U-Haul 2005 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2005 U-Haul annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

61 I AMERCO ANNUAL REPORT

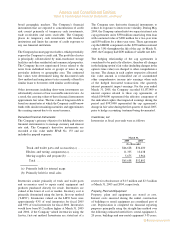

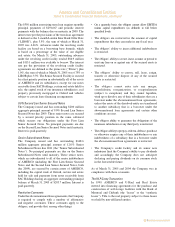

The Company sold available-for-sale securities with a

fair value of $167.5 million in 2004, $267.9 million in

2003 and $248.0 million in 2002. The gross realized

gains on these sales totaled $2.3 million in 2004, $5.3

millionin2003and$6.0millionin2002.Thecompany

realized gross losses on these sales of $1.7 million in

2004, $3.1 million in 2003 and $2.4 million in 2002.

The company recognized a write-down of investments

duetootherthantemporarydeclinesonavailable-for-sale

investmentsofapproximately$4.3millionin2004,$5.0

millionin2003and$9.8millionin2002.Theunrealized

lossespresentedinthetablesabovethataremorethan12

monthsareconsideredtemporarydeclines.TheCompany

trackseach oftheseinvestments and evaluates themon

an individual basis for other than temporary declines

including obtaining corroborating opinions from third

party sources, performing trend analysis and reviewing

underlyingmanagement’sfutureplans.

AMERCO AND CONSOLIDATED ENTITIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS Ì (Continued)

opinions from third party sources, performing trend analysis and reviewing underlying management's future

plans.

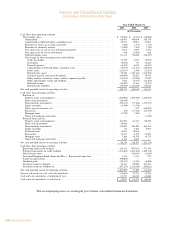

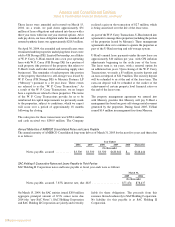

The adjusted cost and estimated market value of available-for-sale investments in debt securities at

December 31, 2004 and December 31, 2003, by contractual maturity, were as follows:

December 31, 2004 December 31, 2003

Estimated Estimated

Amortized Market Amortized Market

Cost Value Cost Value

(In thousands)

Due in one year or less ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $110,679 $112,058 $ 50,698 $ 50,847

Due after one year through five years ÏÏÏÏÏÏÏÏÏÏ 181,455 185,890 270,186 283,711

Due after five years through ten yearsÏÏÏÏÏÏÏÏÏÏ 109,108 113,076 132,009 137,969

After ten years ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 98,200 106,824 100,888 108,795

499,442 517,848 553,781 581,322

Mortgage-backed securitiesÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 78,329 77,981 74,268 74,636

Redeemable preferred stocks ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 30,058 31,278 45,861 47,216

Equity securitiesÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 7,476 6,641 243 349

$615,305 $633,748 $674,153 $703,523

Investments, other

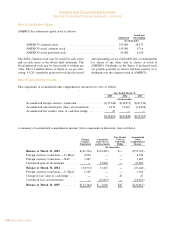

The carrying value of other investments at fiscal year-ends was as follows:

March 31,

2005 2004

(In thousands)

Short-term investments ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $193,525 $187,560

Mortgage loans, net ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 51,196 53,496

Real estate ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 93,178 101,421

Policy loansÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 5,185 5,698

Other ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 2,123 970

$345,207 $349,145

Short-term investments primarily consist of securities with fixed maturities of three months to one year

from acquisition date.

Mortgage loans are carried at the unpaid balance, less an allowance for possible losses and any

unamortized premium or discount. The allowance for possible losses was $1.0 million and $1.1 million as of

March 31, 2005 and 2004, respectively. The estimated fair value of these loans at March 31, 2005 and 2004

approximated the carrying value. These loans represent first lien mortgages held by the Company's insurance

subsidiaries.

Real estate obtained through foreclosures and held for sale and equity investments are carried at the

lower of cost or fair value.

Insurance policy loans are carried at their unpaid balance.

F-18

AMERCO AND CONSOLIDATED ENTITIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS Ì (Continued)

opinions from third party sources, performing trend analysis and reviewing underlying management's future

plans.

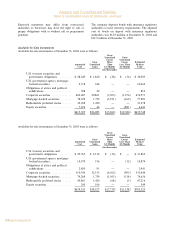

The adjusted cost and estimated market value of available-for-sale investments in debt securities at

December 31, 2004 and December 31, 2003, by contractual maturity, were as follows:

December 31, 2004 December 31, 2003

Estimated Estimated

Amortized Market Amortized Market

Cost Value Cost Value

(In thousands)

Due in one year or less ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $110,679 $112,058 $ 50,698 $ 50,847

Due after one year through five years ÏÏÏÏÏÏÏÏÏÏ 181,455 185,890 270,186 283,711

Due after five years through ten yearsÏÏÏÏÏÏÏÏÏÏ 109,108 113,076 132,009 137,969

After ten years ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 98,200 106,824 100,888 108,795

499,442 517,848 553,781 581,322

Mortgage-backed securitiesÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 78,329 77,981 74,268 74,636

Redeemable preferred stocks ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 30,058 31,278 45,861 47,216

Equity securitiesÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 7,476 6,641 243 349

$615,305 $633,748 $674,153 $703,523

Investments, other

The carrying value of other investments at fiscal year-ends was as follows:

March 31,

2005 2004

(In thousands)

Short-term investments ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $193,525 $187,560

Mortgage loans, net ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 51,196 53,496

Real estate ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 93,178 101,421

Policy loansÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 5,185 5,698

Other ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 2,123 970

$345,207 $349,145

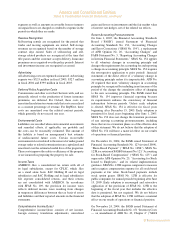

Short-term investments primarily consist of securities with fixed maturities of three months to one year

from acquisition date.

Mortgage loans are carried at the unpaid balance, less an allowance for possible losses and any

unamortized premium or discount. The allowance for possible losses was $1.0 million and $1.1 million as of

March 31, 2005 and 2004, respectively. The estimated fair value of these loans at March 31, 2005 and 2004

approximated the carrying value. These loans represent first lien mortgages held by the Company's insurance

subsidiaries.

Real estate obtained through foreclosures and held for sale and equity investments are carried at the

lower of cost or fair value.

Insurance policy loans are carried at their unpaid balance.

F-18

Amerco and Consolidated Entities

Notes to Consolidated Financial Statements, continued

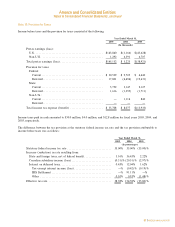

Theadjustedcostandestimatedmarketvalueofavailable-for-saleinvestmentsindebtsecuritiesatDecember31,2004

andDecember31,2003,bycontractualmaturity,wereasfollows:

Investments, other

Thecarryingvalueofotherinvestmentsatfiscalyear-endswasasfollows:

Short-term investments primarily consist of securities

with fixed maturitiesofthree monthsto one year from

acquisitiondate.

Mortgage loans are carried at the unpaid balance, less

an allowance for possible losses and any unamortized

premiumordiscount.The allowanceforpossiblelosses

was$1.0millionand$1.1millionasofMarch31,2005

and2004,respectively.Theestimatedfairvalueofthese

loans at March 31, 2005 and 2004 approximated the

carryingvalue.Theseloansrepresentfirstlienmortgages

heldbytheCompany’sinsurancesubsidiaries.

Realestateobtainedthroughforeclosuresandheldforsale

and equity investments are carried at the lower of cost or

fairvalue.

Insurancepolicyloansarecarriedattheirunpaidbalance.