U-Haul 2005 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2005 U-Haul annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

26 I AMERCO ANNUAL REPORT

Management’s Discussion and Analysis

of Financial Condition and Results of Operations

Results of Operations

AMERCOandConsolidatedEntities

Fiscal 2005 Compared with Fiscal 2004

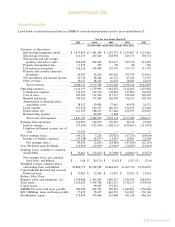

Listedbelowonaconsolidatedbasisarerevenuesforourmajorproductlinesforfiscal2005andfiscal2004:

Results of Operations

AMERCO and Consolidated Entities

Fiscal 2005 Compared with Fiscal 2004

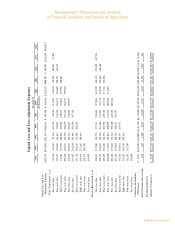

Listed below on a consolidated basis are revenues for our major product lines for fiscal 2005 and fiscal

2004:

Year Ended March 31,

2005 2004

(In thousands)

Self-moving equipment rentals ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $1,437,895 $1,381,208

Self-storage revenues ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 114,155 247,640

Self-moving and self-storage product and service sales ÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 206,098 232,965

Property management fees ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 11,839 259

Life insurance premiumsÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 126,236 145,082

Property and casualty insurance premiums ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 24,987 92,036

Net investment and interest income ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 56,739 38,281

Other revenueÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 30,172 38,523

Consolidated revenueÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $2,008,121 $2,175,994

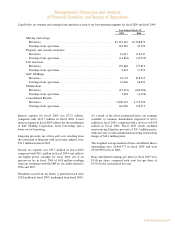

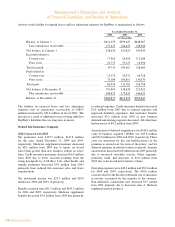

During fiscal 2005, we built our moving equipment rentals through steady transaction volume, modest

price increases and improved mix. Reported storage revenues were reduced $109.2 million as a result of the

deconsolidation of SAC Holding Corporation in fiscal 2004 and were reduced $29.7 million as a result of the

W.P. Carey Transactions (see footnote 9 for a more detailed discussion of the W.P. Carey Transactions).

Self-storage revenues from remaining properties grew as a result of an increase in the number of rooms

available for rent, higher occupancy rates and modest price increases. Sales of moving and self storage related

products and services followed our growth in self-moving equipment rentals, net of the reduction of

approximately $36 million resulting from the deconsolidation of SAC Holding Corporation. Property

management fees increased $10.1 million as a result of the deconsolidation of SAC Holding Corporation and

increased $1.4 million as a result of the W.P. Carey Transactions.

RepWest continued to exit non U-Haul related lines of business and as a result, its premium revenues

declined approximately $67.0 million. Oxford's premium revenues declined approximately $18.8 million

primarily as a result of the lingering effects of its rating downgrade by A. M. Best in 2003.

Net investment and interest income increased primarily as a result of the deconsolidation of SAC

Holding Corporation and decreased primarily as a result of reduced loans with SAC Holdings.

As a result of the items mentioned above, revenues for AMERCO and its consolidated entities were

$2,008.1 million for fiscal 2005, compared with $2,176.0 million for fiscal 2004.

Total costs and expenses fell by $208.0 million as a result of productivity initiatives at U-Haul, the effect

of the W. P. Carey Transactions and the deconsolidation of SAC Holding Corporation. The decrease in total

costs and expenses was partially offset by payroll and benefit inflation, $4.4 million of self-moving equipment

impairment charges related to a lease buy-out, $2.1 million of additional depreciation expense related to lower

residual value assumptions, and litigation settlement costs of $10.6 million at Oxford, net of insurance

recoveries. Benefits and losses fell as a result of lower premium revenues at RepWest and Oxford. Benefits and

losses included approximately $9.5 million as a result of hurricane related losses at RepWest. The absence of

restructuring costs in fiscal 2005 contributed to lower costs and expenses compared with fiscal 2004.

As a result of the above mentioned changes in revenues and expenses, earnings from operations improved

31.6% to $167.0 million in fiscal 2005 compared with $126.9 million for fiscal 2004.

18

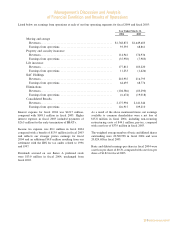

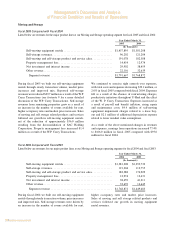

During fiscal 2005, we built our moving equipment

rentals through steady transaction volume, modest

price increases and improved mix. Reported storage

revenueswerereduced $109.2millionas a resultofthe

deconsolidation of SAC Holding Corporation in fiscal

2004andwerereduced $29.7millionas a resultofthe

W.P. Carey Transactions (see footnote 9 for a more

detaileddiscussionoftheW.P.CareyTransactions).Self-

storage revenues from remaining properties grew as a

resultofanincreaseinthenumberofroomsavailablefor

rent,higheroccupancyratesandmodestpriceincreases.

Sales of moving and self storage related products and

services followed our growth in self-moving equipment

rentals,netofthereductionofapproximately$36million

resulting from the deconsolidation of SAC Holding

Corporation.Propertymanagementfeesincreased$10.1

millionasaresultofthedeconsolidationofSACHolding

Corporationandincreased$1.4millionasaresultofthe

W.P.CareyTransactions.

RepWest continued to exit non U-Haul related lines of

businessand as a result,its premiumrevenuesdeclined

approximately$67.0million.Oxford’spremiumrevenues

declined approximately $18.8 million primarily as a

resultofthelingeringeffectsofitsratingdowngradeby

A.M.Bestin2003.

Netinvestmentandinterest incomeincreased primarily

as a result of the deconsolidation of SAC Holding

Corporation and decreased primarily as a result of

reducedloanswithSACHoldings.

As a result of the items mentioned above, revenues for

AMERCO and its consolidated entities were $2,008.1

millionforfiscal2005,comparedwith$2,176.0million

forfiscal2004.

Total costs and expenses fell by $208.0 million as a

resultofproductivityinitiativesatU-Haul,theeffectof

the W. P. Carey Transactions and the deconsolidation

of SAC Holding Corporation. The decrease in total

costs and expenses was partially offset by payroll and

benefitinflation,$4.4millionofself-movingequipment

impairment charges related to a lease buy-out, $2.1

million of additional depreciation expense related to

lowerresidualvalueassumptions,andlitigationsettlement

costs of $10.6 million at Oxford, net of insurance

recoveries. Benefits and losses fell as a result of lower

premiumrevenuesatRepWestandOxford.Benefitsand

losses included approximately $9.5 million as a result

of hurricane related losses at RepWest. The absence of

restructuring costs in fiscal 2005 contributed to lower

costsandexpensescomparedwithfiscal2004.

Asaresultoftheabovementionedchangesinrevenues

andexpenses,earningsfromoperationsimproved31.6%

to $167.0 million in fiscal 2005 compared with $126.9

millionforfiscal2004.