U-Haul 2005 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2005 U-Haul annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.41 I AMERCO ANNUAL REPORT

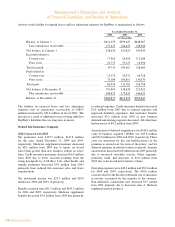

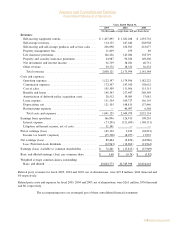

grossreceiptsfromthepropertiesplusreimbursementfor

certainexpenses.Wereceivedmanagementfees,exclusive

of expenses, of $14.4 million during fiscal 2005. This

managementfeeisconsistentwith thefeeswe received

fromunrelatedpartiesforotherpropertieswemanage.

CertainsubsidiariesofSACHoldingsanditsaffiliatesact

asU-Hauldealers.Thefinancialandothertermsofthe

dealership contracts with subsidiaries of SAC Holdings

anditsaffiliatesaresubstantiallyidenticaltothetermsof

thosewithour14,071independentdealers.Duringfiscal

2005,wepaidsubsidiariesofSACHoldings$33.1million

incommissionspursuanttosuchdealershipcontracts.

The Companyleased space forcertain ofits marketing

companyoffices,vehiclerepairshopsandhitchinstallation

centersfromsubsidiariesofSACHoldingsanditsaffiliates.

Total lease paymentspursuant to suchleases were$2.7

millionduringfiscal2005.

These agreements provided revenues of $35.0 million,

expensesof$35.8million,cashreceiptsof$60.5million

andcashdisbursementsof$71.6millionduringfiscal2005.

These amounts exclude rental revenues received by the

CompanyforwhichSACHoldingsanditsaffiliateswere

paidacommission.

During fiscal 2005, a subsidiary of the Company held

various senior and junior unsecured notes of SAC

Holdings.TheCompanyrecordedinterestincomeof$22.0

million and received cash interest payments of $11.7

millionduringfiscal2005.

Fiscal 2006 Outlook

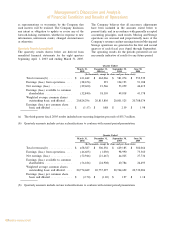

We havemanyexcitingdevelopments whichwebelieve

should positively affect performance in fiscal 2006.

We believe the momentum in our Moving and Storage

Operations will continue. We are investing strongly in

our truck rental fleet to further strengthen U-Haul’s

“do-it-yourself” moving business. We placed purchase

orderslastfallfor6,750ofourlargestrentaltrucksandexpect

tohavetheminservicebymid-August.Thisinvestment

isexpectedtoincreasethenumberofrentabletruckdays

availabletomeetourcustomer’sdemandandshouldreduce

futurespendingonrepaircostsandequipmentdown-time.

AtRepWest,ourplanstoexitnon-U-Haullinesofbusiness

areprogressingwell.

AtOxford,therecentKocherlitigationsettlementshould

produceimprovedratings,whichinturnshouldsupport

theexpansionofitsdistributioncapabilities.

Also, we completed the refinancing of the Company’s

debtonJune8,2005.Thisactionincreasedourborrowing

capacity by more than $45.0 million and is expected to

lower our annual interest expense approximately $25.0

million before taxes (based on current borrowing levels).

Theearlyextinguishmentofourexistingdebtwillresult

in a one time pre-tax charge of approximately $34.0

millionduringthefirstquarteroffiscal2006.

Ourobjectivesforfiscal2006aretopositionourrental

fleettoachieverevenueandtransactiongrowthandcontinue

todrivedownoperatingcosts.

CAUTIONARY STATEMENT REGARDING

FORWARD-LOOKING STATEMENTS

ThisAnnualReportcontainsforward-lookingstatements.

Wemaymakeadditionalwrittenororalforward-looking

statementsfromtimetotimeinfilingswiththeSecurities

and Exchange Commission or otherwise. We believe

suchforward-lookingstatementsarewithinthemeaning

of the safe-harbor provisions of the Private Securities

Litigation Reform Act of 1995. Such statements may

include, but are not limited to, projections of revenues,

income or loss;estimates ofcapital expenditures, plans

for future operations, products or services; financing

needs and plans; our perceptions of our legal positions

and anticipated outcomes of pending litigation against

us; our liquidity and financial resources; goals and

strategies; plans for new business; assumptions about

pricing,costs,andaccesstocapitalandleasingmarkets

as well as assumptions relating to the foregoing. The

words “believe”, “expect”, “anticipate”, “estimate”,

“project” and similar expressions identify forward-

looking statements, which speak only as of the date

the statement was made. Forward-looking statements

are inherently subject to risks and uncertainties, some

of which cannot be predicted or quantified. Factors

that could significantly affect results include, without

limitation,theriskfactorsenumeratedattheendofthis

section,as wellasthefollowing:theCompany’sability

to operate pursuant to the terms of its credit facilities;

the Company’s ability to maintain contracts that are

critical to its operations; the costs and availability of

financing;theCompany’sabilitytoexecuteitsbusiness

plan; the Company’s ability to attract, motivate and

retain key employees; general economic conditions;

fluctuationsinourcoststomaintainandupdateourfleet

andfacilities;ourabilitytorefinanceourdebt;changes

in government regulations, particularly environmental

regulations;ourcreditratings;theavailabilityofcredit;

changes in demand for our products; changes in the

general domestic economy; the degree and nature of

our competition; the resolution of pending litigation

against theCompany; changesin accountingstandards

andotherfactorsdescribedinthedocumentswefilewith

the Securities Exchange Commission. Consequently,

the forward-looking statements should not be regarded

Management’s Discussion and Analysis

of Financial Condition and Results of Operations