U-Haul 2005 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2005 U-Haul annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.38 I AMERCO ANNUAL REPORT

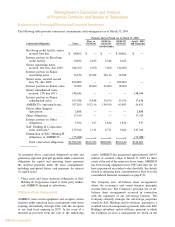

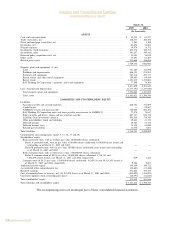

Management’s Discussion and Analysis

of Financial Condition and Results of Operations

Liquidity and Capital Resources and Requirements

of Our Operating Segments

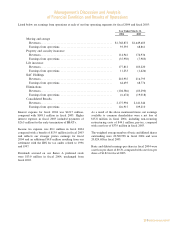

Moving and Self-Storage

To meet the needs of its customers, U-Haul maintains

a large fleet of rental equipment. Historically, capital

expenditures have primarily reflected rental equipment

acquisitions. The capital required to fund these

expenditures has historically been obtained through

internally generated funds from operations, lease

financing and sales of used equipment. Going forward,

weanticipatethatasubstantialportionofourinternally

generated funds will be used to enhance liquidity by

paying down existing indebtedness. During each of the

fiscal years ended March 31, 2006, 2007 and 2008,

U-Haul estimates that net capital expenditures will

averageapproximately$150milliontomaintainitsfleet

at current levels. Financial covenants contained in our

loan agreements at March 31, 2005 limit the amount

of capital expenditures we can make in 2006, 2007

and 2008, net of dispositions, to $245 million, $195

million and $195 million, respectively. We intend to

focus our growth on expanding our independent dealer

network,whichdoesnotrequireasubstantialamountof

capitalresources.

In the past our real estate requirements were for the

acquisitionofself-storagepropertiestosupportU-Haul’s

growth,andwereprimarilyfinanced throughlease and

debtfinancing.Goingforward,U-Haul’sgrowthplanin

self-storageisfocusedoneMove,whichdoesnotrequire

theacquisitionorconstructionofself-storageproperties

bytheCompany.Therefore,wedonotanticipatethatour

realestateneedswillnotrequiresubstantialcapital.

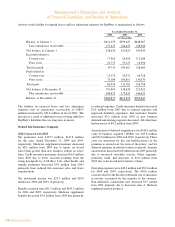

Property and Casualty Insurance

At December 31, 2004, RepWest had no notes

and loans due in less than one year and its accounts

payable and accrued expenses and other policyholders’

funds and liabilities were $8.7 million. RepWest

financial assets (cash, receivables, inventories, and

short-term investments) at December 31, 2004, were

$401.1million.

Stockholder’sequitywas$154.8million,$169.0million,

and $199.1 million at December 31, 2004, 2003, and

2002respectively.Republicdoesnotuse debt or equity

issuestoincreasecapitalandthereforehasnoexposureto

capitalmarketconditions.RepWestdidnotpaydividends

toitsparentduring2004,2003or2002.

Life Insurance

AsofDecember31,2004,Oxfordhadnonotesandloans

payable in less than one year and its accounts payable

and accrued expenses and other policyholders’ funds

and liabilities were $21.3 million. Oxford’s financial

assets (cash, receivables, short-term investments, other

investmentsandfixedmaturities)atDecember31,2004

were approximately $777.4 million. State insurance

regulationsrestrictthe amountofdividendsthatcan be

paidtostockholdersofinsurancecompanies.Asaresult,

Oxford’sfundsaregenerallynotavailabletosatisfythe

claimsofAMERCOoritslegalsubsidiaries.

Oxford’sstockholder’sequitywas$115.0million,$121.0

million, and $111.1 million in at December 31, 2004,

2003 and 2002, respectively. Increases from earnings

were offset by decreases in unrealized gains resulting

fromthechangeininterestrates.

SAC Holdings

SACHoldingsoperationsarefundedbyvariousmortgage

loansandunsecurednotes.SACHoldingsdoesnotutilize

revolving lines of credit to finance its operations or

acquisitions. Certain of SAC Holdings loan agreements

containrestrictivecovenantsandrestrictionsonincurring

additionalsubsidiaryindebtedness.

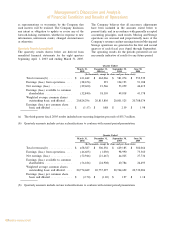

Cash Provided from Operating Activities

by

Operating Segments

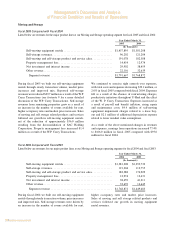

Moving and Self-Storage

Cashprovidedbyoperatingactivitieswas$226.5million,

$60.7millionand$201.1millioninfiscal2005,2004and

2003,respectively.Fiscal2005resultswereprimarilythe

result of net earnings plus non-cash items. Fiscal 2004

was primarily the result of non-cash items, partially

offset by increases in working capital and net losses.

Fiscal2003resultswereprimarilytheresultofnon-cash

itemsplusreductionsinworkingcapital,partiallyoffset

bynetlosses.

Property and Casualty Insurance

Cash used by operating activities were $31.6 million,

$86.1 million, and $75.1 million for 2004, 2003, and

2002,respectively.Thecashusedbyoperatingactivities

wastheresultofRepWest’sexitingitsnonSelf-Storage

and Self-Moving lines and the associated reduction of

reservesinthelinesexited.

RepWest’s cash and cash equivalents and short-term

investment portfolio were $90.3 million, $62.1 million,

and$35.1millionatDecember31,2004,2003,and2002,

respectively. This balance includes funds in transition

from maturity proceeds until reinvested in long term

investments. We believe that this level of liquid assets,

combined with budgeted cash flow, is adequate to

meet periodic needs for the foreseeable future. Capital

and operating budgets allow RepWest to schedule

cash needs in accordance with investment and

underwritingproceeds.