U-Haul 2005 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2005 U-Haul annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

60 I AMERCO ANNUAL REPORT

Expected maturities may differ from contractual

maturities as borrowers may have the right to call or

prepay obligations with or without call or prepayment

penalties.

The company deposits bonds with insurance regulatory

authoritiestomeetstatutoryrequirements.Theadjusted

cost of bonds on deposit with insurance regulatory

authoritieswas$12.9millionatDecember31,2004and

$12.9millionatDecember31,2003.

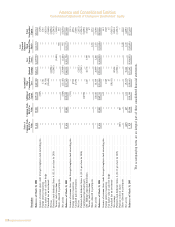

AMERCO AND CONSOLIDATED ENTITIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS Ì (Continued)

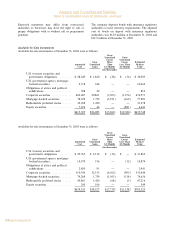

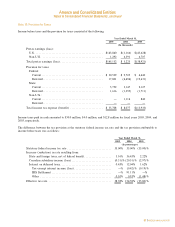

Available-for-Sale Investments

Available-for-sale investments at December 31, 2004 were as follows:

Gross

Unrealized Gross

Losses Unrealized

Gross More Losses Estimated

Amortized Unrealized Than Less Than Market

Cost Gains 12 Months 12 Months Value

(In thousands)

U.S. treasury securities and

government obligations ÏÏÏÏÏÏÏÏÏÏ $ 28,249 $ 1,840 $ (28) $ (56) $ 30,005

U.S. government agency mortgage-

backed securities ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 9,718 344 Ì Ì 10,062

Obligations of states and political

subdivisions ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 788 22 Ì Ì 810

Corporate securities ÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 460,687 20,861 (3,303) (1,274) 476,971

Mortgage-backed securities ÏÏÏÏÏÏÏÏ 78,329 1,752 (1,931) (169) 77,981

Redeemable preferred stocks ÏÏÏÏÏÏÏ 30,058 1,220 Ì Ì 31,278

Equity securities ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 7,476 46 Ì (881) 6,641

$615,305 $26,085 $(5,262) $(2,380) $633,748

Available-for-sale investments at December 31, 2003 were as follows:

Gross

Unrealized Gross

Losses Unrealized

Gross More Losses Estimated

Amortized Unrealized Than Less Than Market

Cost Gains 12 Months 12 Months Value

(In thousands)

U.S. treasury securities and

government obligations ÏÏÏÏÏÏÏÏÏÏ $ 29,765 $ 2,134 $ (36) $ Ì $ 31,863

U.S. government agency mortgage-

backed securities ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 10,570 316 Ì (12) 10,874

Obligations of states and political

subdivisions ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 2,850 91 Ì Ì 2,941

Corporate securities ÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 510,596 32,515 (6,562) (905) 535,644

Mortgage-backed securities ÏÏÏÏÏÏÏÏ 74,268 1,739 (1,053) (318) 74,636

Redeemable preferred stocks ÏÏÏÏÏÏÏ 45,861 1,426 (68) (3) 47,216

Equity securities ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 243 106 Ì Ì 349

$674,153 $38,327 $(7,719) $(1,238) $703,523

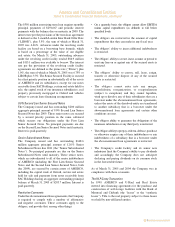

The Company sold available-for-sale securities with a fair value of $167.5 million in 2004, $267.9 million

in 2003 and $248.0 million in 2002. The gross realized gains on these sales totaled $2.3 million in 2004,

$5.3 million in 2003 and $6.0 million in 2002. The company realized gross losses on these sales of $1.7 million

in 2004, $3.1 million in 2003 and $2.4 million in 2002. The company recognized a write-down of investments

due to other than temporary declines on available-for-sale investments of approximately $4.3 million in 2004,

$5.0 million in 2003 and $9.8 million in 2002. The unrealized losses presented in the tables above that are

more than 12 months are considered temporary declines. The Company tracks each of these investments and

evaluates them on an individual basis for other than temporary declines including obtaining corroborating

F-17

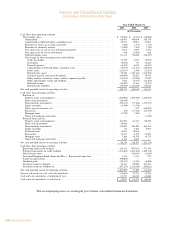

AMERCO AND CONSOLIDATED ENTITIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS Ì (Continued)

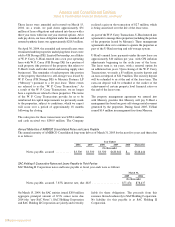

Available-for-Sale Investments

Available-for-sale investments at December 31, 2004 were as follows:

Gross

Unrealized Gross

Losses Unrealized

Gross More Losses Estimated

Amortized Unrealized Than Less Than Market

Cost Gains 12 Months 12 Months Value

(In thousands)

U.S. treasury securities and

government obligations ÏÏÏÏÏÏÏÏÏÏ $ 28,249 $ 1,840 $ (28) $ (56) $ 30,005

U.S. government agency mortgage-

backed securities ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 9,718 344 Ì Ì 10,062

Obligations of states and political

subdivisions ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 788 22 Ì Ì 810

Corporate securities ÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 460,687 20,861 (3,303) (1,274) 476,971

Mortgage-backed securities ÏÏÏÏÏÏÏÏ 78,329 1,752 (1,931) (169) 77,981

Redeemable preferred stocks ÏÏÏÏÏÏÏ 30,058 1,220 Ì Ì 31,278

Equity securities ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 7,476 46 Ì (881) 6,641

$615,305 $26,085 $(5,262) $(2,380) $633,748

Available-for-sale investments at December 31, 2003 were as follows:

Gross

Unrealized Gross

Losses Unrealized

Gross More Losses Estimated

Amortized Unrealized Than Less Than Market

Cost Gains 12 Months 12 Months Value

(In thousands)

U.S. treasury securities and

government obligations ÏÏÏÏÏÏÏÏÏÏ $ 29,765 $ 2,134 $ (36) $ Ì $ 31,863

U.S. government agency mortgage-

backed securities ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 10,570 316 Ì (12) 10,874

Obligations of states and political

subdivisions ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 2,850 91 Ì Ì 2,941

Corporate securities ÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 510,596 32,515 (6,562) (905) 535,644

Mortgage-backed securities ÏÏÏÏÏÏÏÏ 74,268 1,739 (1,053) (318) 74,636

Redeemable preferred stocks ÏÏÏÏÏÏÏ 45,861 1,426 (68) (3) 47,216

Equity securities ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 243 106 Ì Ì 349

$674,153 $38,327 $(7,719) $(1,238) $703,523

The Company sold available-for-sale securities with a fair value of $167.5 million in 2004, $267.9 million

in 2003 and $248.0 million in 2002. The gross realized gains on these sales totaled $2.3 million in 2004,

$5.3 million in 2003 and $6.0 million in 2002. The company realized gross losses on these sales of $1.7 million

in 2004, $3.1 million in 2003 and $2.4 million in 2002. The company recognized a write-down of investments

due to other than temporary declines on available-for-sale investments of approximately $4.3 million in 2004,

$5.0 million in 2003 and $9.8 million in 2002. The unrealized losses presented in the tables above that are

more than 12 months are considered temporary declines. The Company tracks each of these investments and

evaluates them on an individual basis for other than temporary declines including obtaining corroborating

F-17

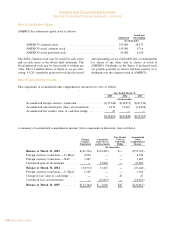

Amerco and Consolidated Entities

Notes to Consolidated Financial Statements, continued

Available-for-Sale Investments

Available-for-saleinvestmentsatDecember31,2004wereasfollows:

Available-for-saleinvestmentsatDecember31,2003wereasfollows: