RonBelec

filed a derivative action in the Second Judicial District

CourtoftheStateofNevada,WashoeCounty,captioned

RonBelecvs.WilliamE.Carty,etal.,CV02-06331and

on January 16, 2003, M.S. Management Company, Inc.

filed a derivative action in the Second Judicial District

CourtoftheStateofNevada,WashoeCounty,captioned

M.S.ManagementCompany,Inc.vs.WilliamE.Carty,

etal.,CV03-00386.Twoadditionalderivativesuitswere

also filed against these parties. These additional suits

aresubstantiallysimilartothePaulF.Shoenderivative

action. The five suits assert virtually identical claims.

In fact, three of the five plaintiffs are parties who are

working closely together and chose to file the same

claims multiple times. These lawsuits alleged that the

AMERCO Board lacked independence. In reaching its

decision to dismiss these claims, the court determined

thattheAMERCOBoardofDirectorshadtherequisite

level of independence required in order to have these

claimsresolvedbytheBoard.Thecourtconsolidatedall

fivecomplaintsbeforedismissingthemonMay28,2003.

PlaintiffsfiledaNoticeofAppealtotheNevadaSupreme

Court. Thepartieshavefullybriefedtheissuesandare

awaitingarulingfromthecourt.

Securities Litigation

AMERCO is a defendant in a consolidated putative

classactionlawsuitentitled“InReAMERCOSecurities

Litigation”, United States District Court, Case No. CV-

N-03-0050-ECR (RAM). The action alleges claims for

violationofSection10(b)oftheSecuritiesExchangeAct

andRule10b-5thereunder,section20(a)oftheSecurities

ExchangeActof1934andsections11,12,and15ofthe

SecuritiesActof1933.Theactionalleges,amongother

things,thatAMERCOengagedintransactionswiththe

SACentitiesthatfalselyimprovedAMERCO’sfinancial

statements and that AMERCO failed to disclose the